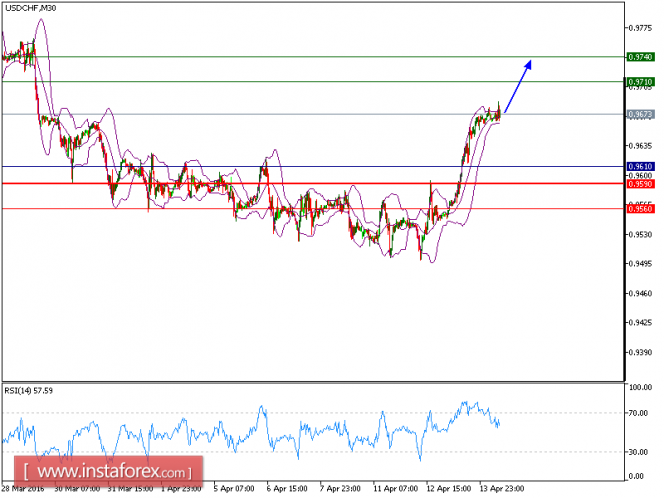

Technical Analysis of USD/CHF for April 14, 2016

USD/CHF is expected to prevail its upside movement. The pair remains in a bullish trend, supported by its ascending 20-period and 50-period moving averages. The nearest support at 0.9610 should limit any downward attempts. In addition, the relative strength index is positive, and also advocates for further advance. At the current stage, the pair is likely to challenge its next resistance at 0.9710 in sight. If there is a breakout, look for a new bounce to 0.9740 in extension.

Trading Recommendations:

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 0.9710 and the second one, at 0.9740. In the alternative scenario, short positions are recommended with the first target at 0.9590 if the price moves below its pivot points. A break of this target is likely to push the pair further downwards, and one may expect the second target at 0.9560. The pivot point is at 0.9610.

Resistance levels: 0.9710, 0.9740, 0.98

Support levels: 0.9590, 0.9560 , 0.95

The material has been provided by InstaForex Company - www.instaforex.com