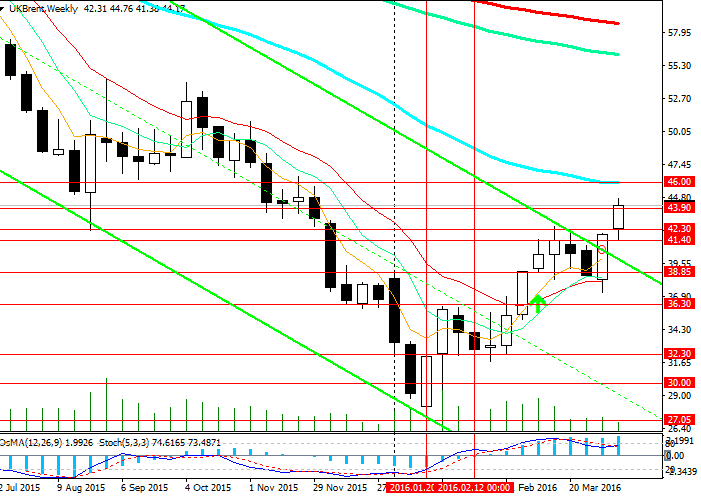

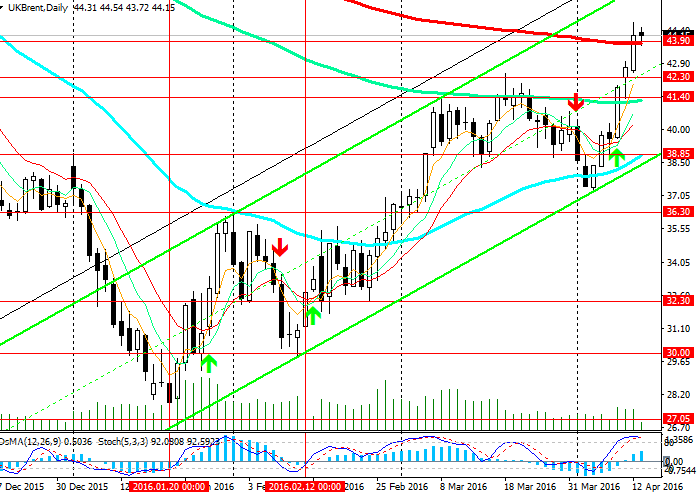

Brent: Will the Price Go Above the Level of 45.00?

Yesterday’s mixed economic statistics prevented the rise in price of crude oil Brent up to the level of 44.78 USD per barrel. After yesterday’s release (22:30 (GMT+2) of the data by US API on oil inventories, the price rebounded from the highs near the level of 44.78 and went back down to 44.18 USD per barrel, which is slightly above resistance level of 43.90 (ЕМА200 on the daily chart). At the same time the price remains in the upward channel on the daily chart with the upper limit at the level of 46.00, which is crossed by ЕМА50 on the weekly chart.

On the daily and weekly charts the indicators OsMA and Stochastic give buy signals. However, on 4-hour chart the indicators are reversing towards the short positions. The decline in price below the level of 43.90 can trigger further fall to the levels of 42.30 and 41.40 (ЕМА144 on the daily chart).

However, the price will be supported by expectations of the favourable outcome of the meeting in Doha on 17 April.

It is likely that the price will not go below the level of 43.90, or above the level 45.00 prior to 17 April.

Breakout of the support levels of 41.40 and 38.85 will trigger further decline in price within downward weekly channel.

As an alternative scenario the price may go up to 46.00 (ЕМА50 on the weekly chart and the upper line of the ascending channel on the daily chart).

Support levels: 43.90, 42.30, 41.40 and 38.85.

Resistance levels: 44.80, 45.00 and 46.00.

Trading tips

Buy Stop: 44.80. Stop-Loss: 44.30. Take-Profit: 45.00 and 46.00.

The material has been provided by LiteForex - Finance Services Company - www.liteforex.com