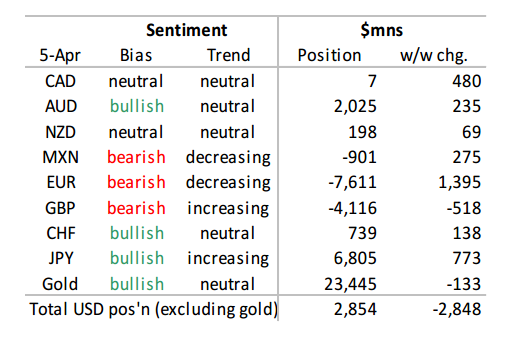

Takeaways From This Week's COT Report - CAD, AUD, NZD At Bullish End Of 52 Week Range -Scotiabank

Data in this report cover up to Tuesday Apr 5 & were released Friday Apr 8.

What remained of the aggregate USD long position was halved in the week ended April 5th with a $2.9bn decline to $2.9bn—its lowest level since May 2014.

Sentiment improved for all currencies with the exception of GBP as CAD shifted back to neutral for the first time since June 2015. Investors added to bullish positions in JPY, AUD, CHF, and NZD. EUR, GBP, and MXN are now the only currencies held net short.

Copy signals, Trade and Earn $ on Forex4you - https://www.share4you.com/en/?affid=0fd9105

A 10th consecutive week of short covering has pushed CAD sentiment back to neutral for the first time since June 2015. Sentiment for CAD, AUD, and NZD is at the bullish end of its 52 week range.

EUR saw the largest w/w change in positioning with a $1.5bn narrowing in the net short to $7.6bn. EUR bears continue to cover their positions, and the outstanding number of short contracts has fallen to its lowest level since October 2015. EUR bulls have also shown an increasing level of confidence, building their positions at an accelerated pace over the past three weeks.

JPY is the largest held net long at $6.8bn following a $0.8bn w/w build. Risk was added to both sides and we can only assume that the freshly built shorts were forced to cover in response to the subsequent JPY gains later in the week. Also note that gross JPY longs have climbed to a fresh record high.