The Euro to Pound Appears Unstoppable, But is That Really So - and What do Finance’s Top Technicians Think?

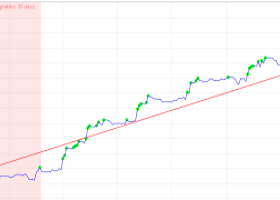

It seems like nothing can stop the EUR/GBP pair from rising.

The euro to pound exchnage rate has now broken above the 0.8000 level and even reached the key 0.8066 level which chart-watchers call a ‘resistance’ line, because it represents a perennial obstacle to higher growth.

The last time the level prevented further upside was in July 2014, the question now is will it happen again?

Lloyd’s Banking Group’s Robin Wilkin sees upside probably capped in a broader zone between 0.80-0.82:

“We expect the upside to now be limited in the cross. This is testament to the huge area of technical resistance we are now reaching between 0.80-0.82.”

Despite the strong rally since the July ’15 lows, and the fact that it remains intact, a continuation higher is now less likely:

Copy signals, Trade and Earn $ on Forex4you - https://www.share4you.com/en/?affid=0fd9105

“Medium-term the trend from the 0.6935 lows set in July 2015 remains intact, but we are now reaching a significant area of monthly resistance up to 0.8200 and would be the ideal area for a top and decline back into a broader medium-term range around 0.7500.”

It appears Lloyds’s base case scenario is therefore that the pair will hit heavy resistance in the 0.80-82 zone and pull-back to 0.7500.

“If the 0.82 region is clearly breached the risks are for a stronger move towards 0.87/0.88.”

Lloyds see a break above the 0.82 level as providing confirmation of more upside to the 0.87-88s.

Commerzbank See Ceiling at 0.8162

One reason to expect EUR/GBP to stall, is that it has now reached a target based on the measurement of the first leg between 0.7492 - 0.6937 higher, according to Commerzbank’s Karen Jones.

Financial markets often display an inherent symmetry, which means waves in sequence are often of equal length (or a Fibonacci ratio thereof). The first leg extrapolated higher gives an upside target 0.8030-65.

“EUR/GBP continues to inch higher and has reached the target .8030/65, this is the measurement higher from the base 0.7492 - 0.6937.”

Resistance at 0.8162, however, is likely to be the main obstacle to a higher ascent:

“We look for the upmove to start to struggle shortly - the 2008-2016 resistance line is located just above here at .8162 so upside scope is now considered to be limited.”

The Trend is Still a Friend for Broker Swissquote

Unlike Commerzbank and Lloyds who see tough resistance limiting gains, Swissquote are more bullish and expect a continuation of the current medium-term uptrend higher:

“EUR/GBP has broken the uptrend channel and is now lying around 0.8000… The technical structure suggests that the pair should show continued increase.”

Apart from strong resistance at 0.8066, analysts at the online broker, forecast a extension higher eventually:

“In the long-term, the technical structure suggests a growing upside momentum. The pair is trading well above its 200 DMA. Strong resistance can be found at 0.8066 (10/09/2014 high).”