The dollar slipped to marginal new lows versus the yen since Q4 '14 last week, a little below JPY110.70. The risk is on the downside unless the JPY112 area is resurfaced. Participants know that yen strength causes the BOJ discomfort, and continue to probe for its pain threshold. The balance between fear and greed may shift toward the former as the JPY110 area is approached. Yen strength risks lower import prices with knock-on effects on consumer prices. Seasonally, there is risk of repatriation ahead of the end of the fiscal year. The stronger the yen, the more likely the BOJ eases policy next month (Marc Chandler, Investing). It will likely take several months for the Fed to hike and USD/JPY is likely to remain top heavy for the time being. Any rebound above 114 will be a sellers’ market for Japan hedgers. Continued disappointment in the limited USD/JPY recovery may greatly decrease the market’s respect for Bank of Japan policy (Daniel Brehon, Deutsche Bank).

Yet, the idea of possible intervention will make traders nervous and this will increase volatility. Note that Japanese authorities could try verbal interventions, but their effect should be limited. On Monday there will be a bank holiday in Japan, so beware of the market swings in the conditions of low liquidity. Pay attention to Japanese inflation figures on Friday. There will be no data from China in the week ahead to weight on risk sentiment, and this could help the pair a bit. The main risk is still a decline to 110.00. Resistance is at 112.30 and 113.00 (Elizabeth Belugina, FxBazooka). Below 111.05, the pair can resume its decline and approach the 110.00 level before the day is over.on the other hand, the positive tone of European equities is helping the pair in advancing some. Nevertheless, the upside seems limited beyond some short term rallies (Valeria Bednarik, Fxstreet).

However, according to Mr. “Yen,” former Minister of Finance Eisuke Sakakibara (was in charge of currency intervention), he remains more bullish on his own currency (Bearish for USDJPY), seeing it rallying to ¥105 in H2 as the outlook for the world economy worsens. He said that “a climb to ¥105 only then is likely to prompt Japanese officials to intervene verbally to try and talk it down, while gains past ¥100 could see physical intervention to weaken it.” (Market Pulse).

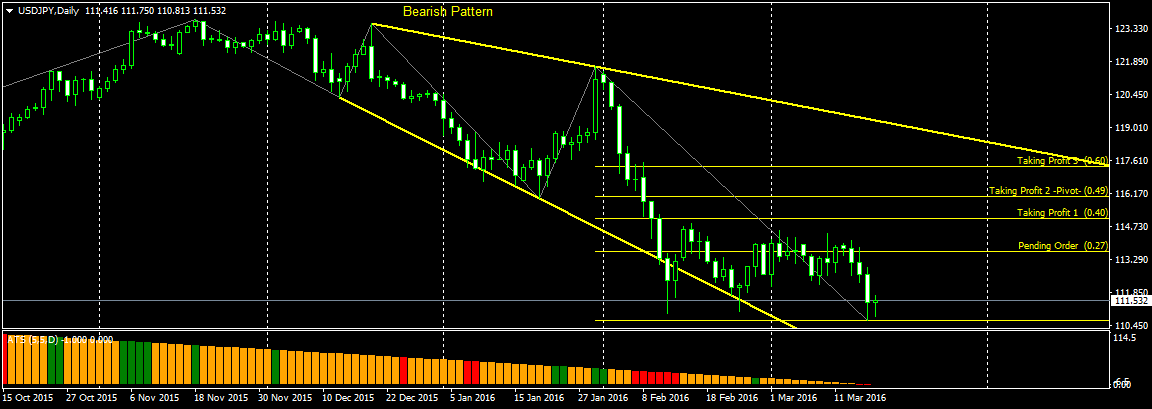

Bearish scenario

Rebound Scenario

Since 2006 (for 10 years) in every march, USDJPY had 2 times bearish and 8 times bullish (80% Bullish Probability).

Since 2006 (for 10 years) in every march, USDJPY had 2 times bearish and 8 times bullish (80% Bullish Probability).

Rebound point possibility

Rebound point possibility

Indicators

- https://www.mql5.com/en/market/product/9653

- https://www.mql5.com/en/market/product/8590

- https://www.mql5.com/en/market/product/11761

- https://www.mql5.com/en/market/product/9748