Daily Analysis of Major Pairs for March 8, 2016

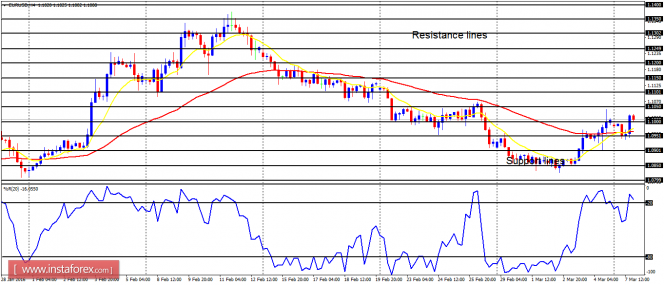

EUR/USD: Beyond a reasonable doubt, there is a bullish signal on the EUR/USD pair. In spite of attacks from bears, the pair managed to trade higher on Monday, forming a Bullish Confirmation Pattern in the chart. This week, the pair might reach the next targets located at the resistance lines of 1.1050 and 1.1100.

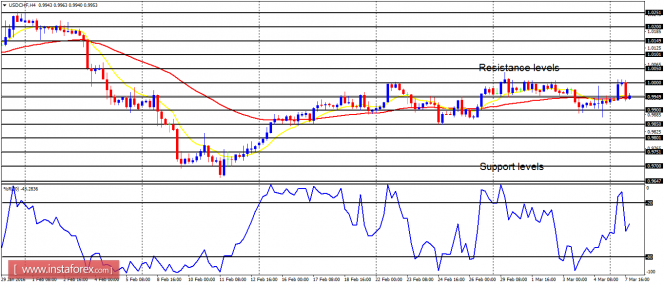

USD/CHF: This currency trading instrument has been trading largely sideways since last week, not going above the resistance level of 1.0000 and below the support level at 0.9900. There is a bound to be a breakout this week, which would take the price below the aforementioned support level or above the resistance level. Since we expect the EUR/USD pair to continue going upwards, the USD/CHF pair would most probably go downwards.

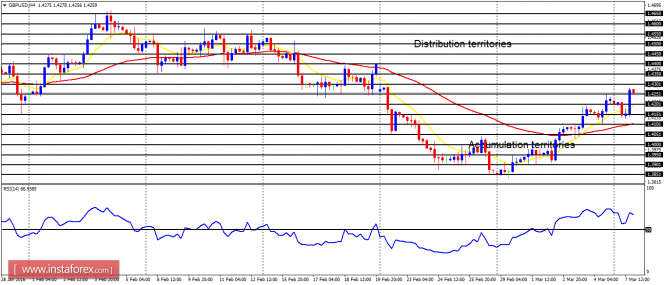

GBP/USD: Bulls have been making commendable efforts in pushing the cable further upwards, something that occurred on Monday as well. The price first got corrected lower, but later it moved higher, rendering the effort of bears useless. The EMA 11 is above the EMA 56 as the RSI period 14 goes above the level of 50. The best line of action is to continue seeking long trading opportunities on the cable chart.

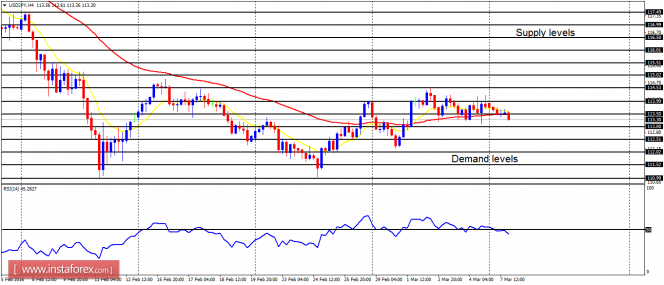

USD/JPY: This currency trading instrument has been moving sideways since last week, the bias on the market has turned neutral in the medium-term. Unlike other JPY pairs, the USD/JPY pair has not traded upwards because the greenback is currently weak. This week, however, would determine the next direction in the market.

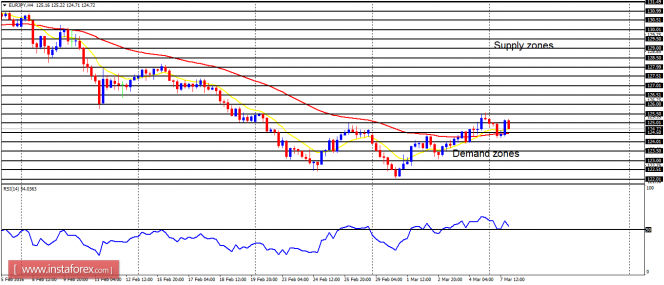

EUR/JPY: There is a bullish signal leading to a Bullish Confirmation Pattern on the EUR/JPY chart. Since the EMA 11 has crossed the EMA 56 to the upside and the RSI period 14 has moved above the level of 50, it is assumed that the cross would continue trending upwards, just as it is expected in some other JPY pairs. So, a strong northward movement is expected to take place soon.

The material has been provided by InstaForex Company - www.instaforex.com