Simplest idea ever

One of the simplest ideas in investing is buy and hold strategy. This type of strategy is most frequent type of investing because most of the mutual funds are offering their products and services without any active management. Underlying assets are commonly stocks and bonds. In this article I would like to show you an alternative, how to use and adapt this strategy in currency market.

Safe o risky

Well, this is the dilemma. If we assume that all assets have different risk and all strategies have different risk profiles, there is always chance to make wrong decision. We cannot say that buy and hold is always risky strategy and we definitely cannot say that is safe as well. All these things depend on multiple factors as fair value of the asset, interest rate or yield, actual price, market condition and many others.

Why should I invest to the particular currencies?

I don’t know if there is any better and flexible market as a cash market. I don’t believe in never-ending bullish stock market. I believe in very serious and conservative way of investing. The way how to to create a fixed income. I don’t want to say that only forex is the best market. There is plenty of them but in this case I think is good way how to increase diversification of income.

Before I start, I would like to mention three most important factors at investing.

– Most powerful and most important factor in long term investing is

the concept of carry trade. In this concept we assume to buy currency

with high interest rate and sell currency with low interest rate. Our

profit is profit from interest rate differential. This profit is

credited to our account on daily basis

– We have to be patient to start invest (buy) only in situation when

high yield currency is extremely oversold and low yield currency is

extremely overbought.

– We have to assume all advantages of monthly basis investing.

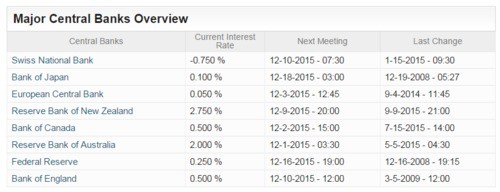

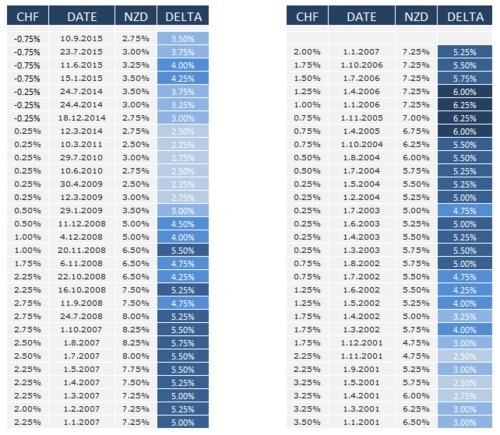

Interest rate table

Example: as you can see there is a huge difference between current

interest rates. We can take a look on two currencies with highest

interest rate differential.

NZD/CHF

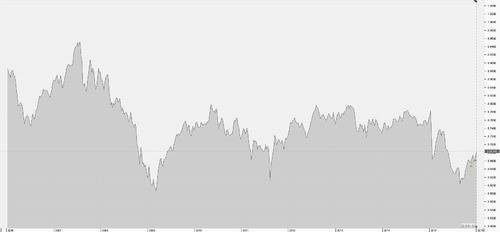

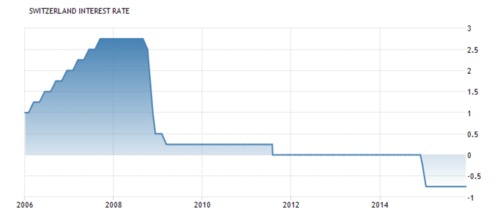

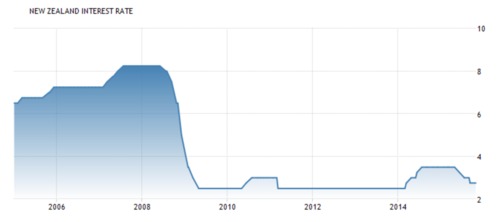

This is the chart of NZD/CHF in past 10 years. As you might see current price is about 23,41% lower than price at 10 years ago. This chart looks as a very pessimistic outlook on your invested money. Isn’t it? The problem is that chart below is not interest rate adjusted. Before I show you an update, I would like to explain where the additional profit of interest rate comes from. Let me show you two charts of Interest rate of both currencies in the history of 10 years.

As you may see, the interest rate policy was very turbulent in case of both currencies. The volatility is logical impact of crisis in 2008 and low interest rates are just result of this crisis and monetary policy of both countries. What we are really interested in this case is not an interest rate of each currency but Interest rate differential between those currencies. This interest rate differential can get us an additional profit.

Well, this is it. In Delta column you can see actual interest rate differential in particular date. You can see 15 years of history but let’s calculate only with 10 years as in previous example.

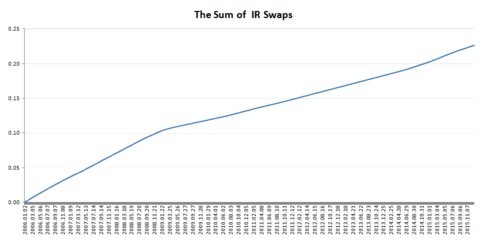

In the chart above you can see IR differential chart in past 10 years. Why is this so important? Reason is that you can make a calculation of IR Fixed income for whole 10 year period on daily basis. Then you can add this income to price chart and you will see a real performance chart of your investment. Let’s see calculation of IR fixed income separately.

As you may see the sum of the gained pips is 0.22621 (2262.1 points) this is a massive boost of performance. Do you remember when I mentioned that NZD/CHF chart went down about 23.41% in past 10 years? The exact number was -0.20891 (2089.1 points). In this calculation we can assume that interest rate income in past 10 years was able to erase negative bearish trend. The result of this calculation is 173 points. What is gain of 1.94 %.

Conclusion

Some of you might say that result of 1.94% in 10 years is totally

unacceptable because stocks are breaking all time highs. Yes you are

right , but let’s assume this:

– You can divide your investment to multiple buyouts depend on market condition and extreme situations. You can buy more when price is low

– You can also use leverage very easily. Average yield of this investment is 3.5% p.a. You don’t need to risk too much to achieve multiplication of this income. Income of 7 or 10,5% a bit better than 5-6% income from stock indexes.

– Stock index cannot end up in bankruptcy. That’s for sure. But there is still huge probability that next financial crisis will cut 50-60% of the equity gains and nobody knows what will happen next. Carry trades are not a safe haven but it is an alternative.

At the end I would like to say my best argument. I always say “what if”. Last 10 years were negative. What if your favorite carry pair will stay at zero? Or what if there will be another 10 years period with income of 20-30%? Then you can calculate with higher return than in stock investing. Nobody knows. This article is not investment recommendation. Please don’t take it like this. This article is pure educative and I am trying to share the alternative view of long term investing.

Good luck,

Sheriff