AUD/USD Whipsawed as Policy Bets, Risk Trends Diverge on RBA

AUD/USD Whipsawed as Policy Bets, Risk Trends Diverge on RBA

Talking Points:

- The Reserve Bank of Australia left its main lending rate unchanged as forecasted

- Aussie Dollar climbs, then falls versus the US Dollar after policy announcement

- Yields reflect fading rate cut bets, helping policy outlook but hurting risk appetite

Losing Money Trading the Australian Dollar? This Might Be Why.

The Australian Dollar first edged higher against its US counterpart after the Reserve Bank of Australia lefts its benchmark lending rate unchanged at 2.0 percent. Such an outcome was widely expected: all 29 economists polled by Bloomberg were anticipating the central bank to hold rates. The RBA has now left its benchmark lending ratestatic for 8 consecutive meetings.

Diving into the monetary policy statement, much of what the Reserve Bank of Australia said in its first interest rate decision of 2016 was a repeat from December’s announcement. Policymakers argued that the current setting of policy remained appropriate, judging that “there were reasonable prospects for continued growth in the economy, with inflation close to target.” However, RBA Governor Glenn Stevens said that low inflation does afford scope for further easing, if needed “to support demand”.

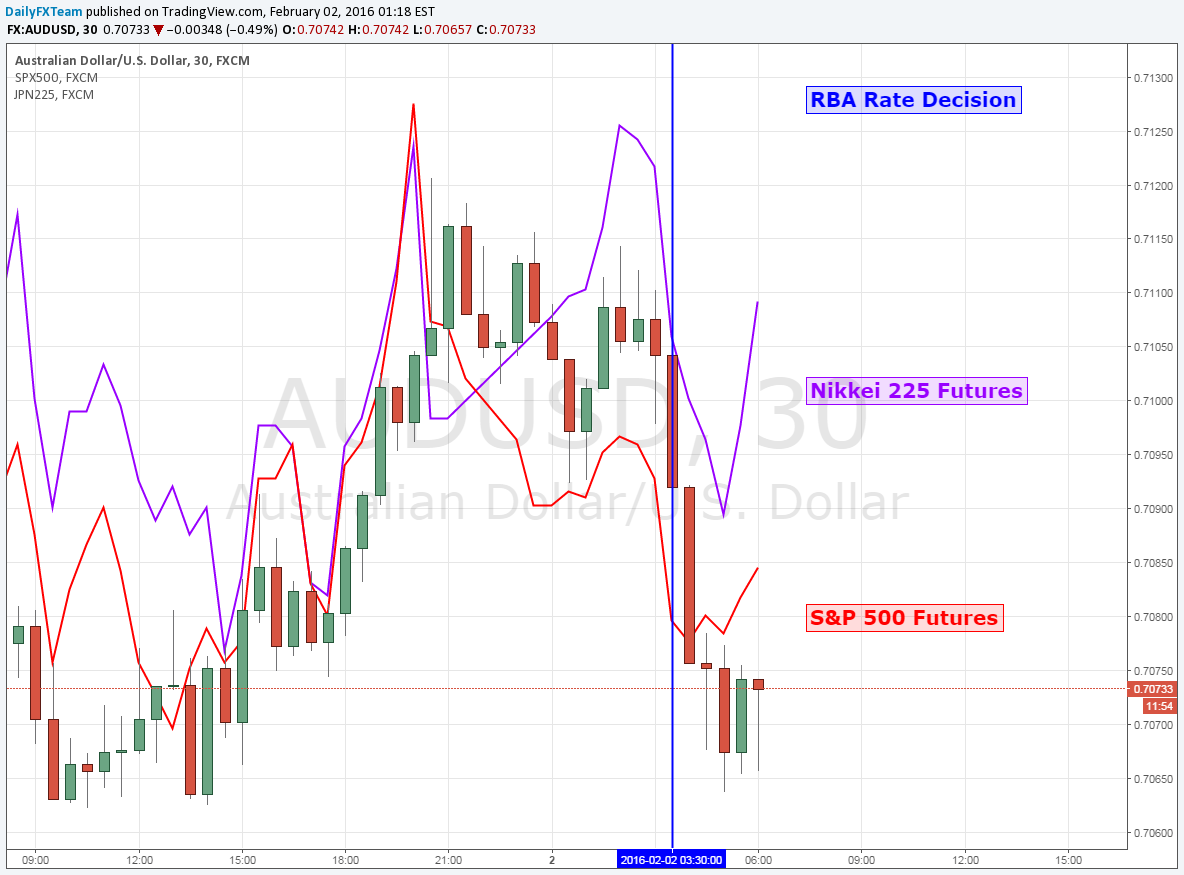

Australian 2-year government bond yields rallied after the monetary policy announcement. This suggests that the markets are becoming less certain of an RBA rate cut in the nearterm. Overnight index swaps (OIS)are pricing in at least one cut in the central bank’s main lending rate over the next 12 months. Yet, shortly after the interest rate decision, the Aussie tumbled while bond yields remained elevated.

Currency Strategist Ilya Spivak has argued that the markets have been cheering increased stimulus from central banks across the globe. For example, the Bank of Japan cut rates into negative territory last week, which saw the S&P 500 and Nikkei 225 futures rally in tandem. In this case, the dimming probability of more easing from Australia sent both stock indexes downward, pulling the sentiment-linked Aussie lower along the way.