GBP/USD

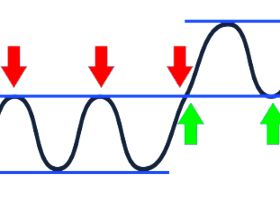

is on the offer on the 4hr chart although is finding some demand below

the 1.50 handle to trade currently at time of writing back on 1.5030.

USD demand is back into vogue while Sterling had been offered, a little stronger on the UK's production data but a shallow recovery encouraged more supply at 1.5032 from 1.5017 on the news.

Meanwhile, we have the BoE coming up this week as the next driver and while there are no expectations of the meeting,the minutes will be of interest. However, analysts at Rabobank explained that they maintain their view that the Bank is unlikely to raise rates before August 2016 and expect McCafferty to remain the lone hawk at the December policy meeting.

GBP/USD downside levels

Technically, GBP/USD broke the recent lows and fib level and now the next support is seen at 1.4860 and this is regarded as the last defence for the 1.4577 April low, according to Karen Jones, chief analyst at Commerzbank.

USD demand is back into vogue while Sterling had been offered, a little stronger on the UK's production data but a shallow recovery encouraged more supply at 1.5032 from 1.5017 on the news.

Meanwhile, we have the BoE coming up this week as the next driver and while there are no expectations of the meeting,the minutes will be of interest. However, analysts at Rabobank explained that they maintain their view that the Bank is unlikely to raise rates before August 2016 and expect McCafferty to remain the lone hawk at the December policy meeting.

GBP/USD downside levels

Technically, GBP/USD broke the recent lows and fib level and now the next support is seen at 1.4860 and this is regarded as the last defence for the 1.4577 April low, according to Karen Jones, chief analyst at Commerzbank.