The GBP/USD

fell to a low of 1.5037 before recovering slightly to 1.5047 in early

Europe as investors await the UK industrial and manufacturing production

release.

Eyes UK data

Both, the industrial production and manufacturing production, are expected to stall in October. In annualised terms a minor improvement is expected.

Sterling fell in Asia after a weaker China trade data highlighted anaemic consumption in the world’s second largest economy and triggered risk-off moves. Apart from the UK data, the movement in the GBP/USD is also at the mercy of the sentiment in the European stock markets.

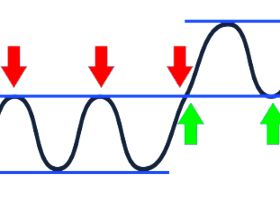

GBP/USD Technical Levels

The immediate resistance is located at 1.5063 (38.2% of 1.5336-1.4895) and 1.5069 (10-DMA), above which the gains could be extended to 1.5115 (50% of 1.5336-1.4895). On the other hand, a break below 1.5028 (Nov 27 low) would expose 1.4999 (23.6% of 1.5336-1.4895), under which the losses could be extended to 1.4950 (Dec 2 closing).

Eyes UK data

Both, the industrial production and manufacturing production, are expected to stall in October. In annualised terms a minor improvement is expected.

Sterling fell in Asia after a weaker China trade data highlighted anaemic consumption in the world’s second largest economy and triggered risk-off moves. Apart from the UK data, the movement in the GBP/USD is also at the mercy of the sentiment in the European stock markets.

GBP/USD Technical Levels

The immediate resistance is located at 1.5063 (38.2% of 1.5336-1.4895) and 1.5069 (10-DMA), above which the gains could be extended to 1.5115 (50% of 1.5336-1.4895). On the other hand, a break below 1.5028 (Nov 27 low) would expose 1.4999 (23.6% of 1.5336-1.4895), under which the losses could be extended to 1.4950 (Dec 2 closing).