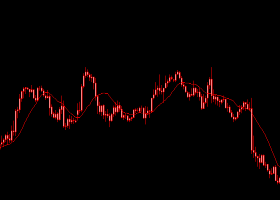

Iron ore prices fell below USD 40; its lowest since 2009 due to

increasing low-cost supply (partly due to low oil prices) and falling

demand from China.

As per Bloomberg report, “Ore with 62% content delivered to Qingdao lost 2.4 percent to $39.06 a dry ton, a record low in daily prices compiled by Metal Bulletin Ltd. dating back to May 2009.”

The iron market is witnessing a fierce battle for the market shares as is seen in oil markets. Producers including BHP Billiton Ltd. and Rio Tinto Group in Australia and Brazil’s Vale SA have ignored falling prices and boosted supply to defend market share.

As per Bloomberg report, “Ore with 62% content delivered to Qingdao lost 2.4 percent to $39.06 a dry ton, a record low in daily prices compiled by Metal Bulletin Ltd. dating back to May 2009.”

The iron market is witnessing a fierce battle for the market shares as is seen in oil markets. Producers including BHP Billiton Ltd. and Rio Tinto Group in Australia and Brazil’s Vale SA have ignored falling prices and boosted supply to defend market share.