Japanese companies and Deutsche Bank to expect the global bearish for EUR/JPY

Although Japanese companies have experience to hedge against the USD, they do not have experience enough to hedge against the EUR, so anyway - they are more concerned for about EUR for now. For example, Taisuke Tanaka (the Global Macro Research Officer for Japan, and Chief Foreign Exchange Strategist at Deutsche Bank) is considering to open sell position on EUR/JPY as a high priority. The reason for that is the following:

- ECB is remaining strongly dovish policy, and

- the BoJ will likely maintain a wait-and-see policy without implementing further easing.

The other analists of Deutsche Bank are also expecting for EUR/JPY to be in more bearish market condition: they expect for this pair to fall into the level to be below 126.08 support in Q1'16.

| Resistance | Support |

|---|---|

| 136.95 | 129.66 |

| 141.04 | 126.08 |

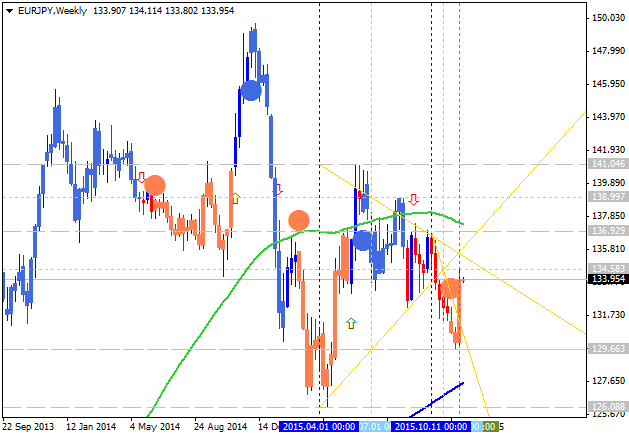

As we see from the chat above - the weekly price is on ranging condition located between 100 period SMA and 200 period SMA within the reversal area between the primary bearish and the primary bullish on the chart. And there are 2 key support levels for the price to be broken on the way to the bearish condition area:

- 129.66 intermediate support level located on the border between the primary bearish and the primary bullish trend on the chart, and

- 126.08 support level located near and below 200 SMA in the beginnijng of the bearish area.

Long-term strategy: watch the price to break 126.08 support level for possible sell trade