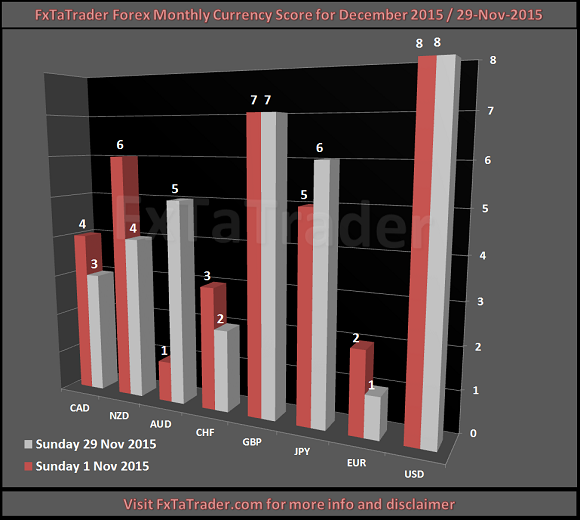

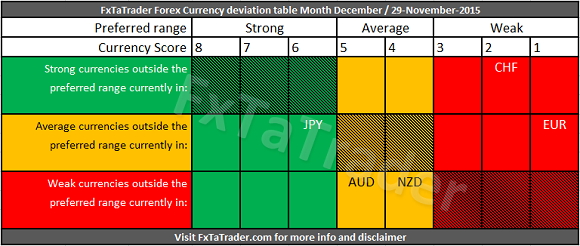

It is recommended to read the page Currency score explained and Models in practice for a better understanding of the article. This article will provide my analysis on the 8 major currencies based on the technical analysis charts using the MACD and Ichimoku indicator on 3 time frames: the monthly, weekly and daily. The result of the technical analysis is the 2 screenshots in this article showing the Currency Score and the Currency deviation table.

______________________________________

Last 12 months currency classification

The last 12 months currency classification from a longer term perspective are provided for reference purposes. See for more information the article: Monthly Currency Score for October where the charts are available. There are no changes since June and the currencies are classified for the coming months as follows:

- Strong: CHF / GBP / USD. The preferred range is from 6 to 8.

- Average: EUR / JPY. The preferred range is from 4 to 5.

- Weak: AUD / CAD / NZD. The preferred range is from 1 to 3.

______________________________________

Currency Score for December 2015

______________________________________

In essence it boils down to the 3 following lines of text:

- A strong currency can be traded long against all the other currencies except on a pullback(deviation) then it seems best to trade it only against a weak currency.

- A weak currency can be traded short against all the other currencies except on a pullback(deviation) then it seems best to trade it only against a strong currency.

- When an average currency is outside the range(deviation) it is best not to trade it against it's own currencies in the average range and the currencies in the range it is at.

According to the Ranking and Rating list already published this week the following pair combinations look interesting:

- EUR/USD with the GBP/CHF

- USD/CHF with the EUR/GBP

We will fit each pair if possible in the right group

here below and within each group also add the following abbreviations for the pair combinations:

A. -> SA = Strong Average

B. -> SW = Strong Weak

C. -> AW = Average Weak

Strong currencies

- There is a deviation for the CHF with a score of 2. This is a strong currency and it should have by preference a score from 6 to 8.

- There is most probably a pullback for the CHF when looking at the market as a whole, the uptrend has lost momentum.

- B. The CHF has a score at the moment of a weak currency and it seems best for trading going long against the weak currencies (SW). There are no pairs selected from the Ranking and Rating list.

- There are no other deviations meaning that the other strong currency (USD and GBP) seem best for trading, depending on the opportunities coming around, in the following ways:

- A. going long against the average currencies (SA). The pairs selected from the Ranking and Rating list are the EUR/USD and the EUR/GBP.

- B. going long against the weak currencies (SW). There are no pairs selected from the Ranking and Rating list.

- There is a deviation for the EUR with a score of 1. This is an average currency and it should have by preference a score from 4 to 5.

- There is an increase of downward momentum for the EUR which is getting weaker.

- A. The EUR has a score at the moment of a weak currency and it seems best for trading going short against the strong currencies (SA). The pairs selected from the Ranking and Rating list are the EUR/USD and the EUR/GBP.

- There is a deviation for the JPY with a score of 6. This is an average currency and it should have by preference a score from 4 to 5.

- There is an increase of upward momentum for the JPY which is getting stronger.

- C. The JPY has a score at the moment of a strong currency and it seems best for trading going long against the weak currencies (AW). There are no pairs selected from the Ranking and Rating list.

- There are no other deviations an no more average currencies and if there were any then they seem best for trading, depending on the opportunities coming around, in the following ways:

- A. going short against the strong currencies (SA). There are no pairs selected from the Ranking and Rating list.

- C. going long against the weak currencies (AW). There are no pairs selected from the Ranking and Rating list.

- There is a deviation for the AUD with a score of 5 and the NZD with a score of 4. These are weak currencies and they should have by preference a score from 1 to 3.

- There is most probably a pullback for the AUD and the NZD when looking at the market as a whole, the downtrend has lost momentum.

- B. The AUD and the NZD have a score at the moment of an average currency and it seems best for trading going short against the strong currencies (SW). The are no pairs in the Ranking and Rating list.

- There are no other deviations meaning that the other weak currency (CAD) seem best for trading, depending on the opportunities coming around, in the following ways:

- B. going short against the strong currencies (SW). There are no pairs selected from the Ranking and Rating list.

- C. going short against the average currencies (AW). There are no pairs selected from the Ranking and Rating list.

______________________________________

- The analyses are complementary where:

- the "Ranking and Rating list" takes strength, direction and volatility into account.

- the "Currency score" looks for the strong trends and pullbacks with a possible disadvantage of being overbought/oversold.

- the "Currency score difference" adds granularity to the "Currency score" by using the score difference for determining potential trends.

- the "Bollinger Band" confirms that a potential trend found is not being overbought/oversold.

- With the "Currency score difference" and the "Bollinger Band" the disadvantage mentioned for the Currency score will be avoided.

______________________________________