The best and worst assets in November 2015 - Deutsche Bank

1 December 2015, 16:27

0

1 045

November was complex and full of surprises for the hedge funds - global stocks started and ended the month off poorly forcing many to load up on short positions. Many prominent asset managers suffered greatly (for example, David Einhorn lost 5.2% in the month and is down 20% for the year).

But November and 2015 weren't only bad for all around. USD-based assets showed good performance.

Deutsche Bank about November:

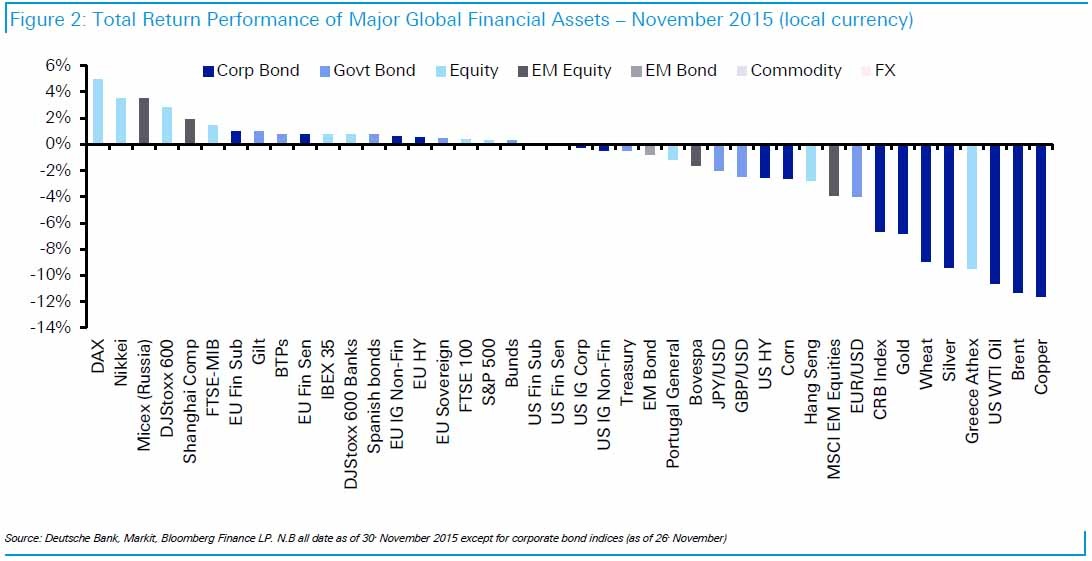

- the biggest losers were commodities: Silver (-9.4%), Brent (-11.3%) and Copper (-11.6%).

- the best performers have been the DAX (+4.9%), the Nikkei (+3.5%) and the Russian Micex (+3.5%). Chinese equity markets showed little less growth (Shanghai Comp. +1.9%).

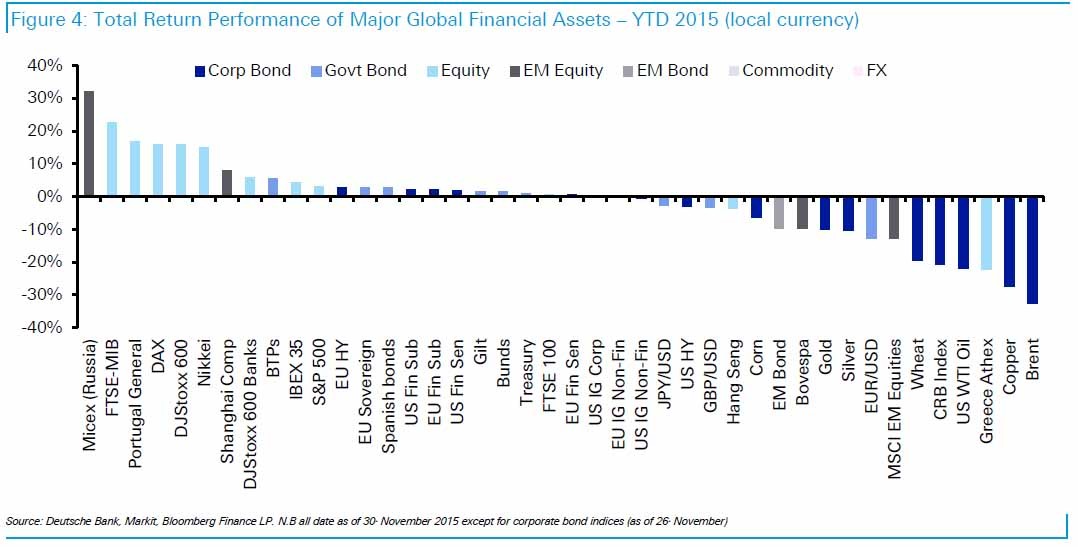

- the best performing asset classes of the year to date now (in a local currencies) are the Russian Micex (+32.2%), European FTSE MIB (+22.8%), Portuguese General index (+16.9%), German DAX (+16.1%), Asian Nikkei (+15.0%) and the Shanghai Comp. (+8.2%),

- the worst were also commodities: Brent (-32.5%), Copper (-27.5%), WTI (-21.8%) and Wheat (-19.4%) and one of the notable underperformers - Greek equities (-22.0%).

Experts say that in a world of a stronger dollar it'll be very difficult to generate positive dollar returns in 2016. And everything can greatly change after the Fed and the ECB meetings, because they can give big momentum to changes in economy.