Oil recovers on Saudi statement. But does it provide anything new?

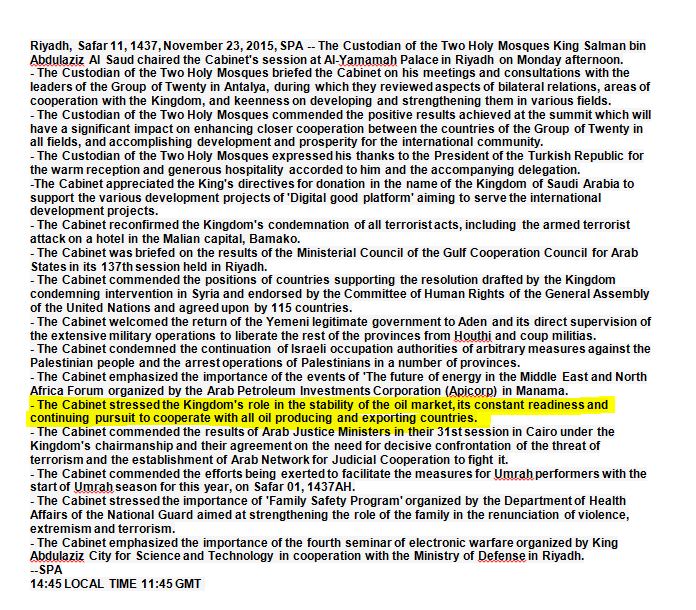

Oil prices turned around to rally on Monday after the Saudi Arabian cabinet said in a statement the kingdom remained ready to work with non-OPEC producing and exporting countries to stabilize prices.

U.S.

West Texas Intermediate (WTI) crude futures were last at $41.39 a barrel, after hitting $42.35 earlier.

Benchmark January Brent futures were at $44.55 a barrel from $45.48 immediately after the statement.

Saudi Arabia hasn't said they won't reduce production, but that doesn't mean they are going to increase production either, analysts noted. The message is quite vague.

Source: Javier Blas

The kingdom had previously said it was keen on cooperating with other oil producers to maintain oil price stability, but the remarks on Monday arrived as futures prices were barely holding above 2-1/2 month lows.

Data from the U.S. Commodity Futures Trading Commission (CFTC) showed last week that big hedge funds have boosted their bets that oil will continue to fall. Players now hold more positions that are betting on a fall in the oil price than at any time since at least 2009, according to Reuters data.

Prices of oil have halved over the last 12 months after the cartel decided to maintain its production levels, or even increase them, to keep its market share, in part by forcing higher-cost producers elsewhere to cut output.

Earlier, Morgan Stanley's commodities research team said they forecast a rise in the physical market towards the end of the year, as refinery margins remain robust and maintenance schedules for next month are predicted to be light.

However, this might not be sufficient to buoy the broader market, they said.

"As long as markets are oversupplied, even if it's by a shrinking amount, technical factors and the U.S. dollar will remain the primary price-setting mechanisms," they said.