GLOBAL AND U.S ECONOMIC FACTORS COULD DERAIL THE DECEMBER RATE HIKE

9 November 2015, 00:23

0

204

GLOBAL AND U.S ECONOMIC FACTORS COULD DERAIL THE DECEMBER RATE HIKE |

--- |

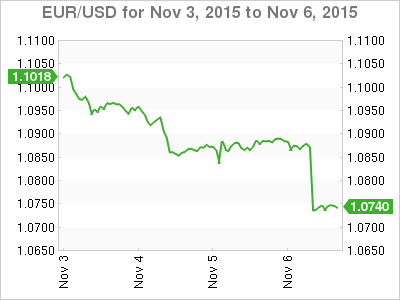

| The USD continues to advance against all pairs since the October Federal Open Market Committee (FOMC) statement put the December meeting back in play as a possibility of announcing a higher U.S. benchmark interest rate. Days later Fed Chair Janet Yellen said that a December rate hike was a "live possibility" and Friday's non farm payrolls (NFP) report has boosted the probability of the first interest rate hike in a decade with an above expectations 271,000 new jobs added to the American economy. Since foregoing the use of forward guidance the Federal Reserve has opted for a data dependency model that has created higher volatility as the market is uncertain where the data is pointing. This time around the data and the Fedspeak are lining up into a higher rate outcome that has more than 50 percent probability according to the CME data. There are still hurdles that must be cleared for this to happen and this week the resolve of the Fed will be tested by external and internal factors. The Chinese slowdown is the biggest factor that has dragged down global economic performance. Inflation and industrial production will be reported this week out of China and investors should focus on what the reaction is from markets and policy makers. Chinese CPI will be released on Monday, November 9 at 8:30 pm EST and Industrial production on Wednesday, November 11 at 12:30 am EST. The U.S. retail sales have put a stop to more than one USD rally. The importance of strong consumer demand as evidenced by sales is a big indicator that will factor in the Fed's decision to pull the trigger in December. U.S. retail sales will be published on Friday November 13 at 8:30 am EST. |

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -  |