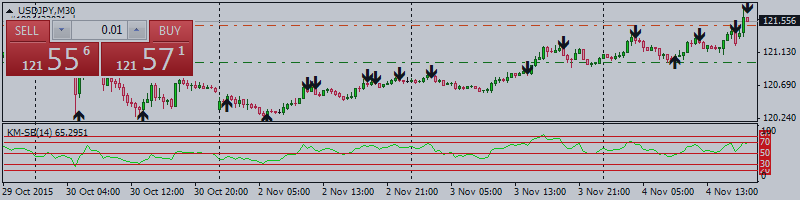

USD/JPY

has remained firm as global equities continue to advance and moves through

October highs of 121.47 with bulls eager for a break-out to test the 100 DMA at

121.76 and the golden ratio 61.8% level of the August highs of

125.27.

The data out of Japan was also impressive with Japanese services

PMI that grew to 52.2 in October from 51.4 in September and composite PMI grew

to 52.3 in October from 51.2 in September. Then, Japanese Consumer Confidence

Index grew to 41.5 in October (Consensus 40.8) from 40.6 in

September.

From the US shift so far, the data has also been good with

Markit PMI Composite for Oct 55.0 vs 54.4 previous, Markit Services PMI for the

same month beating expectation of 54.6 arriving at 54.8 and up on pre 54.4 while

ISM Mon-Manufacturing PMI coming in at 59.1 vs 56.5 consensus and 56.9 pre. The

ADP report, 182k vs 180k, but below 190k pre, still sets a positive back-drop

for Nonfarm

Payrolls on Friday.

See here for

FXStreet's Nonfarm Payrolls forecast

Yellen has finally hit

the wires and treasuries are feeling the pressure on hawkish comments, saying

that Dec is live if data is supportive while saying that the FOMC thinks that it

might be appropriate to move in the same month while saying the economy is

performing well. We await to hear from Dudley and Fisher.