[-copied]

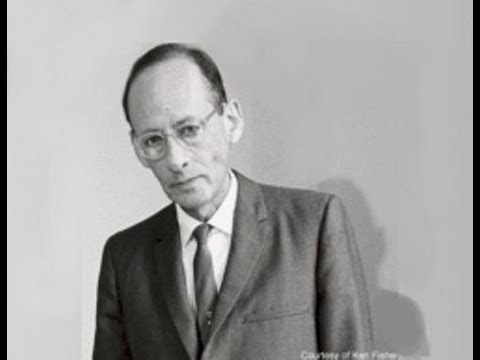

Philip Fisher - one of the most influential investors of all time. His investment philosophies, recorded in his investment classic "Ordinary Shares and extraordinary profits" (1958) are still relevant today, and have been extensively studied and applied throughout construction investment professionals. This was the first investment book ever managed to enter the list of bestsellers of New York Times. Fisher's son, Kenneth Fisher wrote praise for his father in one of his regular articles in the magazine Forbes (11 March 2004): "Among the pioneers of formative thinkers in the school of investing in growth stocks, it may have been the last professional witnessed in 1929 and went after her to become a big name. His career lasted seventy-four years, but is more diverse than the election of increasing shares. He has been engaged in an early venture capital and private equity, has advised executives, wrote and taught. He had an impact. For decades, big names in investing state Dad as a mentor, role model and inspiration. "

Philip Fisher's career began in 1928 when he dropped out of the newly created Stanford Business School, to work as a securities analyst in Anglo-London Bank in San Francisco. He sailed in company targoiya shares for a short period of time before starting his own business for cash management under the name Fisher & Company in 1931. He manages the affairs of the company until his retirement in 1999 at the age of 91 and reported that he had done for their clients exceptional investment returns. Although he began some fifty years before the name Silicon Valley to become known, he specialized in innovative companies driven by research and development. He practiced long-term investment and are looking to buy great companies at reasonable prices. He was a very private person, giving few interviews and was very selective about customers who bear. He was not well known to the public until published his first book in 1958.

Fisher achieved excellent results during the 70 plus years of money management by investing in well-managed, growing companies with high quality, which he has owned in the long run. For example, he bought shares of Motorola in 1955 and sold them to his death in 2004.

His famous "fifteen points to look for in a share" are divided into two categories: performance management and performance of the business. Important qualities for management included integrity, conservative accounting, accessibility and good long-term perspective, openness to change, excellent financial controls, and good policies for staff.

Important business characteristics would include orientation towards growth, high profit margins, high return on capital, commitment to research and development, good sales organization, leading position in the industry and proprietary products or services.

Philip Fisher searched far and wide for information on a company. Seemingly simple tool, which he called "rumor" or "business vine" is his technique of choice.

He devotes a significant part of the

comments on this topic in "Ordinary shares and extraordinary profits".

He was magnificent in networking and the use of all contacts from which

he was able to gather information and perspective about a company. He

believes this method to study the company's extremely valuable.

"I sought out Phil Fisher after reading his book" Ordinary Shares and

extraordinary profits. "When I met him, I was impressed with the man and

his ideas. Thorough understanding of a business by using the techniques

of Phil lets you make intelligent investment actions. " - Warren

Buffett