0

1 183

The ECB left policy unchanged and Mario Draghi delivered the maximum level of dovishness at the press conference.

- "Specifically, he said that the degree of policy accommodation will be re-examined in December and that all policy instruments are being considered, including a further cut in the deposit rate. He also said the ECB is “vigilant” on inflation – a key word that in the past has been used to indicate imminent action."

-

"The bottom line is that the December meeting now appears more a

question of ‘how’, rather than ‘whether’, the ECB will ease policy

further."

- For the outlook for the EUR, we notes that the mention of the possibility of a further cut in the deposit rate was important as this is the policy tool that would probably have the most direct impact on eurozone front-end rates."

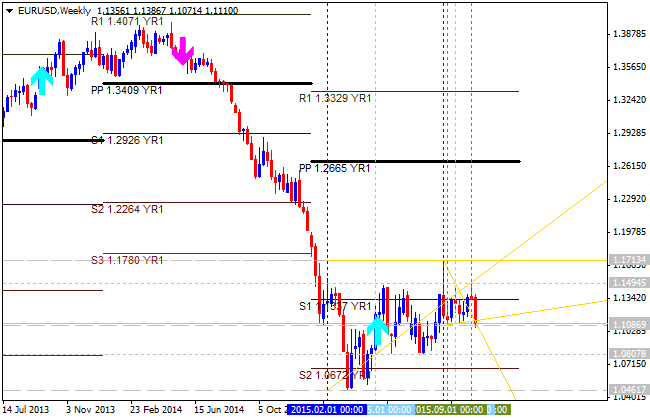

- "However, we would also highlight the role of asset purchases for real rates, which Mr Draghi mentioned specifically once again. A key driver of EUR weakness early this year was a consistent rise in inflation expectations which drove real rates further into negative territory and led to portfolio capital outflows. If these dynamics are restored, the EUR should return to a weakening path."

-

"EUR shorts were largely

unwound in Q2-Q3 and EUR positioning has turned the most bullish since

2013. After ECB meeting the market is likely to be biased to rebuild short positions, selling into any EUR rallies."

- "We maintain EUR/USD short from 1.1450 targeting 1.09 and EUR/GBP short from 0.7395 targeting 0.70."