Competition for the worst quarter: emerging markets among the leaders - Charts

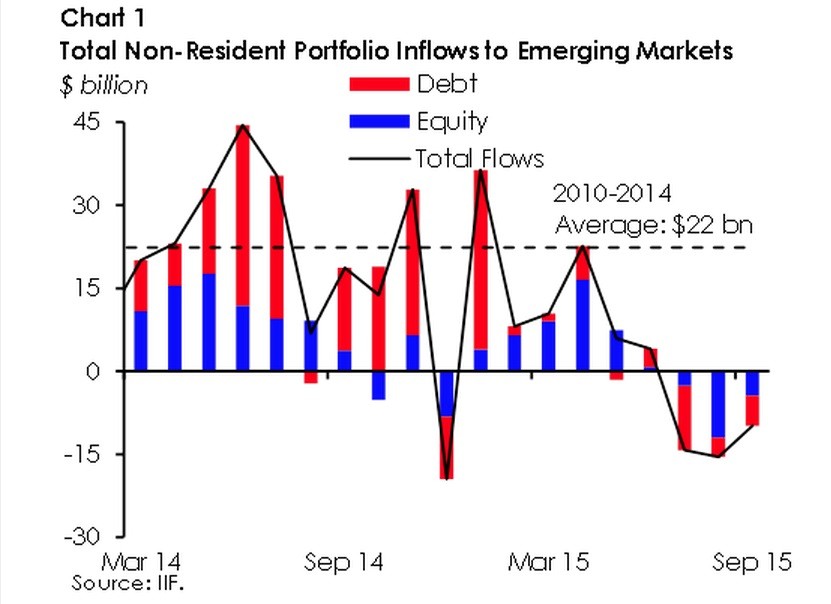

Emerging markets (EM) are on course to register their worst quarter since the global financial crisis.

According the Institute of International Finance (IIF), investors pulled out $40 bn from emerging markets in the three months through September - which marks the worst quarter since the final one of 2008.

States from Argentina to Indonesia have been hurt in recent months as investors have been nervous in the face of possible rate hike in the US, which lowers the appeal of riskier

emerging market assets. Earlier, the International Monetary Fund signaled that higher rates would trigger corporate crisis in EM.

Higher capital outflows in many countries have put local currencies under huge pressure, exacerbating fears for some investors who are now nursing losses on both the underlying asset and the local currency.

IIF has shared five charts which demonstrate what is going on in EM.

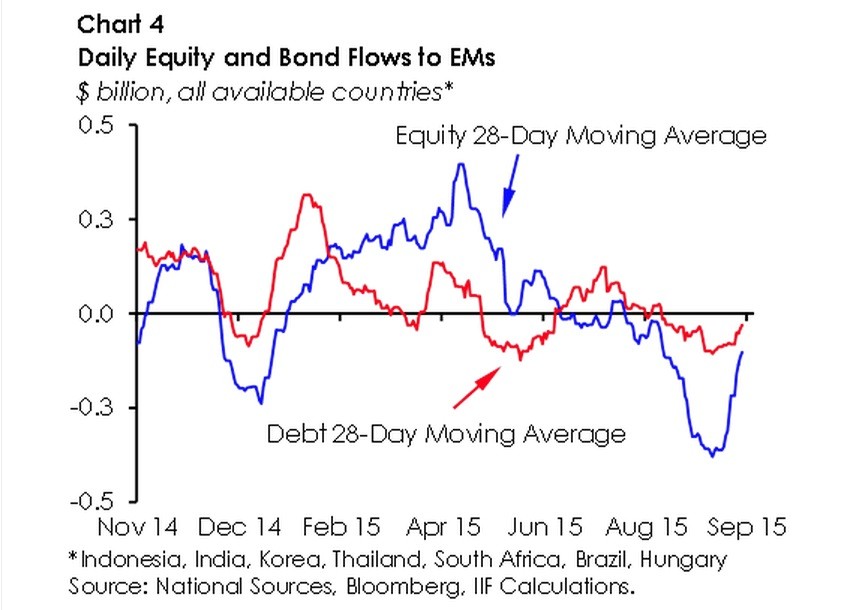

Portfolios saw temporary boost following the Fed's September meeting. While this turnaround has slowed down the outflows in September, it was a short-lived recovery. Equity and debt flows to the seven countries in IIF's sample that post daily portfolio flows data have been negative in September.

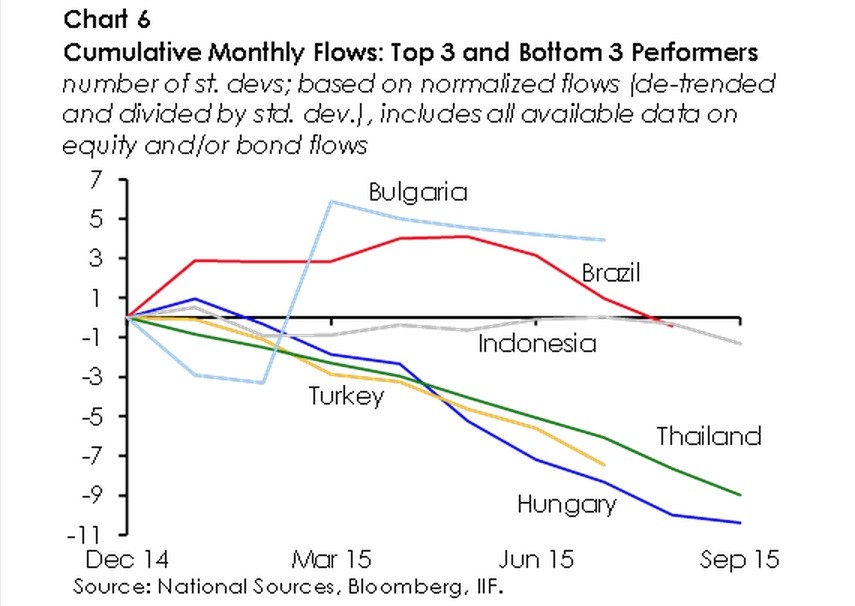

Hungary and Thailand have had a particularly hard time, while Bulgaria seems to have done okay:

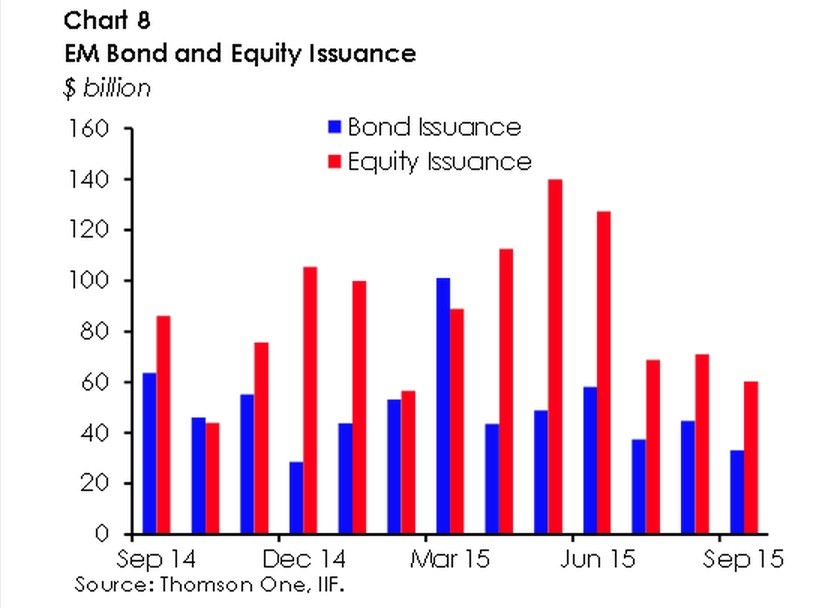

Debt and equity issuance by EM countries and firms looks to have been undermined by the market fall.

Lower issuance resulted in smaller than usual positive contributions to IIF's estimates for equity and bond flows.

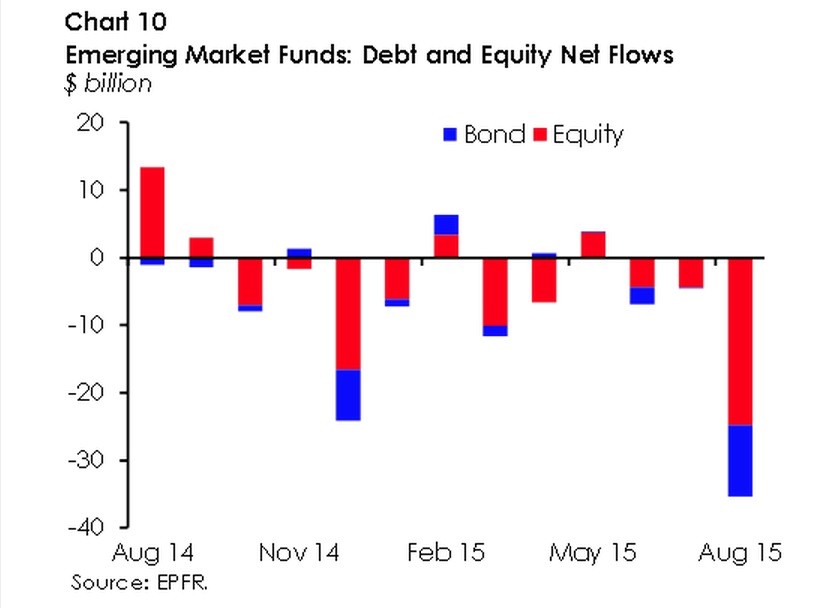

The IIF data complements numbers published by EPFR, another financial information body, but there are several differences.

While the IIF Tracker assesses total

non-resident portfolio inflows to EM, following standard

balance-of-payments conventions, EPFR gauges flows in and out of

mutual funds and exchange traded funds.

There could be some discrepancy based on sampling errors, since both estimates are sample-based.

Still, EPFR data also point to a steep decline in flows to funds related to EM.