Why Fed rate hike would be a great news for Japanese stocks

Japan's stock market suffered in the recent weeks together with the rest of Asia, but its shares may actually get a boost from a Federal Reserve rate hike.

In a recent note, Julian Jessop, chief global economist at Capital Economics said that the single key driver of equity performance in 2016 is likely to be fresh weakness in the yen. He expects the Nikkei will reach 23,000 by the end of 2016.

Jessop sees two fillips of further yen

weakness:

1) Expectations the Bank of Japan (BOJ) will expand its

quantitative easing program, potentially next month;

2) A Fed rate increase.

The uncertainty over the decision due later in the day helped drive a global market selloff amid worries over tightening liquidity.

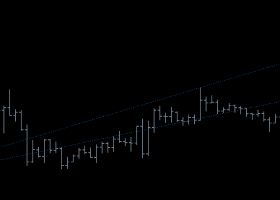

If the spread between the two-year U.S. and Japanese government bond yields broadens to one percentage point - it's currently around 70 basis points - that would warrant the Japanese currency falling to his end-2016 forecast of 140 against the U.S. dollar, from around 120.20 Wednesday, and therefore driving the Nikkei higher, according to Jessop.

What makes Japanese assets less appealing is a rise in U.S. bond yields relative to Japan's, as this helps drive outflows that weaken the yen. A softer currency typically boosts stocks as it makes exports more appealing and overseas earnings look clumsy when they are translated back into the yen.

Abenomics

The Japanese market has already had quite a rally, soaring nearly 75 percent since the beginning of 2013 and up nearly 4 percent so far this year despite doubts over whether Abenomics, as Prime Minister Shinzo Abe's plan to boost Japan's economy out of its decades-long deflationary slump is known, will see any success.

Much of the gains had been spurred by the first wave of Abenomics - a massive quantitative easing program from the Bank of Japan, which sent the yen steeply lower and boosted interest in stocks.

The "second arrow" was meant to be fiscal stimulus. Some strategists got tired of waiting for promised structural reforms, called the "third arrow."

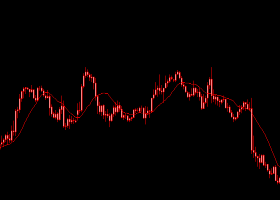

While markets have gained on Abenomics, the world's third-largest economy remained quite mute to the arrows, shrinking an annualized 1.2 percent in the April-to-June quarter, and inflation hasn't reached the BOJ's 2 percent target, with July data indicating zero.

Pointing to some of the concerns over how long the rebound would linger, U.S. ratings agency Standard & Poor's on Wednesday downgraded Japan's credit rating to A+ from AA-.

Japan's Prime Minister Shinzo Abe

A number of analysts, meanwhile, do not expect the Japanese central bank to introduce further easing. DBS thinks BOJ will monitor the impact of any Fed hike on the foreign-exchange market before moving.

"Overall, there appears to be a reluctance

to further expand the monetary base target," DBS said in a note

Wednesday. "If the yen is to weaken again, it will have to come from a

stronger U.S. dollar."

But Capital Economics is not alone in awaiting the BOJ to expand its 80 trilllion yen ($670 billion) worth of asset purchases yearly, therefore pressing down the value of the yen.

David Roche, global

strategist at research house Independent Strategy, said in an interview with CNBC that he expects more money printing:

"They have an inflation target ahead and they're going to have to print more money to hit the inflation target."

In his view, some of that stimulus may flow directly toward the stock market, as central bank appears to be running out of people willing to sell it Japanese government bonds, spurring the BOJ toward buying other risky assets, such as stocks.