______________________________________

Last 12 months currency classification

The last 12 months currency classification from a longer term perspective are provided for reference purposes. See for more information the article: Monthly Currency Score for June. where the charts are available. There are no changes since June and the currencies are classified for the coming months as follows:

- Strong: CHF / GBP / USD. The preferred range is from 6 to 8.

- Average: NZD /CAD. The preferred range is from 4 to 5.

- Weak: AUD / JPY / EUR. The preferred range is from 1 to 3.

______________________________________

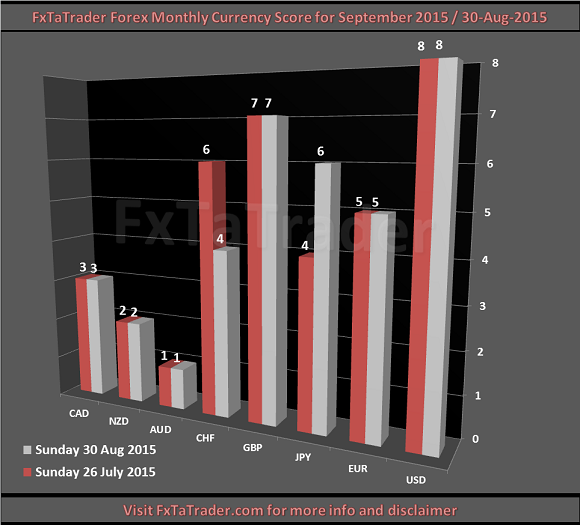

Currency Score for September

- The CHF has a score of 4. This is a strong currency and it should have by preference a score from 6 to 8. It has a score at the moment of an average currency.

- The JPY has a score of 6. This is a weak currency and it should have by preference a score from 1 to 3. It has a score at the moment of a strong currency.

- The EUR has a score of 5. This is a weak currency and it should have by preference a score from 1 or 3. It has a score at the moment of an average currency.

- The NZD has a score of 2. This is an average currency and it should have by preference a score from 4 or 5. It has a score at the moment of a weak currency.

- The CAD has a score of 3. This is an average currency and it should have by preference a score from 4 or 5. It has a score at the moment of a weak currency.

The conclusion is:

- Half of the currencies are at the right level when looking at the last 12 months currency classification.

- There is an increase of momentum for the NZD and the CAD which are getting weaker.

- There is most probably a pullback for the CHF when looking at the market as a whole. The uptrend has lost momentum.

- There is most probably a pullback for the EUR and the JPY when looking at the market as a whole. The downtrend has lost momentum.

- The pairs that we may look at are all most probably trending except for the pairs with the NZD and CAD which are most probably ranging.

- The CHF, EUR and JPY may offer a good opportunity to step in. However, it is important to determine if the pair is indeed having a pullback. For that reason it is better to see the momentum returning in the pair

______________________________________

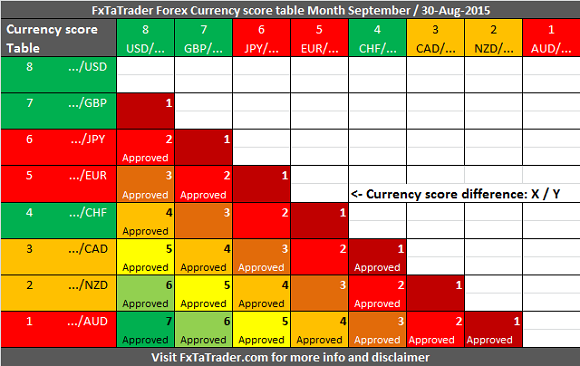

Currency Score difference for September

- GBP/NZD with the AUD/USD

- NZD/USD with the GBP/AUD

When looking at the Currency Score Table here below for this month we can see the currency score differences. The interesting pairs should have by preference a score difference of 4 or higher when they are similarly classified. Or the better classified pair should have a higher score than the counterpart. All the pairs mentioned above comply for trading in the coming month. The Currencies are colored Green, Orange and Red resp. by the classification they have. This way it is easier to see what currencies should have a certain score difference.

______________________________________

- The GBP/NZD is in an uptrend and outside the Bollinger Band. It seems best to wait for a pullback to see the pair back again within the Bollinger Band.

- The AUD/USD is in a downtrend and within the Bollinger Band.

- The NZD/USD is in a downtrend and slightly outside the Bollinger Band. Most likely it will be inside at the start of the new month.

- The GBP/AUD is in an uptrend and slightly outside the Bollinger Band. Most likely it will be inside at the start of the new month.

______________________________________