"Forget buying the dips - sell the rips..." Or should you trust today's rally?

“Forget buying the dips. Sell the rips,” says The

Daily Reckoning’s blogger Greg Guenthner, who advises investors against

immediately trusting this rally or the big ones that will possibly come

in the next few weeks.

Why is that?

"Because the biggest rallies in history have come during

bear markets. It’s that simple,” he says.

Guenthner recalls some factoids from

a USA Today article written during the 2008 meltdown. Four of the top

five all-time point gains for the Dow and ten of the biggest point rises

for the Nasdaq Composite occurred 2000-2002 bear market.

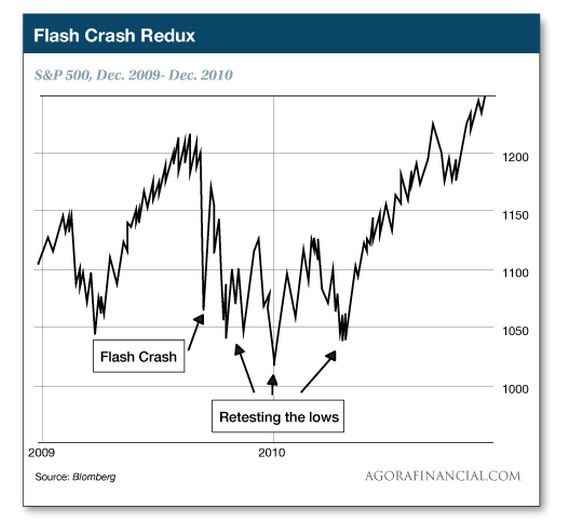

The blogger uses this chart showing the aftermath of the Flash Crash of May 2009:

Some analysts are far from being convinced the pain is over:

“It is time to tighten seat belts, as

it’s going to stay volatile for some time, because we do not have

definitive answers to the China, Fed and earnings questions,” Kim

Forrest of Fort Pitt Capital Group says to MarketWatch.

Meanwhile, Joshua Brockwell, director of investment communications at Azzad

Asset Management, thinks that investors who may have tried to time this market

will possibly hurt themselves at the end of the day.

It's hard to say how many investors bailed recently, but the

millions driven out by the 1987 stock market collapse are a testament to

what can go wrong, he notes.

“The S&P 500, a proxy for the market as a whole, posted an annual return of more than 30% two years later, one of only 12 calendar years since 1926 when the market performed that well,” writes Brockwell, noting that successful investors keep in mind that the stock market rises and dips, and that the only way to profit when the market recovers is to stay invested when it drops.

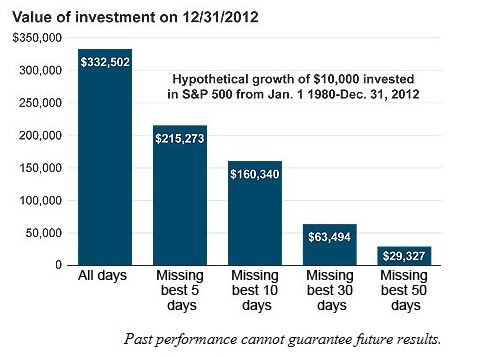

This chart of his shows that the price of leaving the market may be high: