FX Review FxTaTrader Weekly Strategy Week 31 / Sunday 26-July-2015

______________________________________

Open/pending positions of last week

NZD/USDThis pair will be analyzed briefly, for more information read the article Weekly Review Strategy Wk30 where the pair was tipped for going short. Positions were opened for this pair. Unfortunately the stop loss got hit last week and all positions were closed. The pullback after the RBNZ Interest Rate Decision was too strong and the par did not gain enough profit since opening on July 16 to set the stop loss at a larger distance.

The NZD is one of the weakest currencies with a currency score of 2 after the AUD(1). The USD is at the moment the strongest currency with a score of 8. From a longer term perspective the pair succeeded on May 29 to close and break through the lows of February and March around 0,7170. Since then it remains an interesting pair for taking short positions.

- On the weekly(decision) chart the indicators are looking strong for going short.

- In the weekly chart the Ichimoku is meeting all the conditions.

- The MACD is in negative area and the histogram is showing increase of momentum.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Ranking and rating list Week 31

Rank: 4

Rating: - - -

Total outlook: Down

______________________________________

This pair will be analyzed briefly, for more information read the article Weekly Review Strategy Wk29 where the pair was tipped for going long. A position was opened on July 14. The pair is clearly in an uptrend and it is gaining momentum. It consolidated last week and this make the pair interesting again when looking at the Weekly chart because it is close to the Bollinger Band. This means that the pair is no more that overbought as in the period before.

From a longer term perspective it broke through a previous significant top of February 24 at 1,9554. The pair was already in an uptrend before breaking through this level but after the break it boosted up even further. When trading with the CAD I also check the Weekly Crude Oil chart and this one is again picking up the downtrend after the pullback that started in February and March. The GBP is one of the stronger currencies at the moment with a currency score of 7 just below the USD(8). The CAD is an average currency and is one of the weakest currencies at the moment with a score of 3 after the NZD(2) and the AUD(1). With a score difference of 4 and the GBP being better classified it remains an interesting pair.

- On the weekly(decision) chart the indicators are looking strong for going long.

- In the weekly chart the Ichimoku is meeting all the conditions.

- The MACD is in positive area and the histogram is showing strong increase of momentum.

- The Parabolic SAR is long and showing the preferred pattern of higher stop loss on opening of new long and short positions.

Ranking and rating list Week 31

Rank: 7

Rating: + +

Total outlook: Up

______________________________________

Possible positions for coming week

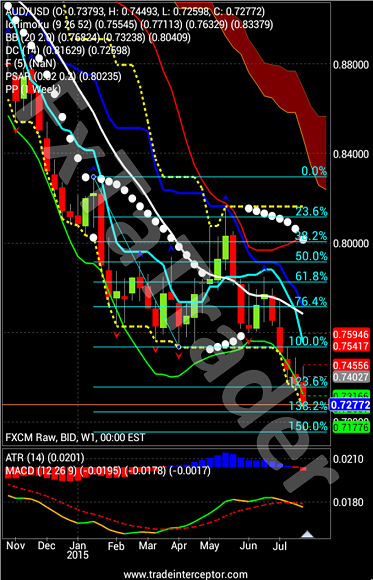

AUD/USDThis pair will be analyzed in detail. Last Friday it also succeeded to break through the recent lows at around 0,7340 and it is clearly building momentum. From a longer term perspective the pair succeeded on July 3 to close and break through the lows of March and April at 0,7535. Since then it remains an interesting pair for taking short positions.

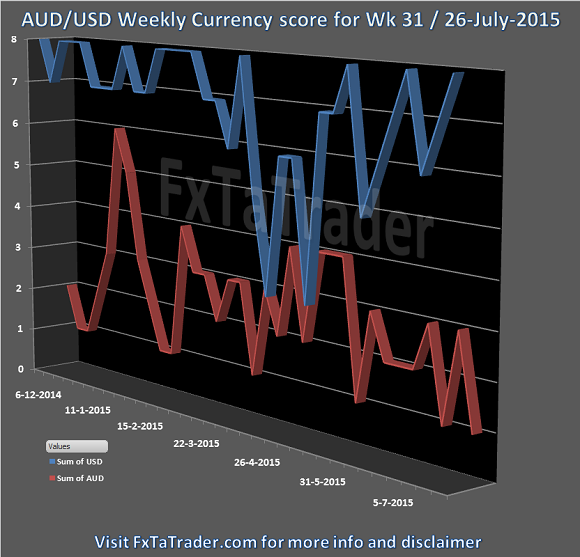

The AUD has been weak for more than 6 months and had a light pullback in May. Since August 2014 The USD is clearly in an uptrend and is having almost all of the time a currency score of 6 or higher. Only during the pullback last May it had several times a score lower than 6 and succeeded to correct itself fast. The pair is clearly in a downtrend and it is gaining momentum.

- As shown in the Currency Score chart in my previous article of this weekend the USD has a score of 8 and the AUD a score of 1.

- In the current Ranking and Rating list of this weekend the pair has a rank of 3. This list is used as additional information besides the Currency score and the Technical Analysis charts.

- Besides the general information mentioned the outlook in the TA charts also makes this an attractive opportunity.

Ranking and rating list

Week 31

Rank: 3

Rating: - - -

Weekly Currency score:

Down

Based

on the currency score the pair looked interesting since the end

of May. The USD is a strong currency from a longer term perspective and

after the pullback in May it found the uptrend again. The AUD is a weak

currency from a longer term perspective and it remains weak. This offers an opportunity. With currently a Score

difference of 7 and the USD being better classified it is an

interesting pair for taking positions in the coming week.

_______________________________________________________

Monthly chart: Down

- On the monthly(context) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all of the the conditions.

- The MACD is in negative area and gaining strength.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

- Since the monthly chart is used to get the context how that pair is developing for the long term the indicators are looking fine because they are showing strength in the current downtrend.

Weekly chart: Down

- On the weekly(decision) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative area and gaining strength.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Daily chart: Down

- On the daily(timing) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative area and gaining strength.

- The Parabolic SAR is short showing the preferred pattern of lower stop loss on opening of new long and short positions.

Total outlook: Down

AUD/USD Weekly chart

______________________________________

______________________________________