Greek Prime Minister Alexis Tsipras and his creditors sparred heading into Sunday’s referendum on austerity as a poll suggested voters are inclined to accept deeper cuts.

As rationing of pensions began in the first week of capital controls, a survey showed more Greeks going against the government’s call to vote against creditors’ terms for more aid. A late compromise bid by Tsipras, who’s urging citizens to vote “no,” was quashed by the rest of the euro region, meaning negotiations would have to wait until after the plebiscite.

The battle lines ahead of the vote now appear immovable as Greeks adjust to financial misery with no prospect of their economic woes ending any time soon. The political posturing -- along with the expiration of its bailout deal and a missed payment to the International Monetary Fund -- masked the desperation as the economy sputtered and cash ran low.

“The clock cannot be simply set back to where it was Friday night before Tsipras broke off the talks,” Holger Schmieding, an analyst at Berenberg Bank, wrote to clients. “The old bailout is not expiring. It has expired. Getting a new agreement now will be more difficult.”

First Poll

If it means staying in the currency bloc, the majority of Greeks may be willing to vote against the very government they elected five months ago to take a stand against austerity.

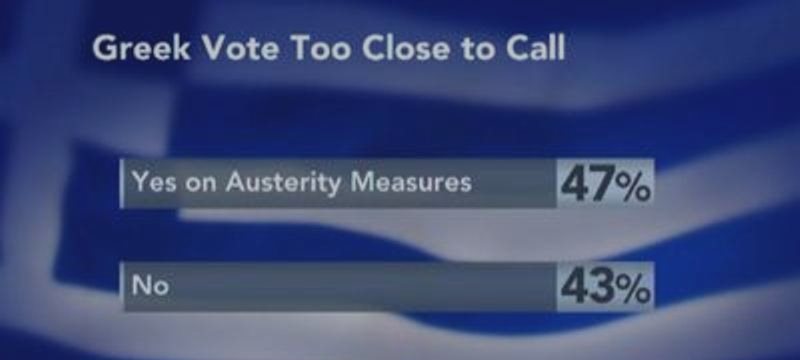

A GPO poll cited by euro2day.gr said 47 percent of people are leaning toward a “yes” vote, with those in the “no” camp not far behind with 43 percent. GPO interviewed 1,000 adults on Tuesday, four days after Tsipras’s call for referendum. There is a margin of error of 3.1 percentage points.

European stocks and bonds jumped on signs of a thaw in Athens. Asia followed them higher Thursday. The MSCI Asia Pacific Index rose for a third day, adding 0.2 percent by 11:22 a.m. in Tokyo. The euro was little changed in Asia trading.

“Whatever the scenario is, at the end of the day, the euro zone can handle the scenario,” Societe Generale Chief Executive Officer Frederic Oudea told Bloomberg Television. “The situation in terms of the structure of the banks, the exposure of Greece and the Greek economy is certainly different” than at the beginning of the crisis.

In a letter to European Commission President Jean Claude Juncker, European Central Bank President Mario Draghi and International Monetary Fund Managing Director Christine Lagarde, Tsipras resisted their demands on pensions and tax discounts to Greek islands.

Pensions, Tax

He proposed delaying implementation of the zero-deficit clause for retirement funds and other pension reforms until October instead of July and maintaining a 30 percent discount on sales tax for islands. He also wants to proceed with changes to collective-bargaining rules that creditors opposed.

Creditors are insistent on pension reforms that would bring savings of as much as 1 percent of gross domestic product by 2016 and immediate steps to eliminate early retirement benefits and allowances for lower pensions.

In Athens, the queue of retirees at the few banks that opened Wednesday underscored the country’s plight. At 7 a.m., a few dozen pensioners were outside a central branch of the National Bank of Greece. They were to receive a maximum of 120 euros ($133), compared with the average monthly payment of about 600 euros. Many left with nothing after being told only those with last names from letters A to K would get paid.

A call among euro-area finance ministers failed to budge the situation.

Waiting for Referendum

“We see no grounds for further talks at this point,” Dutch Finance Minister and Eurogroup chief Jeroen Dijsselbloem said in a video message. “We will simply wait now the outcome of the referendum on Sunday and take into account the outcome of that referendum.”

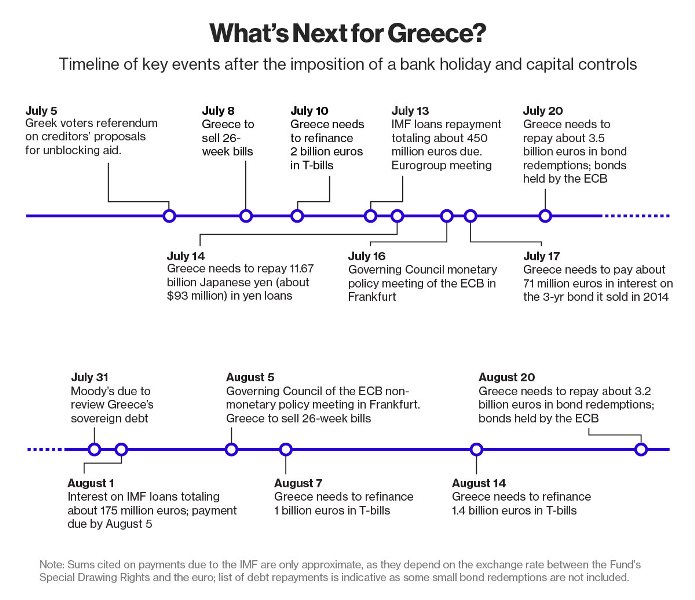

In Frankfurt, the European Central Bank maintained its emergency support for Greek lenders following Greece’s failure to repay $1.7 billion to the IMF. The cap, which was frozen after the referendum was called, was kept unchanged.

With banks now shut and Greeks limited to daily withdrawals of 60 euros, the decision by ECB policy makers gives the country more time for a political solution to succeed.

Following reports of his letter to creditors, Tsipras addressed the nation to quash speculation swirling on social media that he might cancel the referendum.

Instead, he doubled down, reiterating his call to reject austerity. He said it would strengthen his bargaining position.

Popular Verdict

“Come Monday, the Greek government will be at the negotiating table after the referendum, with better terms for the Greek people,” Tsipras said in a Twitter message posted as he spoke on national television. “A popular verdict is much stronger than the will of a government.”

Angela Merkel -- Europe’s dominant political figure and his chief adversary -- took it in stride. Asked whether she and Tsipras are still on speaking terms, the German chancellor said the two had talked several times in the last few days.

“Our personal relationship has not been damaged at all,” Merkel told reporters. “We can talk to each other anytime and have done so recently.”