Japan’s Retail Traders Betting Yen Haven Surge Will Be Fleeting

2 July 2015, 05:28

0

128

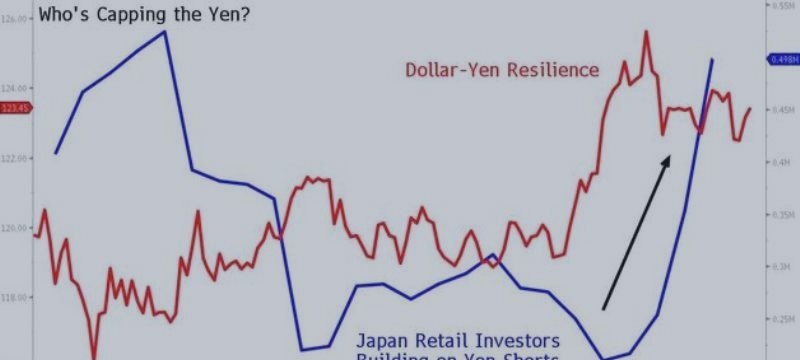

Japan’s retail investors aren’t buying into the yen’s rally as the Greek crisis spurs traditional haven flows into the Asian nation’s currency.

Wagers by individuals, who borrow so they can trade greater amounts than the cash held in their accounts, turned the most bearish on the yen since Feb. 3 last week, just as Europe’s turmoil amplified the currency’s rebound from last month’s 13-year low against the greenback.

Who's Capping the Yen

The yen slid to 125.86 per dollar June 5 and has dropped 3 percent this year amid prospects the Federal Reserve will raise interest rates this year while the Bank of Japan sticks to record monetary easing. The Japanese currency surged to a one-month high of 121.94 on June 30 on concerns that Greece will miss its payments, only to see it pushed back lower to the 123-level two days later.

“Individual investors’ bargain-hunting is supporting the dollar-yen,” said Kengo Suzuki, chief currency strategist at Mizuho Securities Co. in Tokyo. “Views are firmly rooted in the trend for a stronger dollar and a weaker yen as the U.S. raises interest rates, while Japan keeps an easy monetary stance.”

Bets among smaller investors for the yen to fall against the dollar reached 498,134 contracts on June 23, according to the latest data available from the Tokyo Financial Exchange Inc.’s Click 365, where such trading takes place. That’s the most since the record 524,472 contracts seen on Feb. 3.

Typical Behavior

“It is typical retail behavior,” said Simon Pianfetti, a senior manager at market solutions department at SMBC Trust Bank Ltd. in Tokyo. “They at least waited for the dollar-yen to fall a bit to unwind their short positions.”

One-week implied volatility on the yen against the dollar, a measure of bets on future price swings, jumped to its highest since Feb. 3 on June 29. The dollar rose 0.2 percent to 123.46 yen at 11:11 a.m. Tokyo time, its highest this week, after Greece signaled it was ready to compromise on ending a standoff over bailout aid. The Mediterranean nation will hold a referendum on creditors’ demands on Sunday.

“Dollar-yen volatility will rise as the yen will be hit by speculative trade related to Greece,” said Masashi Murata, vice president at Brown Brothers Harriman & Co. in Tokyo. “Rising volatility pushed the lower end of the range but the trend isn’t down. The floor is firm and buying at lows is the trading idea.”

Wagers by individuals, who borrow so they can trade greater amounts than the cash held in their accounts, turned the most bearish on the yen since Feb. 3 last week, just as Europe’s turmoil amplified the currency’s rebound from last month’s 13-year low against the greenback.

Who's Capping the Yen

The yen slid to 125.86 per dollar June 5 and has dropped 3 percent this year amid prospects the Federal Reserve will raise interest rates this year while the Bank of Japan sticks to record monetary easing. The Japanese currency surged to a one-month high of 121.94 on June 30 on concerns that Greece will miss its payments, only to see it pushed back lower to the 123-level two days later.

“Individual investors’ bargain-hunting is supporting the dollar-yen,” said Kengo Suzuki, chief currency strategist at Mizuho Securities Co. in Tokyo. “Views are firmly rooted in the trend for a stronger dollar and a weaker yen as the U.S. raises interest rates, while Japan keeps an easy monetary stance.”

Bets among smaller investors for the yen to fall against the dollar reached 498,134 contracts on June 23, according to the latest data available from the Tokyo Financial Exchange Inc.’s Click 365, where such trading takes place. That’s the most since the record 524,472 contracts seen on Feb. 3.

Typical Behavior

“It is typical retail behavior,” said Simon Pianfetti, a senior manager at market solutions department at SMBC Trust Bank Ltd. in Tokyo. “They at least waited for the dollar-yen to fall a bit to unwind their short positions.”

One-week implied volatility on the yen against the dollar, a measure of bets on future price swings, jumped to its highest since Feb. 3 on June 29. The dollar rose 0.2 percent to 123.46 yen at 11:11 a.m. Tokyo time, its highest this week, after Greece signaled it was ready to compromise on ending a standoff over bailout aid. The Mediterranean nation will hold a referendum on creditors’ demands on Sunday.

“Dollar-yen volatility will rise as the yen will be hit by speculative trade related to Greece,” said Masashi Murata, vice president at Brown Brothers Harriman & Co. in Tokyo. “Rising volatility pushed the lower end of the range but the trend isn’t down. The floor is firm and buying at lows is the trading idea.”

![[$9,496] in 5 Days Using 'Supply Demand EA ProBot' (Live Results) [$9,496] in 5 Days Using 'Supply Demand EA ProBot' (Live Results)](https://c.mql5.com/6/965/splash-preview-761070-1740062258.png)