3 Numbers: German Ifo survey setback, US mortgages, US Q1 GDP

The Ifo survey update will show a minor decline in German macro expectations

Positive tailwinds in US housing point to a likely rise in mortgage applications

The Q1 slump in the US is on track to ease in today’s revised GDP report

By James Picerno

United States

James Picerno is a macro analyst/editor at CapitalSpectator.com

The crowd’s focused on reports of a rescue plan for Greece that's in the works. If the plan survives, Grexit risk will fade while boosting the prospects that the Eurozone recovery will roll on. Meantime, a slight setback is expected for today’s update on expectations for the German economy, via the Ifo survey release. Later, two US numbers will grab the crowd’s attention: the weekly update on mortgage applications and a revised estimate for Q1 GDP.

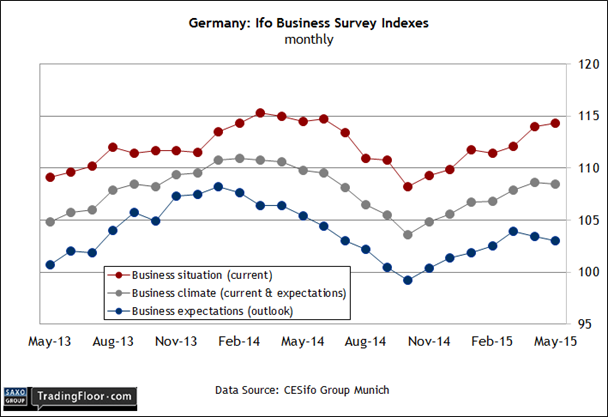

Germany: Ifo Economic Survey (08:00 GMT) Europe’s biggest economy continues to expand at a moderate pace, according to Markit’s preliminary survey numbers for June. The flash PMI figures for the services and manufacturing sectors inched higher in this month's flash estimates. In other words, the prospects look favourable for stability and growth at the Eurozone’s core — all the more so if the Continent can move past the Greek crisis.

Nonetheless, the Markit economist who oversees the data for Germany advises that the broad profile in the latest batch of numbers still paints a mixed outlook. “While companies reported that output rose at a stronger rate than in May, the latest increases in new business and employment were only slight and suggest that activity growth may slow again in coming months,” said Oliver Kolodseike. “Moreover, the survey data for the second quarter signal it is unlikely GDP growth has picked up since the first quarter.”

A slightly tempered but still positive outlook is expected in today’s survey update from the Ifo Institute. Econoday.com’s consensus forecast sees modest declines for the current and expectations benchmarks in June. Lower numbers aren’t a surprise for the expectations’ figures, which slipped in April and May for the first time since last October. The crowd’s forecast for a dip in the current climate reading, however, would mark the first retreat since January.

Even so, a modest dip at this stage isn’t surprising or particularly troubling. Given the mounting worries linked to Greece in recent months, it’s no shock to learn that sentiment is softer these days. But with reports that Europe is working on a rescue plan for Greece, the odds are still high that Germany’s macro pace will continue to deliver moderate if unimpressive growth for the near term.

That’s the implied forecast in the German stock market these days, which has stabilized over the past week after sliding for two months. Assuming the Greek crisis is fading as a real and present danger, the macro focus for Europe generally will return to what’s increasingly looking like an enduring if still-moderate recovery.

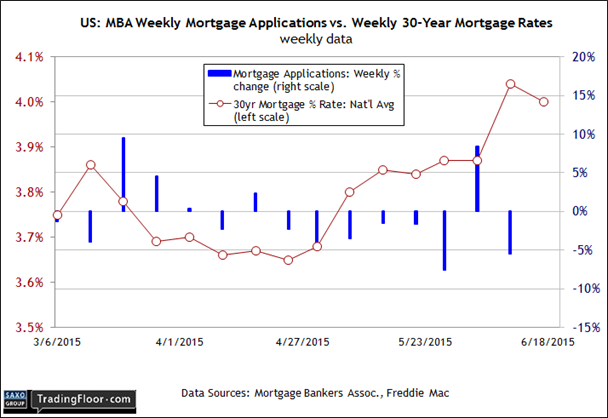

US: Weekly Mortgage Applications (11:00 GMT) This week’s news that home sales surged in May raises the odds that the housing market is headed for a sustained run of stronger growth in this year’s second half.

Existing home sales last month increased to the highest rate in more than five years while new one-family sales inched ahead to a seven-year high. Reviewing a broad spectrum of numbers convinced economists at Nationwide, an insurance company, to forecast an upbeat future. “Most US housing markets are healthy with little chance of a downturn in the near term,” the company advised. This week’s quarterly update of the firm’s leading indicator for housing dipped slightly to 109.4, but remains comfortably above the neutral 100 mark for Q2 — a “very positive” level, according to Nationwide.

Given the upbeat numbers of late, it’s reasonable to expect that we’ll see some improvement in today’s weekly update on demand for mortgage applications. A positive comparison would certainly be welcome after declines in seven of the past eight weeks.

Of course, with the prospect of higher interest rates still lurking in the not-so-distant future, the housing market could face new headwinds. But the national average for a 30-year fixed mortgage rate dipped slightly last week to 4.0% after a sharp gain in the previous week. It seems that the broad trend remains productive for another round of good news in today’s weekly release.

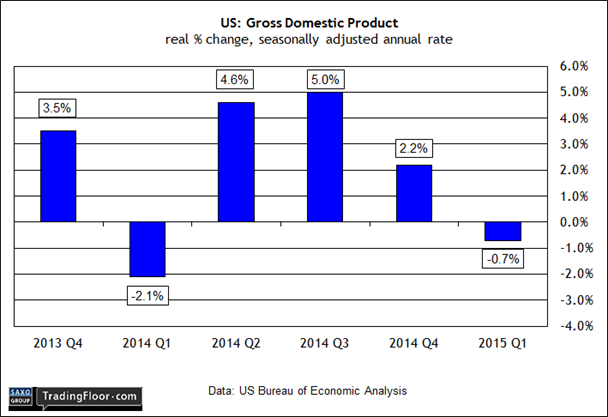

US: Q1 GDP - 3rd Estimate (12:30 GMT) The economy suffered a setback in the first quarter, but the decline is expected to ease a bit in today’s revision. Econoday.com’s consensus forecast anticipates a 0.2% decline (seasonally adjusted annual rate). That’s still a weak number, but it’s an improvement over the current estimate of a 0.7% slide.

If the crowd’s right, a lesser decline in Q1 will boost confidence that the recovery that appears to be underway in the second quarter remains intact. The Atlanta Fed’s GDPNow model projects a 1.9% rise for GDP in the second quarter. That’s still relatively sluggish, but it’s a decent rebound from Q1. Yes, slow growth is still the prevailing assumption, but some analysts are looking for a stronger pace of expansion when the government next month publishes the initial GDP data for Q2.

Economists at BMO Capital Markets are especially upbeat. “The economy had a slow start to the second quarter, though recent data point to a solid 3% rebound,” the macro team at the bank advised this week. “Auto sales are running the fastest in a decade, companies have boosted hiring, and home sales are at multi-year highs in response to low mortgage rates, easier lending standards and increased household formation. We expect growth to stay near 3% in the second half of the year, led by consumer spending.”

Tomorrow’s income and spending update for May will provide deeper context for stress-testing BMO’s bullish forecast. But first, let’s see how today’s final revision for Q1 GDP compares. A lesser decline will make it that much easier to climb out of the hole in Q2 and beyond.