Bullish Divergence Saved Sterling From The Strengthening Of The U.s. Dollar

On Tuesday's trading yesterday, the U.S. dollar index rose supported by the release of the new home sales data in the us to reach the highest level of 7 years. Sales of new homes in the u.s. are recorded as much as 546.000 units, higher than the previous period 534.000 units. Strengthening of the U.S. dollar index reached level 95.640, test the Fibonacci Retracement level 38.4% (from 93.560-96.910). In the midst of the market's anxiety about the debt problems of Greece who up to now haven't reached an agreement, the strengthening of the US dollar index is estimated to still be taking place in the short term to wait for the release of the Final U.S. GDP data will be released at 19.30 BST later that night, with an estimated increase to-0.2% from the prior-0.4%. The rise in the estimation of potentially provide positive impact the strengthening of the us dollar index.

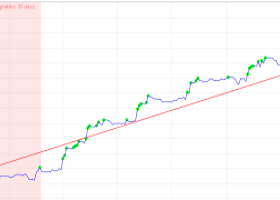

Strengthening of the U.S. dollar index put pressure against competing currencies including GBP/USD that depressed until the lowest intraday level scored at level 1.57100. The level is now a key support for the day. However, in the intermediate penddek GBP/USD potentially rebound supported by bullish divergence signal is indicated by the indicator RSI are forming a higher low and price movements form a lower low. GBP/USD is expected to attempt a rebound towards level 1.58440, level 1.57100 with keeping as a limitation of risk. Transpiration under level 1.57100 will change the direction of movement of the GBP/USD turned bearish, with a target of 1.56400 to 1.55500.