Those skeptical about staying in the European Union and trying to convince the U.K. to leave the bloc, will now have a slippery economic argument, data shows.

According to fresh data compiled by Bloomberg, growth in the euro area will pick up significantly in the lead-up to the referendum.

Although, an exact date of the referendum has not been set yet, British authorities are thinking about conducting it in October 2016 - just shortly before the 2017 deadline.

Last week, Prime Minister David Cameron publicly ruled out a May 2016 vote, however, people with knowledge of the matter are sure that representatives of the financial industry and government counterparts in other countries were told by some U.K. officials that the referendum was aimed to be held after summer next year.

The reason for delaying the date was that David Cameron needed more time to push for concessions from other EU nations, according to Bloomberg.

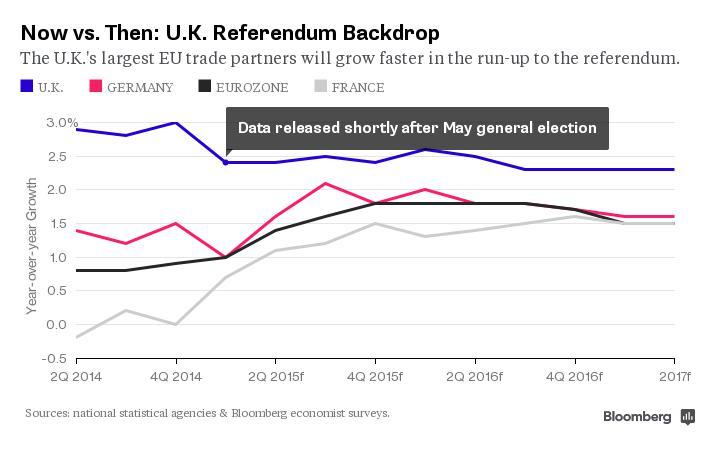

In order to see that the economic background is changing, you should see a couple of charts below.

The first one shows that after the May general election, the U.K. economy expanded 2.4 percent year-over-year in the first quarter compared to just 1 percent in Germany and in the euro area overall. France grew only 0.7 percent during the same period.

In the period between now and the end of 2017, that 1.4 percentage point growth differential between the U.K. and euro area is expected to fall to as low as 0.5 percentage point, thanks to the better rebound finally taking hold across Europe.

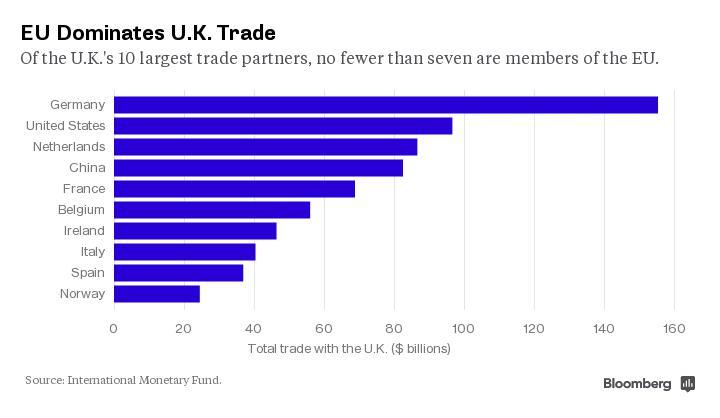

The EU improving outlook portrayed below (which still lags behind that of the U.K.) is certainly good news for the U.K. It counts seven EU member states among its 10 largest trade partners. How it will impact the pro-EU and anti-EU teams is a less clear question, as they prepare their arguments for the U.K.'s second referendum on its membership in the EU.