Dow theory

The father of this theory is Charles H. Dow

who said that the most of instruments are behaving in specific way. This theory

is based on

* the currencies and instruments have clearly based trend

* the instrument contains "trendmaking" factors based on supply and

demand

* when the trend has changed a specific formation is created and is always

repeated with the purpose to predict the trend

For supporting this theory he built

well known indexes :

1. Dow Jones

Industrial Average - based on 30 most important industiral companies

- called industrial index

2. Dow Jones Rail Average (DJRA) - based on 12

transport companies , today known as Dow Jones Transportation Average

According to Dow all these aspects

happened on market are reflected through these two indexes. For each index are

typical three trends :

* primary trend - it

is the most important because it contains all positive and negative moves. Each

of this movement has its specific length.

* secondary trend it shows us less important

movements , short term movements ( 3months - 1 year)

* tercial trend it show us very shor term

movements of the market during few days

Each trend contains these periods:

* cyclical period - it represents periodical /

cyclical movements of the market with specific time lenght.

* seasonal period - it represents periodical

changes of the market but only during specific period ( eg. summer , winter)

* random period - sometimes in doesnt contain

any of this period . The random period is buil up by cyclical and seasonal

period.

This is just a basic theory about dow

theory and also today we can find the people which dont like this theory.

The question is how to use this

theory. We will use the first period - cyclical

Let me show you how ....i will ask you have you ever try this ?

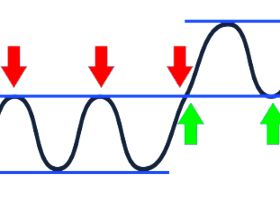

As you can see on the market we have some cycles ,...isnt it easy ? I have made just a symle example . But the same research could be done on lower TFs and also in uptrend ! ,... you get it ? The market behaves in some specific ways . I understand the market is changing each day , but this theory is here for many years.

Wish you many green pips.

T