FX Review FxTaTrader Weekly Strategy Week 14 / Sunday 29-Mar-2015

29 March 2015, 19:59

0

129

In

this article I will provide my view on the EUR/NZD and the AUD/USD. These are

the

pairs that I am currently interested in or was interested in last week

for trading with the FxTaTrader

weekly

strategy. I will pick one to analyse in more

detail from the pairs that have not been discussed yet recently.

This pair will be analyzed briefly, for more information read the article Weekly Review Strategy Wk13 where the pair was tipped for going short. The NZD is a stronger currency from a longer term perspective with a score of 6. The EUR remains weak with a score of 2. With a Currency score difference of 4 and the NZD better classified it is an interesting pair.

The downtrend is still strong but there is a pullback in the last few days offering an opportunity. One position was opened last week and it missed the profit target by 10 pips last Friday. The pair recovered significant but seems to have found the downtrend again at the end of the trading session last Friday.

Ranking and rating list Week 14

Rank: 9

Rating: - -

Total outlook: Down

This pair will be analyzed in detail. The USD is a stronger currency from a longer term perspective with a score of 7. The AUD remains weak with a score of 3. The pair had during the last weeks a pullback. It seems as if this is ending and the downtrend can resume again soon. The 4 hour chart is starting to look interesting again for going short.

Rank: 6

Rating: - -

Weekly Currency score: Down

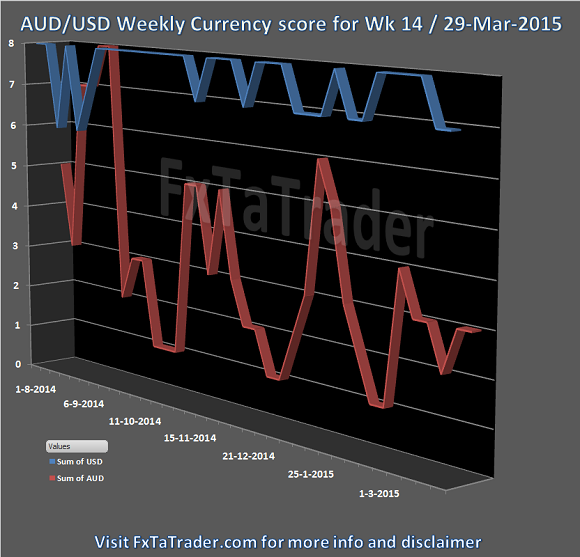

Based on the currency score the pair looked interesting in the last 3 months. The USD is a stronger currency from a longer term perspective and had in the last weeks a score of 7 and 8. The AUD is a weaker currency from a longer term perspective and had in the last weeks a score between 1 and 4. The currency remains weak and it seems to stay this way in the coming period. With currently a Currency Score difference of 4 and the USD being better classified it is an interesting pair for taking positions in the coming week.

Monthly

chart: Down

Weekly chart: Down

Daily chart: Down

Total outlook: Down

If you would like to use this article then mention the source

by

providing the URL FxTaTrader.com

or the direct link to this article. Good luck in the coming week and

don't forget to check my weekly Forex "Ranking and Rating list" and the

"Currency Score".

DISCLAIMER: The

articles are my personal opinion, not recommendations, FX trading is

risky and not suitable for everyone.The content is for educational

purposes only and is aimed solely for the use by ‘experienced’ traders

in the FOREX market as the contents are intended to be understood by

professional users who are fully aware of the inherent risks in forex

trading. The content is for 'Forex Trading Journal' purpose only.

Nothing should be construed as recommendation to purchase any financial

instruments. The choice and risk is always yours. Thank you.

_______________________________________________________

Open/pending positions of last week

EUR/NZDThis pair will be analyzed briefly, for more information read the article Weekly Review Strategy Wk13 where the pair was tipped for going short. The NZD is a stronger currency from a longer term perspective with a score of 6. The EUR remains weak with a score of 2. With a Currency score difference of 4 and the NZD better classified it is an interesting pair.

The downtrend is still strong but there is a pullback in the last few days offering an opportunity. One position was opened last week and it missed the profit target by 10 pips last Friday. The pair recovered significant but seems to have found the downtrend again at the end of the trading session last Friday.

- On the weekly(decision) chart the indicators are looking strong for going short.

- In the weekly chart the Ichimoku is meeting all the conditions.

- The MACD is in negative area and gaining momentum.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Ranking and rating list Week 14

Rank: 9

Rating: - -

Total outlook: Down

_______________________________________________________

Possible positions for coming week

AUD/USDThis pair will be analyzed in detail. The USD is a stronger currency from a longer term perspective with a score of 7. The AUD remains weak with a score of 3. The pair had during the last weeks a pullback. It seems as if this is ending and the downtrend can resume again soon. The 4 hour chart is starting to look interesting again for going short.

- As can be seen in the Currency Score chart in my previous article of this weekend the USD has a score of 7 and the AUD a score of 3.

- In the current Ranking and Rating list of this weekend the pair has a rank of 6. This list is used as additional information besides the Currency score and the Technical Analysis charts.

- Besides the general information mentioned the outlook in the TA charts also makes this an attractive opportunity.

Rank: 6

Rating: - -

Weekly Currency score: Down

Based on the currency score the pair looked interesting in the last 3 months. The USD is a stronger currency from a longer term perspective and had in the last weeks a score of 7 and 8. The AUD is a weaker currency from a longer term perspective and had in the last weeks a score between 1 and 4. The currency remains weak and it seems to stay this way in the coming period. With currently a Currency Score difference of 4 and the USD being better classified it is an interesting pair for taking positions in the coming week.

_______________________________________________________

- On the monthly(context) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative area and gaining strength.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

- Since the monthly chart is used to get the context how that pair is developing for the long term the indicators are looking fine because they are showing strength in the current downtrend.

Weekly chart: Down

- On the weekly(decision) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative area but consolidating because of the current pullback.

- The Parabolic SAR is short showing the preferred pattern of lower stop loss on opening of new long and short positions.

Daily chart: Down

- On the daily(timing) chart the indicators are looking reasonable for going short.

- The Ichimoku is meeting almost all the conditions. The MA's are almost crossing. However, the pair broke through both MA's.

- The MACD is in negative but making higher bottoms because of the recent pullback.

- The Parabolic SAR is long but showing the preferred pattern of lower stop loss on opening of new long and short positions.

Total outlook: Down

AUD/USD Weekly chart

_______________________________________________________

_______________________________________________________