Technical Chart Pattern Analysis for US Dollar, S&P 500, Gold and Crude Oil - Gold Aims Higher, Crude Oil Stalling Below $57

US DOLLAR TECHNICAL ANALYSIS

Prices reversed downward as

expected, making good on bearish cues telegraphed through negative RSI

divergence. Near-term support is in the 11854-78 area (March 2009 high,

14.6% Fibonacci expansion), with a break below that on a daily closing

basis exposing the 11679-737 region (February 26 low, 38.2% Fib

retracement).

S&P 500 TECHNICAL ANALYSIS

Prices put in a bearish Evening

Star candlestick pattern below February’s swing high, hinting a move

lower is ahead. A daily close belowthe 14.6% Fibonacci expansion at

2084.00 exposes rising trend line support at 2057.10.

GOLD TECHNICAL ANALYSIS

Prices look poised for another move

above the $1200/oz figure. A break above the 38.2% Fibonacci retracement

at 1205.58 exposes the 50% level at 1225.04. Alternatively, a turn

below the 23.6% Fib at 1181.51 targets the 1166.67-1170.09 area (channel

top resistance-turned-support, 14.6% retracement).

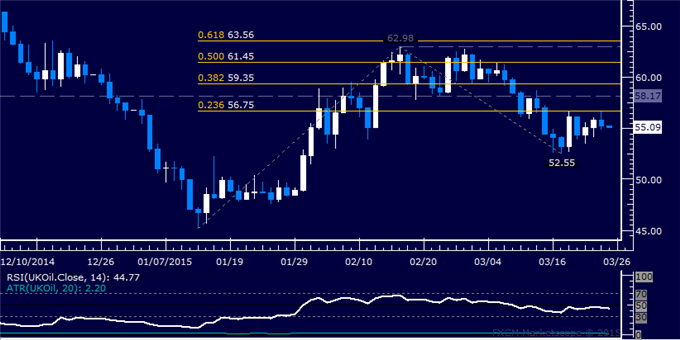

CRUDE OIL TECHNICAL ANALYSIS

Prices continue to stall below the

$57.00/barrel figure. A daily close above the 23.6% Fibonacci expansion

at 56.75 exposes support-turned-resistance at 58.17. Near-term support

is at 52.55, the March 17 low.