Gold & Silver Stocks: 2015 will clearly show the bottom, and Gold & Silver Stocks will rise again

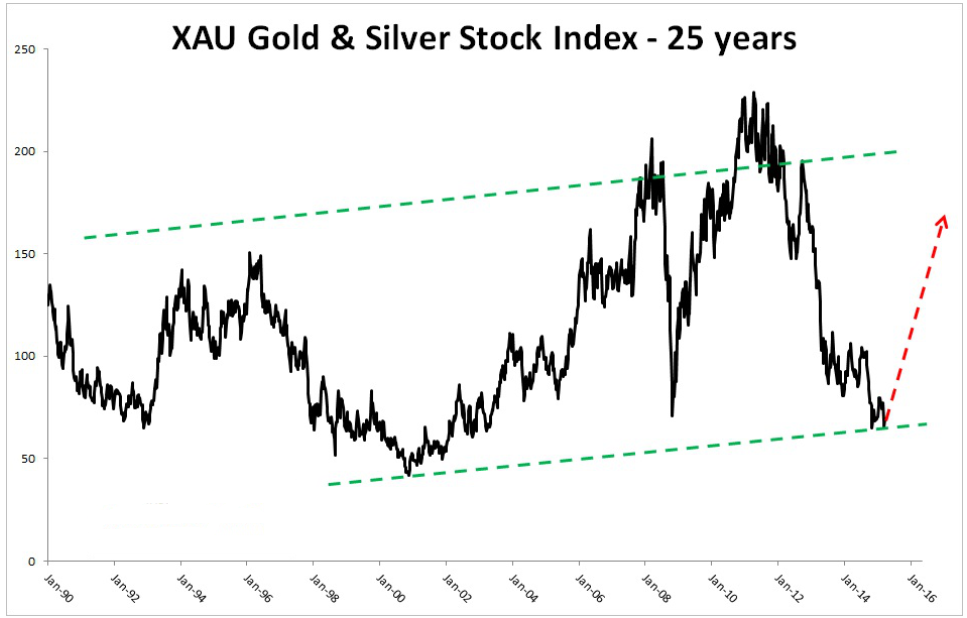

The XAU is an index of gold and silver stocks. The XAU bottomed in November 2014 below 62 at a 14 year low, down

approximately 73% from its 2011 high at approximately 230. As of Friday

March 20 it closed at 69.27. This is the 25 year graph of the XAU:

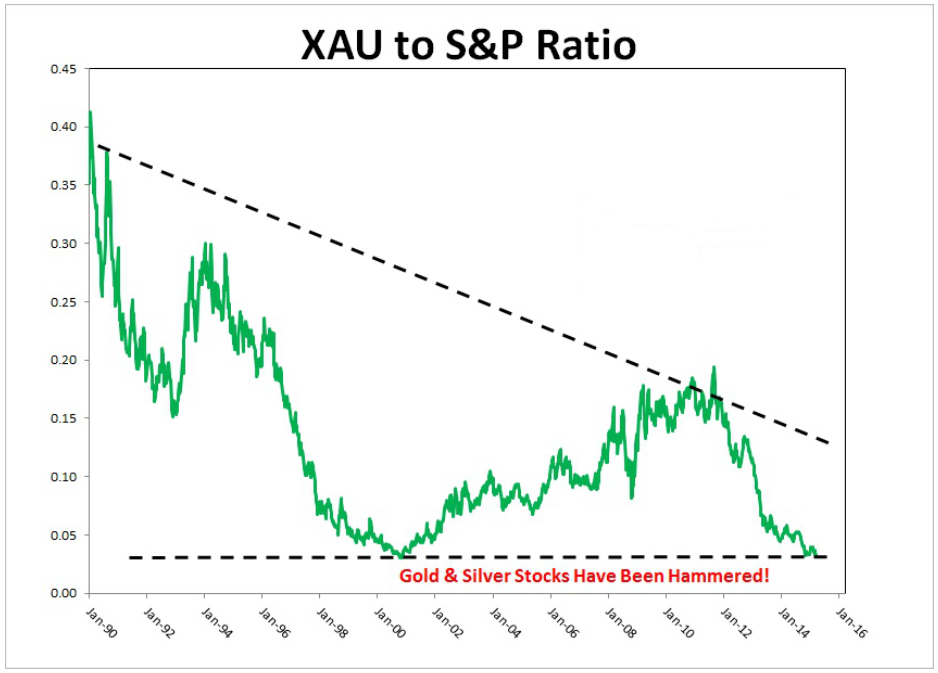

S&P 500 Index has rallied to new highs, looks toppy, and has been levitated by “money printing” and low interest rates. You can find below the graph of the ratio between the XAU and the S&P. The ratio is currently at lows last seen in 2000 and is near all-time lows. Gold and silver prices have been weak for four years and the XAU has been crushed further. Expect gold, silver, their stocks, and their ratio to the S&P to rally in 2015 and 2016.

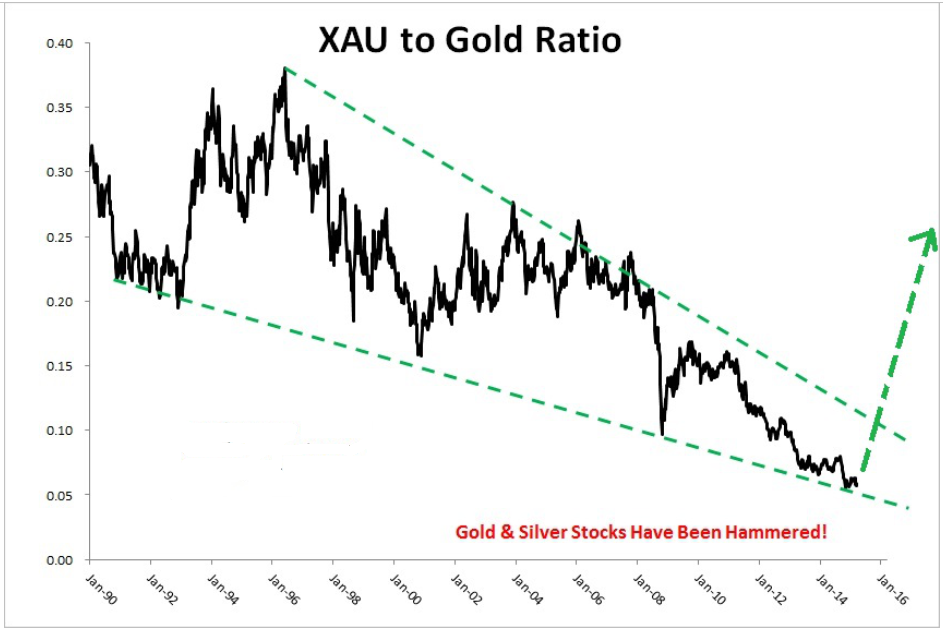

Have gold stocks fallen in tandem with gold prices? No! Examine the chart of the XAU to Gold ratio. It peaked in 1996 and has fallen since then. Gold and silver stocks have been “out of favor” for nearly two decades. The ratio hit a low in November of last year and is still exceptionally weak. Expect a rally.

Gold and silver have fallen hard since 2011 and gold and silver stocks have been crushed. The chart of the XAU shows a November low not seen since 2000. The ratios of the XAU to the S&P and to gold show that gold and silver stocks have been “out of favor” as easy money has levitated the broad stock market at the expense of gold and silver stocks. Those stocks should “regress to the mean” and move much higher. We see that 2015 will clearly show the bottom occurred in 2014 for gold, silver and the XAU. The US dollar already has or will soon peak in 2015, which will add to the volatility and “tailwind” for gold, silver, and their stocks.