The U.S. Non-Farm Payrolls report, due to be released on August 2, could set the tone for August. A strong number will likely move the U.S. Federal Reserve closer to hiking interest rates in early 2015. The key factor of the report the Fed will be watching is Average Hourly Earnings. A stronger number will lift the doubt the Fed has about the strength of the economy. This could lead to further selling pressure on the British Pound.

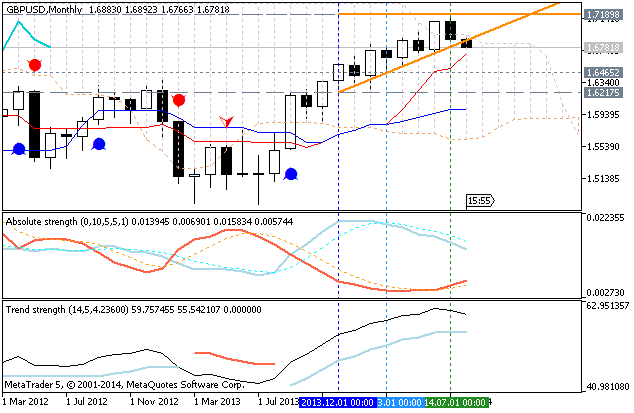

Technically, the GBP/USD posted a potentially bearish closing price

reversal top in July. This chart pattern occurred slightly below a

downtrending angle at 1.7236 this month, and inside a major retracement

zone bounded by 1.6829 to 1.7614.

The major uptrending angle to watch is 1.6892. Taking out this angle

with conviction will put the Forex pair on the weakside of this

long-term angle that has given the market support and guidance for 13

months, or since the market bottomed at 1.4812 in July 2013. A sustained

move under this angle will do some serious damage to the structure of

the bull market.

The short-term range is 1.6251 to 1.7190. Its retracement zone at 1.6721 to 1.6610 is the first downside target.

The main range is 1.4812 to 1.7190. The retracement zone formed by this

range at 1.6001 to 1.5720 is another possible target, but it may take

months to reach this zone.

The angle at 1.6892 should control the direction of the market this

month. The closing price reversal top gives the GBP/USD a bearish tone.