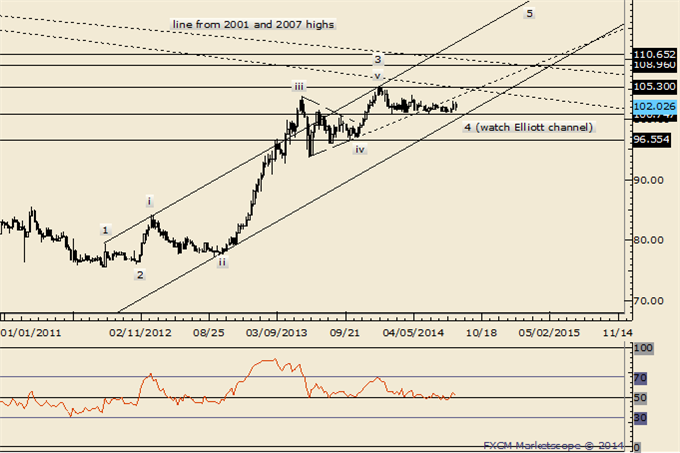

The miserable trading conditions in USDJPY are probably explained by its

long term Elliott wave position. That is, the rate has been mired in a

corrective 4th wave all year. The good news is that wave 4 probably ends

soon. Keep focused on the Elliott channel. The line crosses from about

100 to 100.75 for the remainder of August.

The USD/JPY pair initially fell during the course of the day on Friday,

but as you can see the market did find enough buying pressure nearly

101.50 level to turn things back around and form a hammer. We are still

right dead in the middle of the larger consolidation area between the

101 and 103 levels, so we are not looking for any reason to get involved

at the moment. Nonetheless, we do believe that the market will

ultimately go higher, and probably break out to the upside. Perhaps

short-term long positions could be played, but that’s about it at this

point.