Inflation in the US may be the investment topic of the moment. Whether inflation is merely a case of paranoia or actually raising its ugly head is yet to be seen. One thing looks certain – that the risk of disinflation is receding quickly while the Fed Reserve is readying itself to eventually meet factual or perceived inflation on the battle field of monetary policy. Consequently, investors should recognize the merits of adding US equity exposures to specifically deal with the type of inflation most likely to affect US risk assets in the near term, “creeping inflation.”

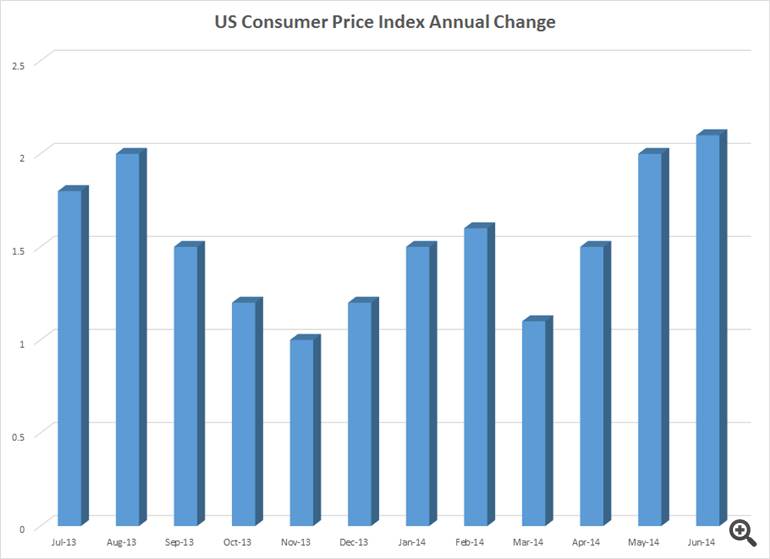

Recent readings of US inflation paint a rather listless picture with actual inflation continuing to trend at low levels. This is especially true when considering that the world’s central banks espouse a desire for sustained inflation nearer to 2.0% and have adjusted monetary policy accordingly. The US Consumer Price Index for all goods registered a 2.1% year-over-year change at the last monthly reading in June. The CPI trend is up, but just barely.

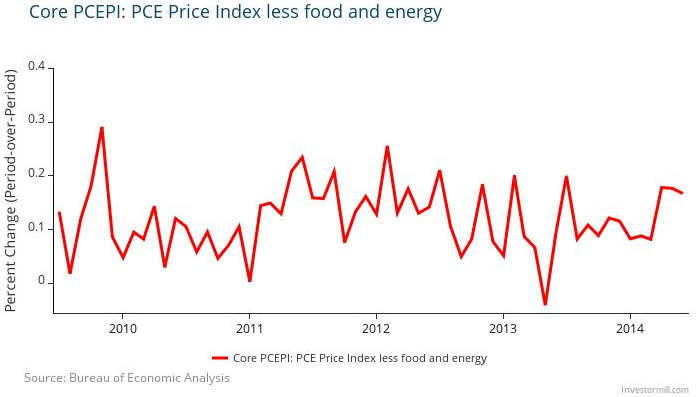

The Federal Reserve’s favored measurement of inflation, the Core PCE Index, also shows very little current inflation. Note: the Core PCE Index, also referred to as the PCE deflator, is an index measuring all core domestic personal consumption with a dynamic price index and a chained index to compare quarterly prices instead of a fixed base amount.

The key for regarding inflation as a driver of monetary policy or investment decisions is for core inflation readings to sustain a growing level of inflation. US readings, no matter how measured, are not quite there yet, even if the most recent data shows a slight uptick.

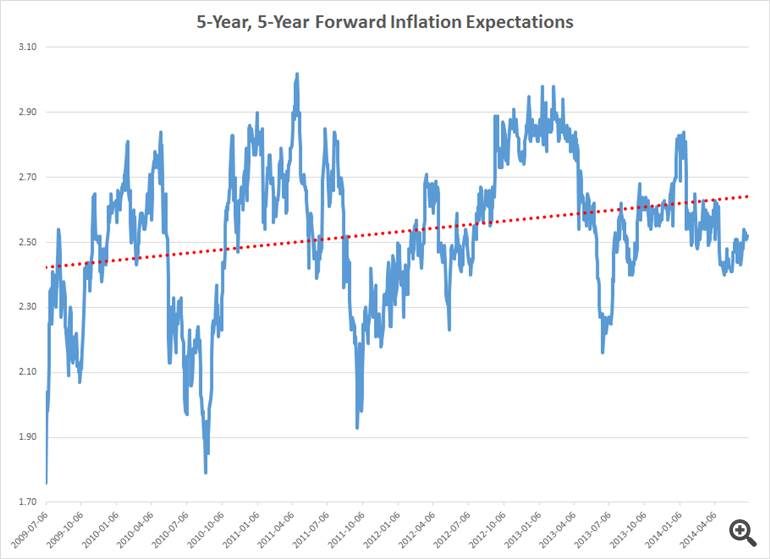

Beyond actual inflation readings, market participants are more attuned to expectations of inflation. Even if historical, measured inflation is growing at a negligible pace, if expectations of inflation increase materially, assets prices will be affected. Currently, the market expects the US inflation rate to be around 2.5% in five years.

Based upon this forecast of gently sloping inflation, it is safe to say that the market doesn’t anticipate the type of high inflation or hyperinflation that many have warned about for years. Combined with continued readings of subdued actual inflation and historically low US Treasury rates, the overall picture of inflation in the US can at best be described as, “not high.”

Inflation as an investment theme has gathered steam recently. First, it is the fact that inflation readings have ticked up ever so slightly in recent readings in combination with much better US employment numbers and the anticipation of better US growth numbers for the second half of the year that have rotated the issue of inflation from the backburner to the front of investment analysis. Second, the cacophony of the loud voices of the gold-loving, doom and gloom crowd is growing louder again. These are the same folks which have wrongly been calling for inflation for the last six years and remain apoplectic (and angry) that Quantitative Easing (experiments) has not created hyperinflation. The third reason inflation has reemerged as an investment theme is because the Fed has told investors to expect rates to rise. The Fed knows that the asymmetry between the quickening pace of jobs growth and low inflation is not likely to persist forever and is preparing the market for the Fed Funds Rate to move slowly upwards sometime in the next year. That action alone can portend higher inflation.

Perhaps the more important question should be what type of inflation will the US experience over the next several years? The type of inflation most likely to be experienced by the US over the next several years is creeping inflation rather than spikes in inflation readings or expectations. The Fed keeps reminding the market that rates will eventually “normalize” for a reason. The Fed wants ameliorate the risk of a mismatch between market expectations and Fed policy while pursuing the goal of full employment for as long as the market (inflation) will provide cover. In this type of inflation, the most important component is, and will continue to be, wage growth or the lack thereof. There is a quantifiable relationship between wages and the unemployment rate. Currently, average hourly earnings are on a pace to increase 2.0% this year while CPI is trending at 2.1%. Many analysts predict higher wage pressures as the slack in the labor market recedes but there are many factors to counter wage pressures such as lower productivity and the labor participation rate. All of these factors point to a creep higher in inflation rather than a spike.

If inflation is muted yet back as an investment consideration, is it worth the effort to construct trades to take advantage of creeping inflation and if so what should be purchased by astute global macro investors? The answer is yes – a small allocation to assets benefiting from creeping inflation and doing so at present is likely to be a reasonable strategy. It should be noted however, that assets that perform well in a creeping inflation environment may be very different from traditional inflation trades: gold, real estate, real assets, collectibles and other currencies. These types of assets are best correlated to either hyperinflation or exploding inflation expectations. Neither of those scenarios are forecast to be a substantial part of creeping inflation.

The superior choice of asset class will presumptively be US stocks with a high beta to inflation and demonstrating robust earnings in steady growth economic cycles. The conventional thinking about equities and inflation is to purchase commodity stocks, REITS and infrastructure plays. In times of creeping inflation those plays could underperform because: (a) growth might be very moderate(GDP of 2.0% to 3.5%) but high enough to push out of mere dividend yielding stocks; (b) the US rates curve is still organically coming off historical lows (separate from inflation pressures); (c) global trade continues to excel and is higher than past inflation analogues so that the likes of China and Europe may continue to export (to the US) deflationary pressures and moderate homegrown inflation expectations; and, (d) monetary policy is shifting from accommodation at the Fed and Bank of England to aggressive policies by the ECB and Bank of Japan. All of the above argue for the fact that stocks selected for creeping inflation should be more than mere inflation hedges.