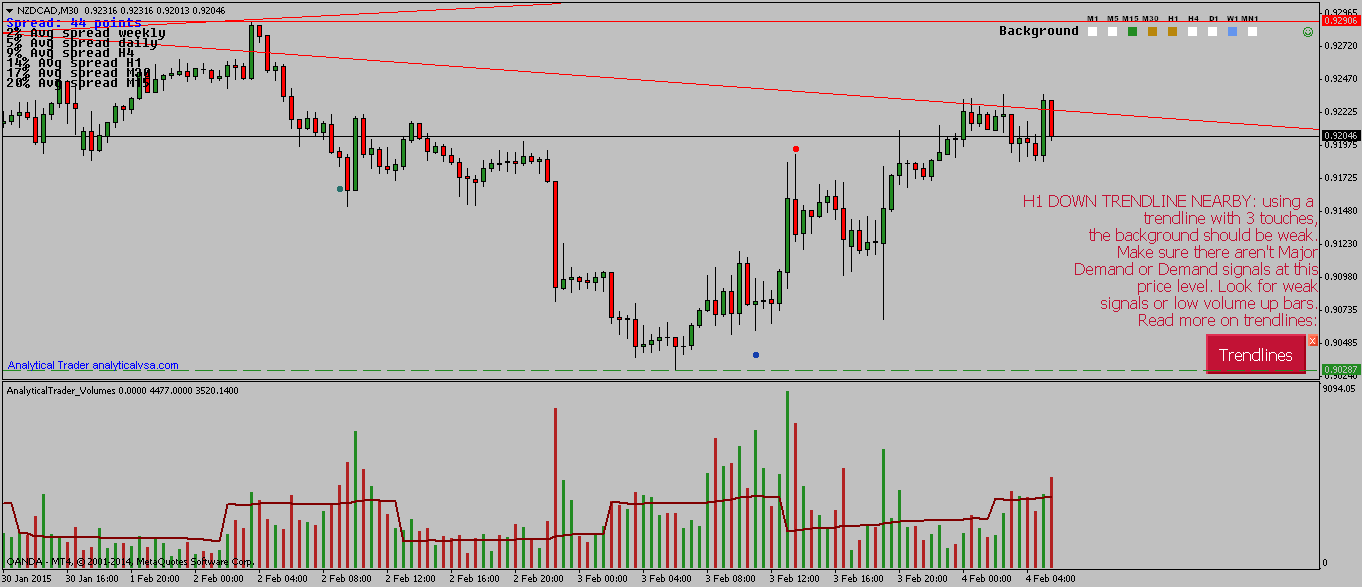

After being alerted of prices being near a down trendline in NZDCAD, it also can be seen that Analytical Trader is pointing that the background is weak both in M30 and H1, which is a good indication. This is consistent with the fact that there has been a significant amount of supply in this downtrend since 20th January.

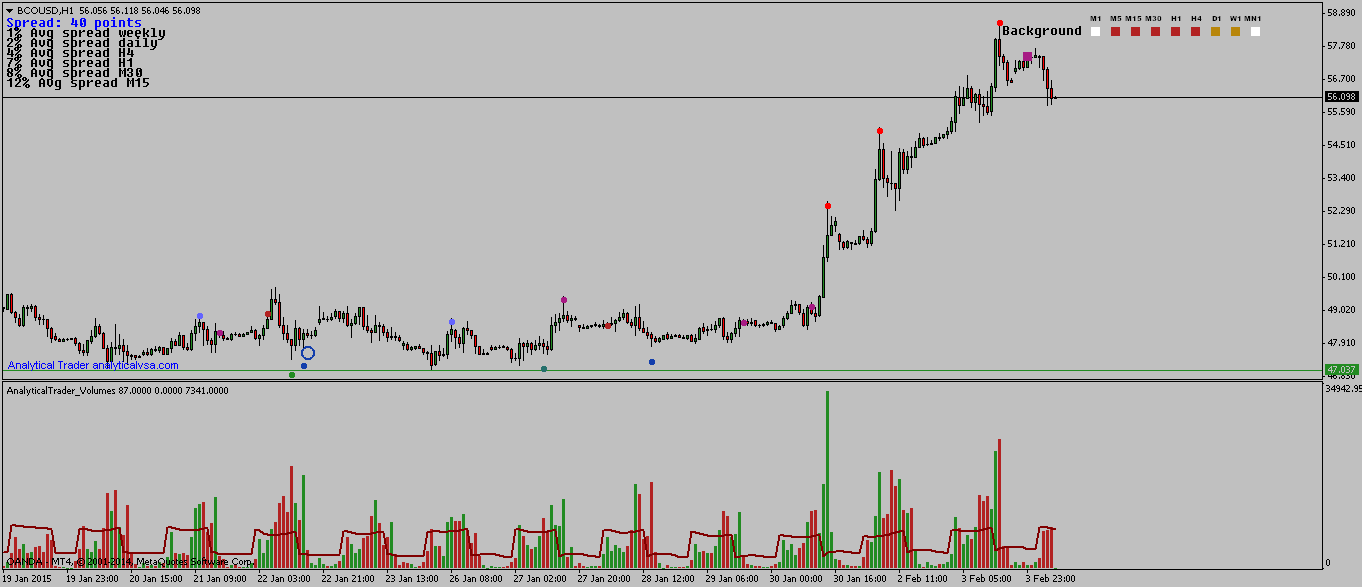

What's a cause of concern is that Brent Crude Oil (which is positively related to CAD) isn't showing particularly much strength lately, despite the strong trend - there are strong supply signals, and more importantly, one with really high volume in this price level. This relationship between Oil and Canadian Dollars (which exists because Canada is a big oil exporter) is stronger on the higher timeframes though, so it may not prevent further weakness on the NZDCAD.