In December Xiaomi became the world’s most valuable tech startup, worth $46 billion. Meanwhile, last week Apple said it sold a record 74.5m iPhones during the three months to December – the equivalent of 34,000 per hour – significantly ahead of forecasts that it would sell 65m.

The stunning success of the two tech giants reflects nothing less than the world's growing income inequality.

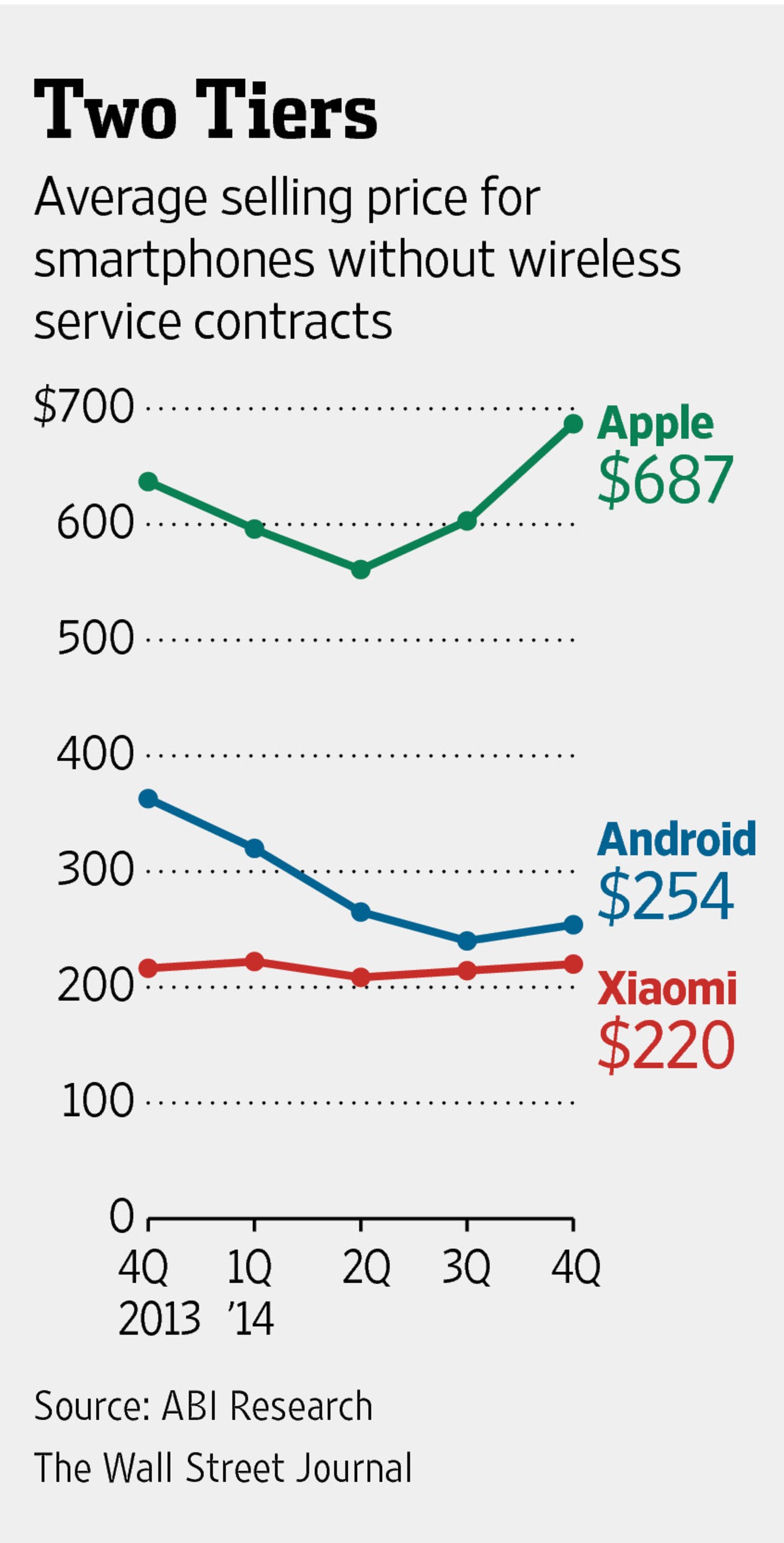

The chart below indicates the average selling price for smartphones from Apple, Xiaomi and all makers of Android-based phones. Undoubtedly, the falling price of the average Android phone is driven by supply and demand. As smartphone components become ever-cheaper, devices by Xiaomi, Coolpad Group, Vivo and countless no-name Chinese manufacturers whose wares are rebranded and sold throughout the developing world, keep driving down the price at which a smartphone is “good enough” for most users, says The Wall Street Journal.

Nick Spencer, ABI Research analyst, considers Xiaomi to be masterful at this game, as its online-only sales and narrow range of products allow it to sell its phones at rock-bottom prices.

Let us have a look at Samsung Electronics’ mobile division. In the most recent quarter its profits plunged 62% from a year earlier, and thus declared it would attempt to sell less-expensive phones, just like Xiaomi. Meanwhile, Chinese mobile giant Huawei Technologies, is going in the opposite direction, and will attempt to sell only high-end phones.

However, these trends are not applicable to Apple, which did the "phenomenal" thing last quarter - that is, sell more phones, but at a higher average price, than in previous quarters. Only one thing behaves like that, which is a luxury good.

According to a survey released last week by Hurun Report, which tracks luxury goods in China, Apple has become a luxury gift beating Louis Vuitton, Gucci and Chanel. The thing is Apple has sufficiently differentiated itself from the mass of Android phones to charge consumers on average two to three times as much as they would pay for a comparable Android device.

Two markets

A recent article in The Wall Street Journal on America’s “two tier” economy outlined the hollowing out of America’s middle class: they are moving either to the high or the low end of their respective markets. The same thing is happening to phones. The commoditization of smartphones has led to price trends which emphasize the fact that there have always been two distinct markets for smartphones: a luxury one, and all the rest.

Predictably, distribution of profits between these two markets

mirrors the distribution of wealth between the buyers of these goods.

According to some analysts, in the past quarter, Apple captured about 90% of

all profits in the mobile market. The world’s top 10% control 87% of the

world’s wealth.

We should expect two things to happen if current macroeconomic trends remain. The first is that, as long as it can maintain its luxury brand, Apple should continue to show strong revenue, if not growth. Analysts say there are about 350 million iPhones in use in the world, which means Apple has already captured nearly 5% of the world’s population.