EURUSD

The euro has been called the "anti-dollar" since it is highly sensitive to US data. Because the recovery in the US has been uncertain, the market closely watches developments in the US economy to determine the strength of the recovery. Fears that the US is hitting a "soft patch" in its economic growth generally boost the euro.

Though the EUR/USD actively trades 24-hours a day, the most action

is concentrated in the time when the US and European banking hours

overlap, from 7:00 AM EST to 10:00 AM EST. Of all the majors, this pair

best reflects how the US economy is doing compared to the rest of the

world.

The US economy is dependant on imported oil - so movements in the price of oil tend to impact the value of the dollar!

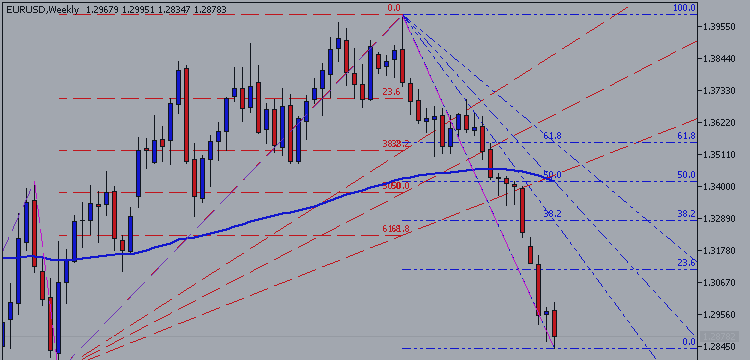

- Average daily range: 111 pips

- Tends to consolidate into wide ranges after sharp trends

- Good for: trading in all time frames, depending on strategy

- Surprises in US economic releases. This pair is hypersensitive to US data.

- Talk of Euro.

- Interest rate.

- Trade Deficit.

- FOMC Rate Decisions

- US Non Farm Payrolls

- U.S. Current Account

- US Trade Balance

- US TIC Data (Treasury Inflow Capital)

- US Retail Sales

- FOMC Minutes

- European GDP

- European Trade Balance

- European CPI

- ECB Rate Decision

- IFO Business Climate Survey

- German Unemployment