Keep It Simple and Stupid, or Any Indicator Is a Really Just a Fancy Moving Average

The moving average is probably the most simple to use and understand of all the major technical indicators. It’s simply the past x periods divided by x. This has a smoothing effect, as near-term price movements are registered in scope of the period of activity (x).

It’s because of this simplicity that many traders, especially new ones,

will often dismiss moving averages as part of their trading approach;

under the premise that moving averages ‘don’t work.’

Well – by this tune, no indicator ‘works.’ :)

Three Ways to Proactively Incorporate Moving Averages

Moving averages can be a simple way to read and evaluate trends. With

price action, this is a very subjective art of observing ‘higher-highs’

and ‘higher-lows.’ The moving average allows you to be objective around

this analysis. You can definitively look at your chart and say – ‘this

trend is up, so I want to buy,’ or ‘this trend is down so I want to

sell.’

1. This is using a moving average as a trend-filter

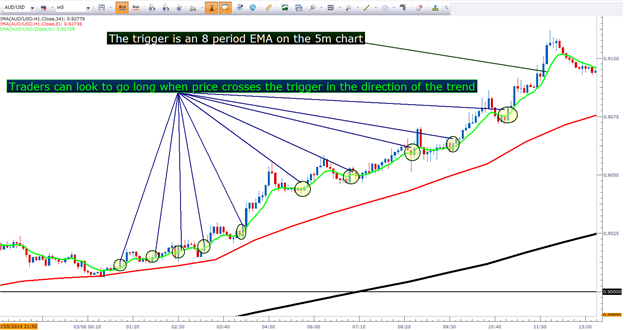

2. Moving Averages can also be used to enter positions in the direction of momentum

3. Common Moving Average Inputs can help to provide support and/or resistance to a market