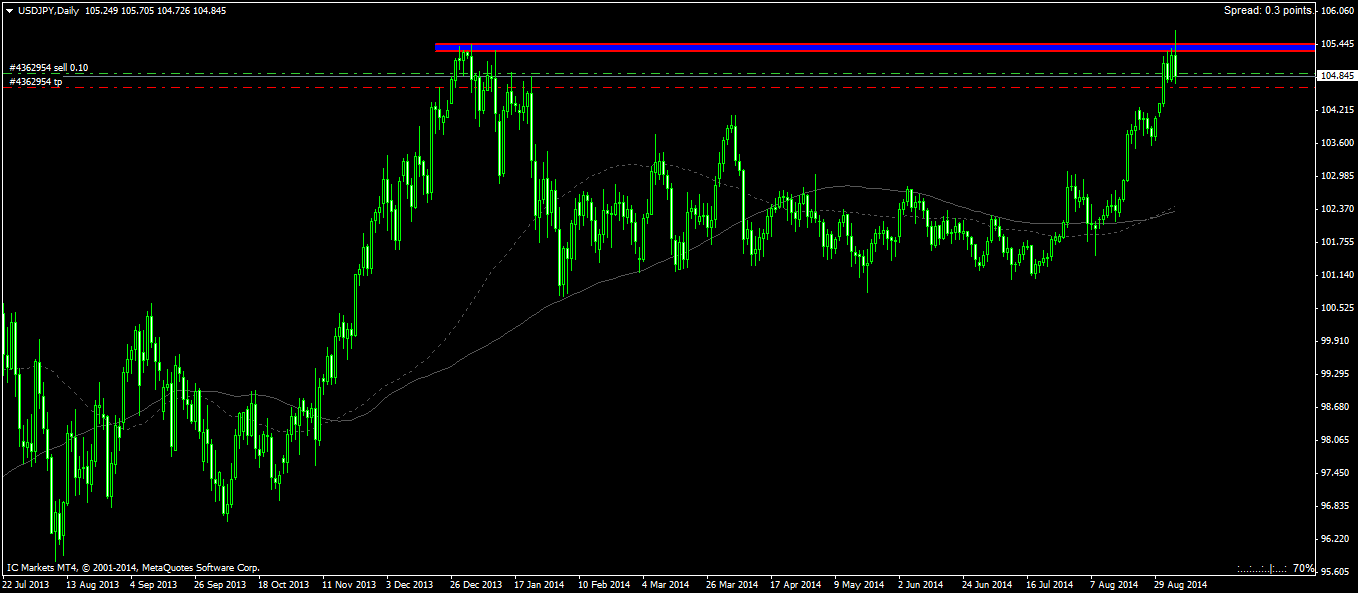

First up, USDJPY is at a relative high point only hitting this point in December, 2013.

We are seeing a string of overlapping bars becoming bigger and bigger. Keep in mind that this is the daily. Order flow wise, you have buyers and sellers pushing the price up one day and down the next. Generally trading outside bars is not a good idea. Why? It shows traders becoming more and more aggressive with their order sizes, but neither side is able to gain grounds. I have marked a resistance zone and it looks like it is holding for now.

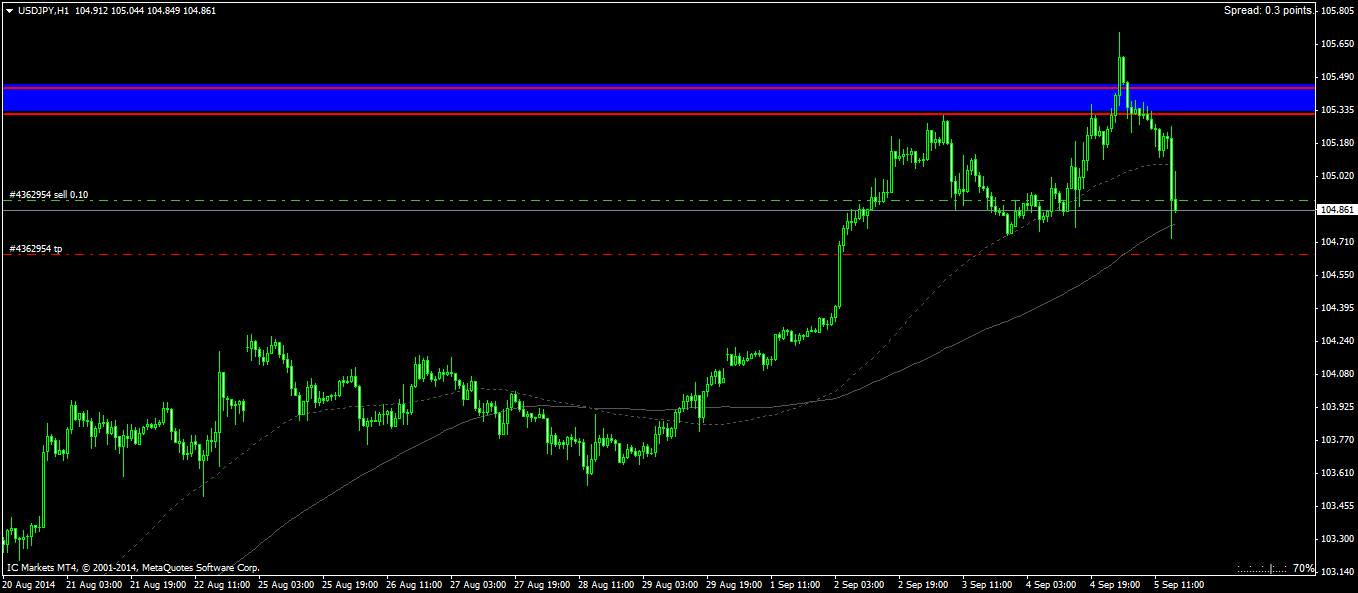

My entry has been timed over on the hourly time frame. I missed the initial sell off, but because it has been heavily overbought for the past year it looks like it will continue. We may see a temporary pull back as sellers cover their short positions. However, we can definitely expect multiple rounds of selling. Keep in mind that the NFP release will have an impact on the US Dollar strength. As for right now, keep selling orders to the extreme short term. You don't want to be going for the long run. Keep entering and exiting is a much safer bet even though it reduces potential profits. Commissions and spreads will eat a portion, but better some safer profits than no profits at all.

By the way, this is a post NFP analysis so I have no been keeping an eye at the actual NFP release. All I know is unemployment fell to 6.1 percent so we maybe seeing greater outputs by the US in the coming months as it takes time for employed workers to generate greater outputs for the economy. It wouldn't be a surprise to see this pair shoot up once again.