Technicians exercise variety of time and price filter in order to identify valid trendline penetration and avoid bad signals or "whipsaws". Depending on the type of financail market, some use 1% while others use 3% penetration critera. This means that the trendline be broken on a closing basis by at least 1% or 3%.

In stock market, generally the two day rule is the most commonly applied in determining the valid penetration of a trendline. It requires that price penetrate the valid trendline and close beyond the trendline for two successive days.

In forex trading, I apply a valid breaking of a trendline to require a close of a full bodied candle beyond the trendline. So in the case of an uptrend, a full valid penetration of a trendline requires a full bodied bearish candlestick formation beyond the trendline on the south side or sell zone.

Likewise, in the case of downtrend, a valid penetration of a trendline

rquires a full bodied bullish candlestick formation beyond the trendline

on

the north side or buy zone.

Often times, a valid penetration of trendline signal only the change of a more steep trendline to a more sustained trendline. But when major trendline is violated trends change direction and so does the role of trendlines.

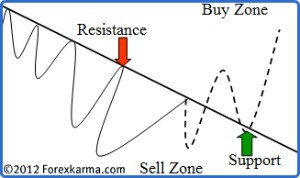

In an uptrend, uptrendline acts as a support line. When this uptrendline is violated, it acts as a resistance.

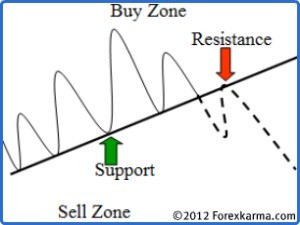

Similarly in a down trend, downtrendline acts as a resistance line. When this downtredline is violated, it acts as a support.