CADCHF Technical Analysis - Monthly Forecast for 2015: Ranging Bearish

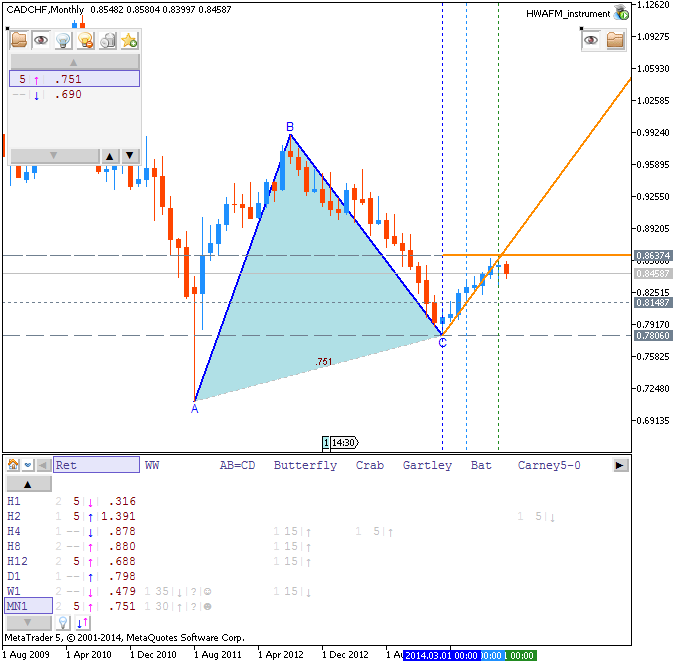

MN price.

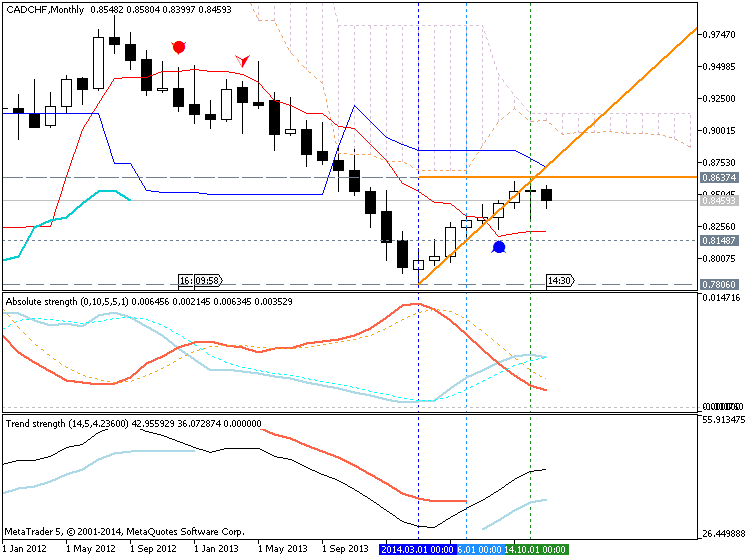

Ichimoku Analysis

The price is located

below Ichimoku cloud/kumo and below the nearest border of the cloud - Senkou

Span A line which is the virtual border between the bullish and bearish market condition. Chinkou Span line of Ichimoku indicator is located too far from the price for any possible breakout/breakdown in the near future.

- If the price will cross Senkou Span A line (0.8992) from below to above so the price will be reversed to the bullish: we may see the ranging market condition within primary bullish.

- If not so the primary bearish will be continuing

Support & Resistance Analysis

The nearest resistance line is 0.8637 and key support is 0.7806: if the price will cross one of those level so the primary bearish or secondary rally will be continuing; if not - we may see the ranging market condition.

- If

MN1 price will cross 0.8637 resistance level on close

monthly bar so the market rally within primary bearish will be continuing.

- If MN1 price will break 0.7806 support level so we will see the bearish to be continuing.

- If not so the price will be ranging between 0.8637 resistance and 0.7806 support.

| Resistance | Support |

|---|---|

| 0.8637 | 0.8148 |

| 0.8992 | 0.7806 |

To make it shorter - I am expecting the secondary ranging market condition with the primary bearish for the next year which may be good for martingale systems, for counter trend strategies and for scalping for example.

Trading Summary: ranging bearish

If we look at patterns for MN1 timeframe so we can see Retracement forming pattern for uptrend: