0

1 366

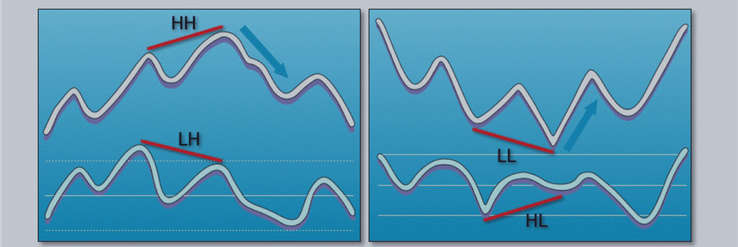

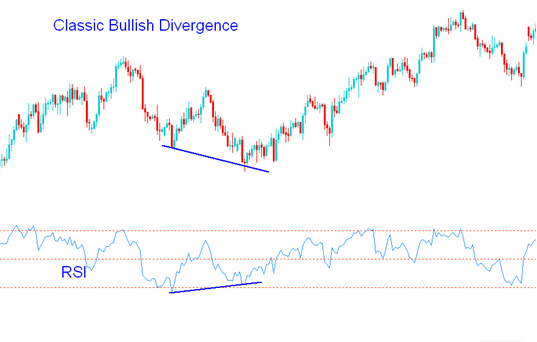

Divergence is one of the trade setups used by Forex traders. It involves looking at a chart and one more indicator. For our example we shall use the RSI indicator. To make this setup find two chart points at which price makes a new swing high or a new swing low but the RSI indicator does not, indicating a divergence between price and momentum.

In the chart below we identify two chart points, point A and point B (swing highs). Then using RSI indicator we check the highs made by the RSI, these are the highs that are directly below Chart points A and B. We then draw one line on the chart and another line on the RSI indicator.

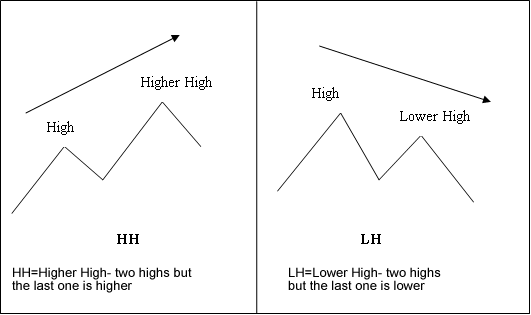

- HH=Higher High- two highs but the last one is higher

- LH= Lower High- two highs but the last one is lower

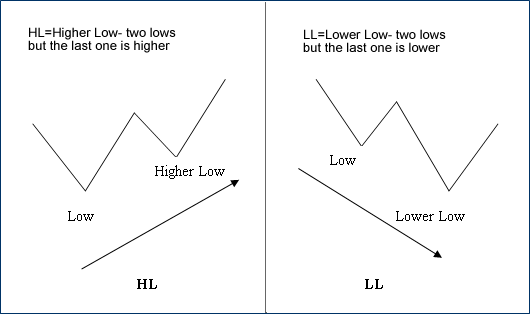

- HL=Higher Low- two lows but the last one is higher

- LL= Lower Low- two lows but the last one is lower