FXTM's Weekly Review – Janet Yellen inspires USD profit-taking

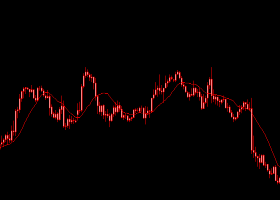

EURUSD – A fresh two-year low

The EU economic sentiment continued to weaken last week following the European Commission downgrading economic growth forecasts alongside an unexpected 1.3% monthly decline in Retail Sales. ECB President Mario Draghi wasted no time in sending the Euro to a fresh two-year low on Thursday afternoon (1.2456) when he said EU inflation levels were set to remain low and the ECB is willing to further loosen monetary policy to support the Eurozone economy. The US economy adding a slightly more modest 214,000 jobs to its payroll in October led to the Eurodollar concluding the week back at 1.24.

There is no doubt the longer term risks weigh towards the downside for EURUSD. At the same time, shorter term USD profit-taking will lead to the Eurodollar benefiting from risk appetite. The US employment report not meeting the high expectations set for it, and US exports declining due to the higher valued USD, are both valid reasons for the Federal Reserve to cool down interest rate expectations, meaning investors should be vigilant towards any potential moves towards 1.25. On Friday, EU GDP figures are released and further signs of stagnant economic growth or the EU slipping back into contraction territory will have bearish implications on the Euro.

From a technical standpoint on the Daily timeframe, the Eurodollar is continuing to trade in the same bearish direction it has done for months, with there being no indications this will end in November. The pair has just bounced away from the lower trendline, which has proven dynamic in the past. The pair entering a consolidation period would allow the EURUSD to trade lower in the future. Possible resistance can be found at 1.2440 and 1.2470, while support is located at 1.24 and 1.2358.

GBPUSD – Further reasons to expect a dovish BoE

The Cable tumbled to its lowest valuation since early September 2013 at 1.5790 late last week following additional indications of an economic slowdown in the UK. The week started positively when the UK Manufacturing PMI surged to its highest level since July (53.2) and was followed by the Construction PMI hitting 61.4, but things went downhill from there. The UK Services PMI – the UK’s main GDP contributor – unexpectedly dropped to a 17-month month low of 56.2 and heavily weakened investor appetite towards the GBP. A comment from Federal Reserve Chair, Janet Yellen, on Friday afternoon that “supportive policy is still needed in slow global recovery” increased speculation that the Fed will keep interest rates low and encouraged USD profit-taking, resulting in the Cable concluding the week around 1.59.

The Cable is in for another volatile week, with Wednesday’s Bank of England (BoE) Inflation Report posing one of the major event risks for the week. Bearing in mind UK CPI recently dropped to a five-year low of 1.2%, the downside risks for the inflation report are strong. The BoE’s views on weak price pressures have strengthened over recent months and, when you consider that alongside signals of UK economic momentum slowing, BoE Governor Carney might announce on Wednesday that a potential UK rate rise will be delayed for after Spring 2015. If the GBPUSD does move to the upside before then, it will be due to further profit-taking on the US Dollar encouraging risk appetite in the currency markets.

In reference to the technicals on the Daily timeframe, GBPUSD downside moves can find support around 1.5874, 1.5824 and 1.5790. If the USD profit-taking that occurred on Friday afternoon continues, possible resistance levels are located at 1.5926, 1.5942 and 1.5994.

USDJPY – Signaling another pullback

Widespread US Dollar strength following the Federal Reserve concluding QE, GDP surpassing expectations and impressive Initial Jobless Claims led to this pair climbing as high as 115.201 on Friday morning. The subdued reaction to the US economy only adding 214,000 jobs to its payroll in October encouraged the rally to stall, while the comment from Janet Yellen regarding the need for “supportive policy to remain” on Friday afternoon encouraged investors to close positions.

To be honest, this pair is more vulnerable to pulling back to 113 than it is in appreciating back to 115. Although the US economic outlook continues to be bright, investors have once again been tempted into pricing in a sooner-than-expected US interest rate rise. The US economy adding less jobs in October is only going to reaffirm to the Federal Reserve that the economy is progressing moderately with rates needing to remain low for a considerable time. Moreover, the US Trade Deficit unexpectedly widening suggests the higher valued USD is now weakening export competiveness. Although the US economy is domestically focused, exports declining will lower economic growth forecasts – providing the Federal Reserve with a valid reason to keep rates low.

Both the Stochastic Oscillator and RSI are each pointing sharply downwards after approaching the overbought boundaries, providing further indications this pair is looking to pullback. Any upside moves can find resistance around 114.480, while support can be found at 113.957, 113.510 and 113.230.

Gold – High volatility in the Gold market

Gold finally breaking below the psychological $1180 support level resulted in the metal falling as low as $1131 on Friday morning. With US Dollar demand running high following strong US economic performances, Gold accelerated to the downside. However, the comment made from Federal Reserve Chair Janet Yellen on Friday afternoon regarding the need for “supportive policy to remain” resulted in Gold reversing and the commodity recorded its largest daily gain since early June ($47).

Aside from Friday’s Advance Retail Sales, high risk economic data from the United States is lower this week. Gold will continue to move in accordance to demand for the USD, but Gold investors should remain very vigilant towards any possible USD profit-taking in the next couple of days. The previously critical $1180 support level will now act as major resistance, but a further dovish comment from the Federal Reserve would encourage Gold bulls to challenge $1180.

Overall, Gold breaking below $1180 was a critical indicator that the bears are in control of the longer term future for Gold. As long as widespread USD profit-taking doesn’t occur, Gold should continue gradually moving to the downside. Possible support can be found at $1160, $1149 and $1140.

Written by Jameel Ahmad, Chief Market Analyst at FXTM.

For more information please visit: Forex Time