- EUR/GBP, GBP/CHF Flags Ready for Liftoff as Carney Signals Policy Shift

- GBP/USD Diagonal Line Still in Focus above 1.7100

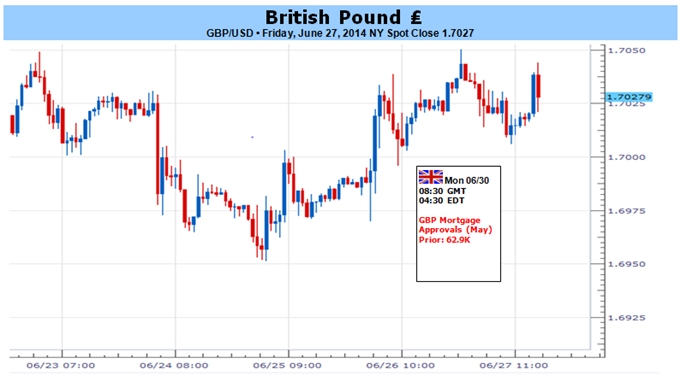

The GBP/USD held within the previous week’s range as the Bank of England (BoE) laid out new measures to stem the risk for an asset-bubble,

but the bullish sentiment surrounding the British Pound may gather

pace throughout the second-half of the year as the central bank shows a

greater willingness to start normalizing monetary policy sooner rather

than later.

Increased efforts to cool the housing market may continue to limit the

near-term rally in the British Pound as U.K. Mortgage Applications are

expected to narrow to an annualized 61.8K in May, and a dismal print

may generate a larger correction in the GBP/USD as it dampens the

prospects for a stronger recovery in the second-half of 2014.

Nevertheless, the policy outlook should play a larger role in dictating the long-term outlook for the sterling as BoE Governor Mark Carney

sees greater scope to raise the benchmark interest rate towards the

end of this year, and it seems as though the Monetary Policy Committee

(MPC) will sound increasingly hawkish going forward as the pickup in

economic activity raises the risk for inflation. With that said, it

seems as though the BoE will allow the British Pound to appreciate

further as it helps the central bank to achieve price stability in the

U.K., and we will retain a bullish forecast for the GBP/USD as the

Federal Reserve remains in no rush to move away from its easing cycle.

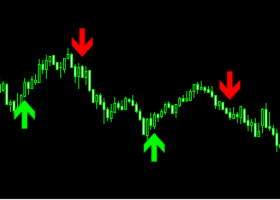

In light of the growing deviation in the policy outlook, we will

continue to look for opportunities to ‘buys dips’ in the GBP/USD, and

the pair may continue to carve a series of higher-highs &

higher-lows in July as price and the Relative Strength Index (RSI)

retain the bullish momentum from earlier this year.