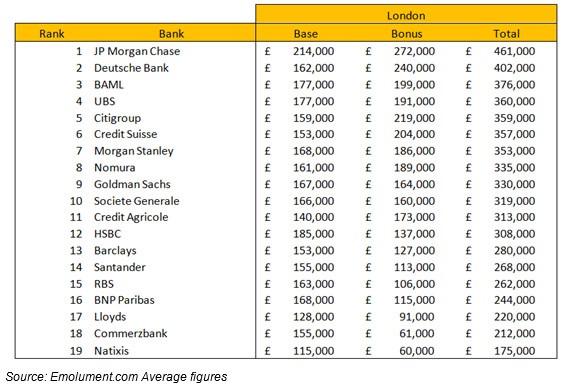

JPMorgan pays its investment bankers the most. And does Nomura really pay more than Goldman Sachs?

Investment banks live and die by revenue league tables, clamouring for prime spots like Premier League football teams craving a Champions League spot. But while they’re happy to shout about their success across different business areas, they’re less likely to want to disclose more politically sensitive information about how much they pay their employees.

Thankfully, their employees are not nearly so coy and only too happy to divulge their pay to data providers like the salary benchmarking website Emolument, which has just come up with a league table of the best paying investment banks. These figures are for London only and provide an average figure across the different divisions for directors and managing directors.

JPMorgan leads the way, it suggests, with average total compensation of £461k, followed by Deutsche Bank and Bank of America Merrill Lynch. Surprisingly, Goldman Sachs is pegged down in 8th place, behind all its US rivals as well as Swiss banks Credit Suisse and UBS and…Nomura.

Goldman’s lowly place is down to its lack of generosity to director-level employees, says Emolument, despite the fact that it pays its MDs very well. JPMorgan pays its directors more by some distance, it suggests, and Deutsche Bank also rewards its director-level employees, hence the second position.

More recently, in its public accounts, JPMorgan has lumped its investment bankers and corporate bankers together, making it difficult to come up with an accurate pay per head figure. Usually, therefore, it appears to not be a particularly generous payer, but Emolument’s figures suggest otherwise.

French banks struggle because they are reluctant to pay their London-based staff significantly more than bankers in their home markets, and City expectations on average are higher than in continental Europe. UK banks, by and large, are weighed down by political pressure to cut pay combined with poor performance.