Evgeniy Scherbina / Profile

- Information

|

10+ years

experience

|

30

products

|

547

demo versions

|

|

0

jobs

|

1

signals

|

0

subscribers

|

I have done a few more tests with the newest advisor Excelsior. And I think I have come to an almost perfect configuration of options.

Below is a picture of 2 trainings: one with the current version 2.1 and the other with the next version 2.2. Both charts contain the top 20 rows with profits for training, validation, and test periods. Over a 150 thousand rows for each training were sorted by the validation profit.

What we can clearly see, is that the current version 2.1 produces a few configurations that secured a modest profit in the test period (passes 6, 12, 16, 17, 18, and 19). But the next version 2.2 has a much better performance in the unknown test period. While it is still a history test and nothing guarantees a profit on the volatile Forex market, it is a very clear indication that this system of 2 competing networks, that I am tuning right now, is absolutely wonderful.

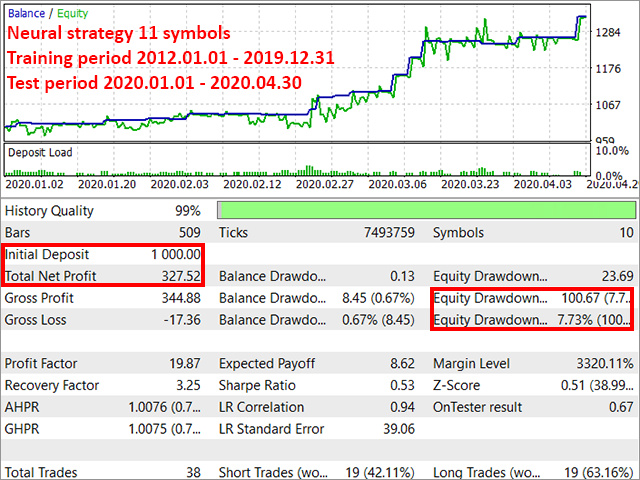

1. Ain't No Trend (or "ANT" for a short name) was my first attempt to understand how neural networks may help evaluate the market noise. It was initially developed completely in MQL, and then I transported the training part to Python. All the various configurations of fully-connected neural networks have enabled this strategy to produce a ridiculously low number of trades. It should be considered as the most conservative and least profitable.

Number of symbols: 6

Timeframes: H4

Trading strategy: MACD indicator

Training strategy: fully-connected neural network

Number of trades in real-time: less than 10 per month

A major upgrade is due in August.

2. Neural Bar Predictor (or "NBP" for a short name) was made with a more sophisticated approach and super-tricky-complicated recurrent neural networks. I spent 2 hours figuring out a way to transport the weights from a TensorFlow fully-connected neural network of ANT, and it took me 2 weeks to finally do it the right way for the recurrent neural network of NBP. It was various configurations of training, too, with very many options still to be explored. The basic idea for NBP was to make it generate by far much more trades than ANT did. I got to it by packing 5 timeframes and different types of signals together. The next big step for this strategy will be to introduce more fine-tuning and exclude tons of unrealistic trading results in order to achieve a more stable version and keep a decent number of trades.

Number of symbols: 6

Timeframes: D1, H12, H8, H6, H4

Trading strategy: ADX indicator

Training strategy: recurrent neural network

Number of trades in real-time: over 40 per month

A major upgrade is due in August.

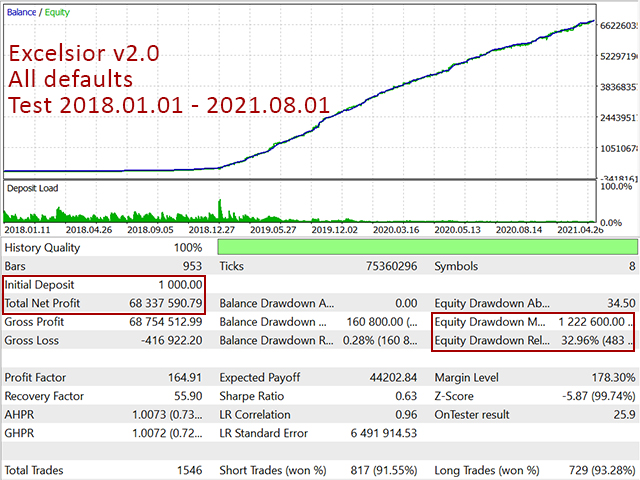

3. Excelsior (no short name this time) is currently my best and most advanced effort at harnessing a popular variant of the recurrent neural networks and making it forecast the most reliable daily charts of 8 symbols. With this approach, I understood that recurrent networks could forecast any time series. To make it a stable system, it should be 2 independent competing networks. The trading strategy relies simply on daily bars so all trading decisions are made by a combination of the recurrent neural networks. Also, this enables the advisor to reconsider its trading decisions on every new day and even during a day! To overcome all the new obstacles of this approach, I had to find a way to speed up training and validation calculations about 4000 times.

Number of symbols: 8

Timeframes: D1

Trading strategy: daily bars

Training strategy: 2 competing recurrent neural networks

Number of trades in real-time: stat expected soon

The latest version 2.0 has recently been published.

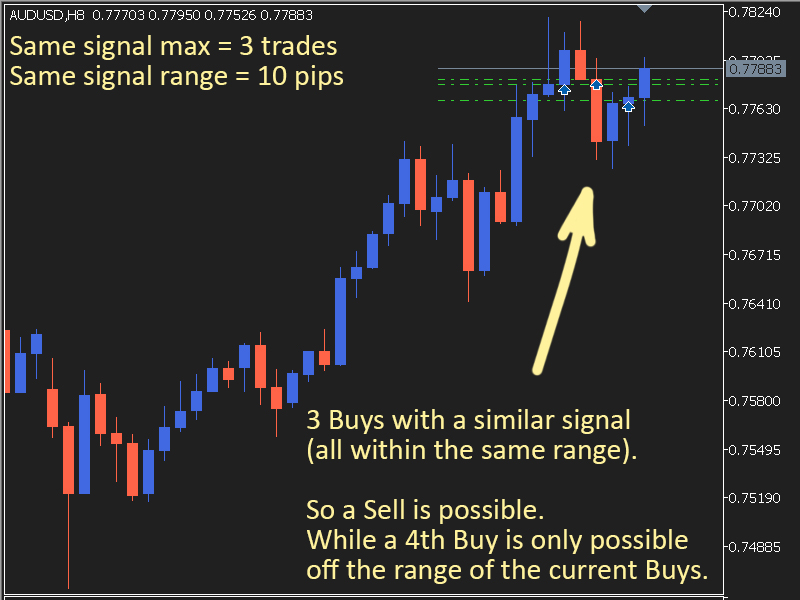

I think I need to elaborate on the 2 new properties - "Same signal max" and "Same signal range" for the Neural Bar Predictor.

These two are related and control the number of trades that can open when signals repeat. A signal repeats after any number of bars, and it repeats because it is very close to any current open trade. A Buy and a Sell do not have a similar signal. Buys compete with Buys, Sells compete with Sells.

While a signal is gathering its momentum to make a move it may be fluctuating in an area. So the advisor may think at this time that we have a very strong signal which may have several trades. However, signals do not repeat because the current price is stuck in an area. The recurrent neural networks of the advisor make totally isolated estimations of each signal.

What happens if the price reverses after several trades open? This is a risk that we have to take on because it is the only way to make a profit on Forex. The recurrent neural networks of the advisor have been trained on 20 years of history so there should be a high probability of success.

The risk may be optimized using historical tests. Any value between 1 and 5 for the Same signal max makes a big difference. While 0 or 10 or higher make no sense.

Any value between 0 and 100 for the Same signal range is fine, but you should use a big step like 10. So values 30, 31, 32, 33 do not show any difference, while values 20, 30, 40, 50 etc should produce different results. The value of 0 for the Same signal range turns off this checking so any number of trades with a similar signal is possible.

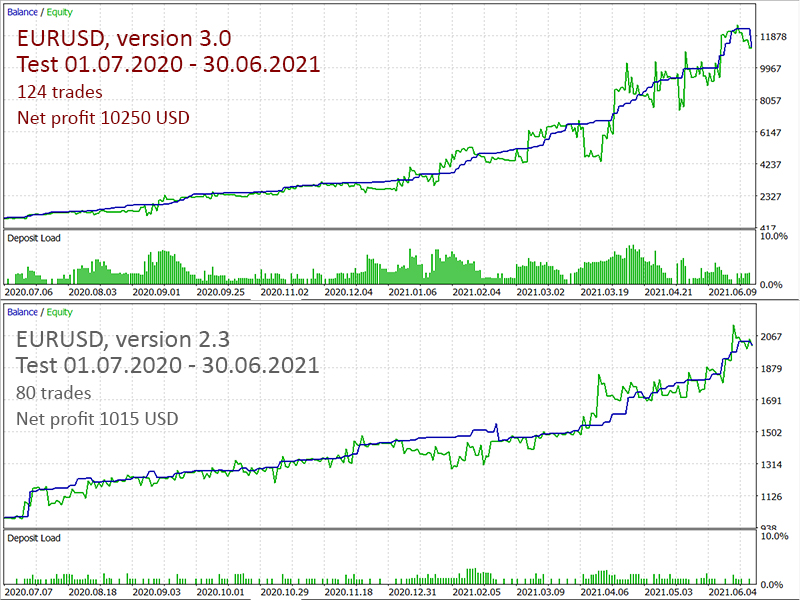

Finally, I have to admit that the versions prior 3.0 were not successful. This new version 3.0 is very much different because I used a new binary classification to train it instead of the categorical classification I had used earlier. I noticed right away that the binary classification performed significantly better in my technical tests. So I do encourage you all to give a totally new try to this version 3.0.

May profit come our way frequently and lavishly!

The python multi procceses have allowed to speed up the training process 12 times. So here we go.

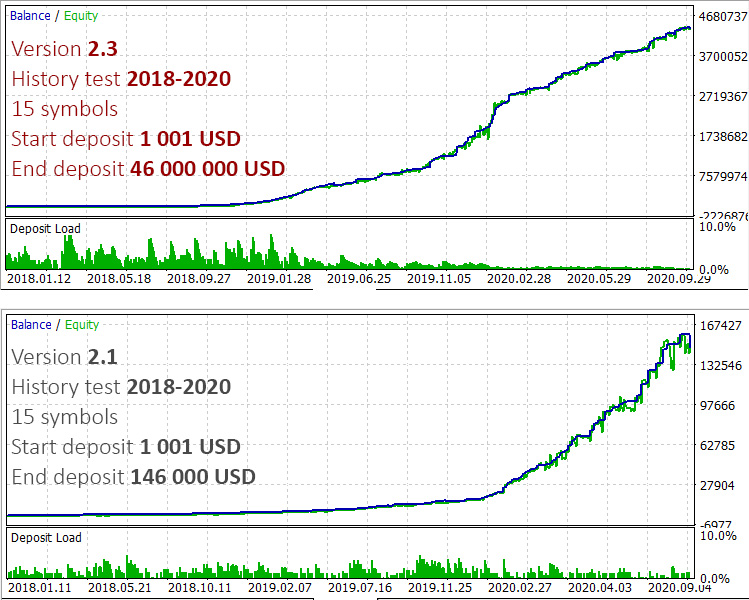

I have made a comparison picture between the old version 2.1 and the newest version 2.3. It is for all 15 symbols. This enourmous difference has become possible only recently thanks to the great machine learning library "TensorFlow" developed by Google.

I have been working hard over my neural strategy for about 2 years. I have bumped into pitfalls and made a number of bad decisions in the process. This is what they call "learning the hard way". But unlike many developpers out there, I understand that the training of a neural network includes 3 periods: training, test, and validation. The validation for the version 2.3 starts on July 1st 2020, check it out, it works just great!!

Forex is risky and volatile. Nothing guarantees profits 100%. But we know machine learning can do it up to 99%. I will keep working to improve this strategy and make it even more stable and profitable. I plan to add a new indicator ADX very soon.

This is the newest neural strategy "Ain't No Trend". And this is happening right now!!

I have finally found my way to the ML library of TensorFlow and mastered the fancy Sparse Categorical Cross Entropy. So now I have a neural network of 64x64x3, which has proved to be a much better performing solution.

I still cannot figure out a way to create a custom function for calculating profits and losses as indicators in the training process. Primarily because those Google geeks are too focused on recognizing images and evaluating the survival rate of the Titanic passengers. So this will be the objective for me to crush in the coming weeks.

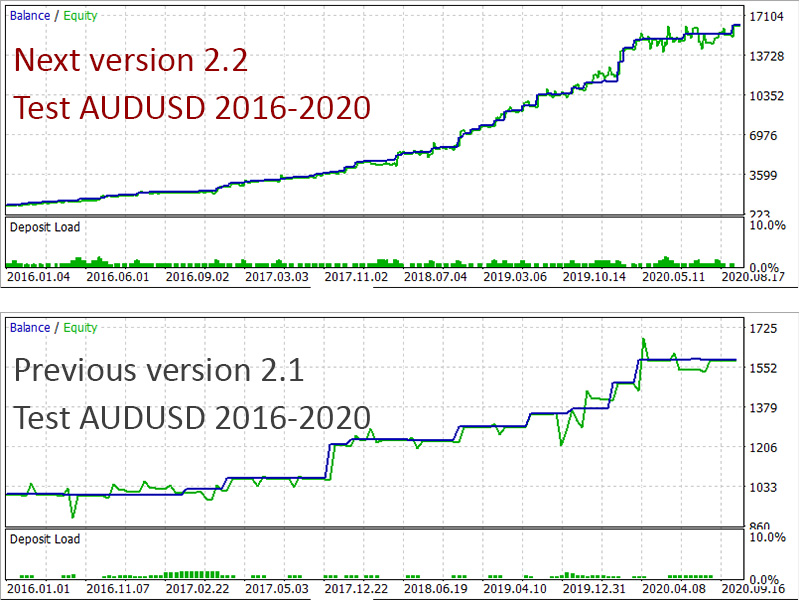

Right now I want to share with you a picture of the AUDUSD test in 2016-2020 with previous version 2.1 and this next version 2.2. As you can see, it is a 10-times difference. And it is only for one symbol. This is the game-changer!!

Oh yes, I forgot to mention. The little disadvantage of this new version 2.2 is that it takes 1 month to train. After 1 week of collecting all data.

So I think I should split the training into 3 parts. I am going to publish this next version 2.2 with only 5 symbols no later than next Monday. Then, a new version will have all 15 symbols. And finally, I will publish another new version with a new indicator ADX by the end of December. So we can all start a new year with totally incredible profits!!

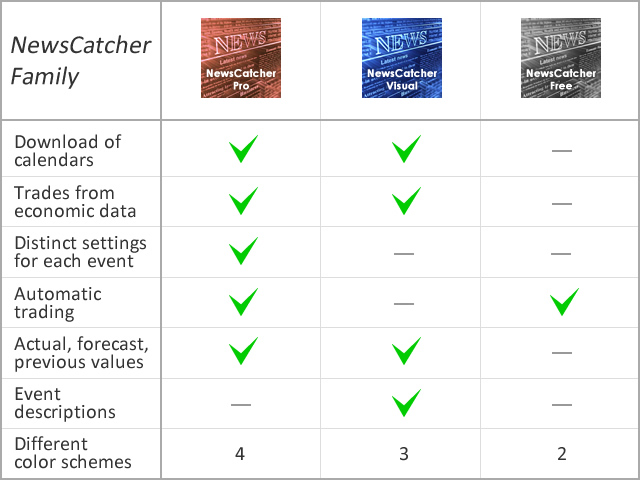

The NewsCatcher Visual can be downloaded for FREE until the end of 2020!

Just to remind you that NewsCatcher Visual allows to trade on economic data using an automatic or manual strategy.

Besides, if you download it now, it will be FREE for you forever, including all the future updates.

You may also check out the NewsCatcher Pro which refreshes data 2 times a second, allows to trade on related events, set up individual strategy settings and so much more!

Check them out now in my seller profile!

The biggest advantage of this new strategy is speed! The advisor can now refresh data 2 times a second and open a trade on the 1st second after data has been released.

I am so excited with this cheap and fast solution that I started a new signal to see how it works for me. I hope I will be able to make it public within a few weeks.

I did more tests.

After 2 months of live trading and humble results, I decided:

1) to add 2 more symbols

2) to remove the RSI indicator.

3) and to add an indicator of my invention. The new indicator measures the ongoing move and puts it against the max move found in the last 6 months. Much better than the RSI.

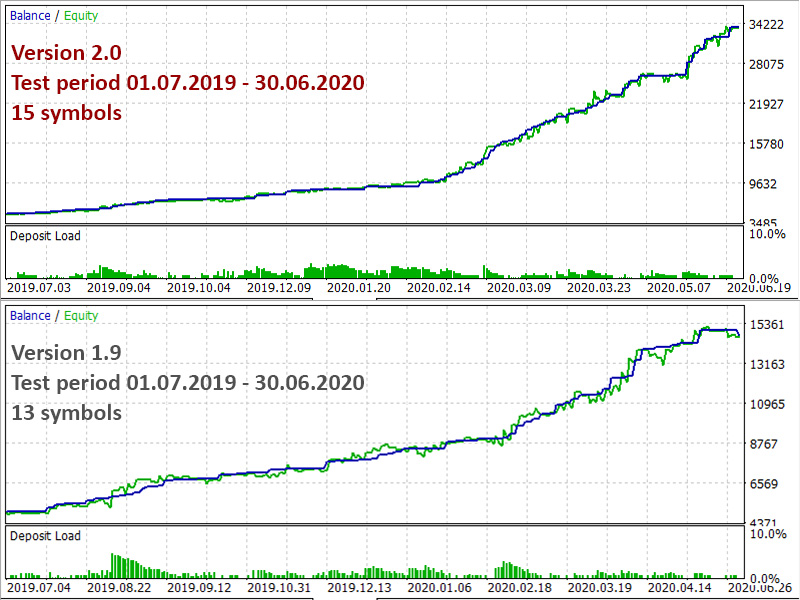

Below are the 2 charts showing a substantial difference. It also showed a better result in the super-test period, the one that starts on July, 1st 2020 and is not part of the training cycle. The version 2.0 should be available next week.

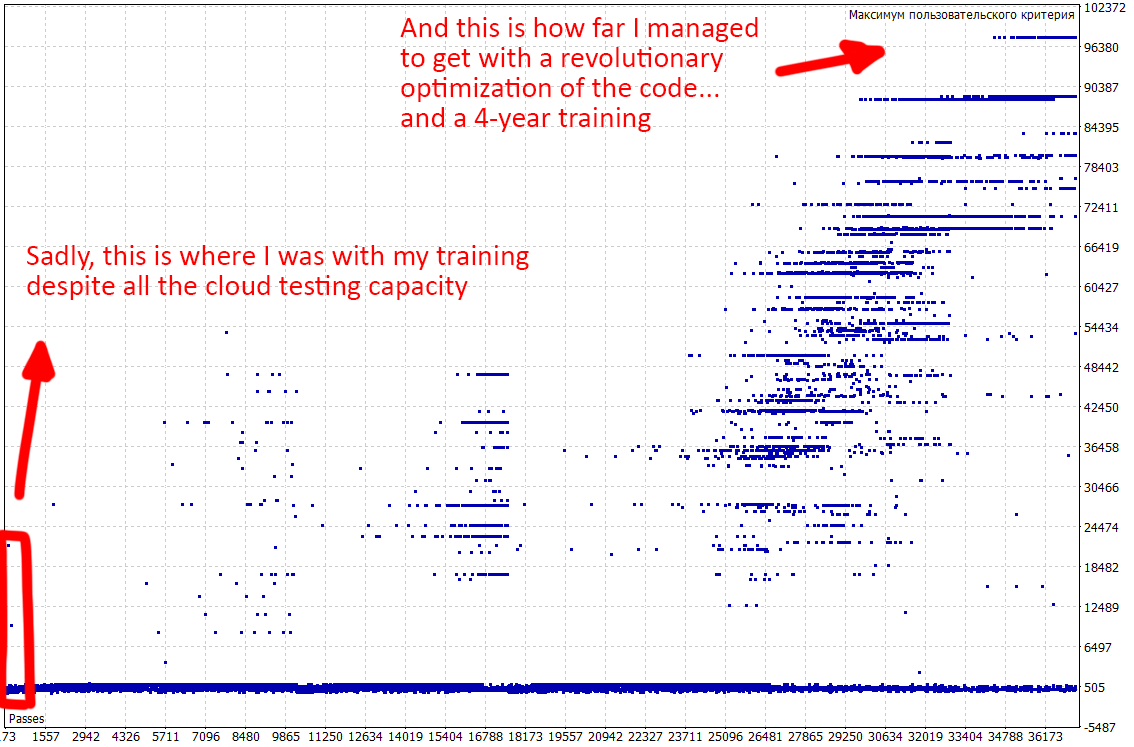

After which, it became easily possible to do a 4-year training. Below is a picture of 4-year training results. Previously, I was stuck with about 500-1000 test results in the cloud platform. Because it was costly, because it was so long... And then it turned out it didn't have to be so long and I could even avoid cloud testing and do it all on my new powerful PC.

It does not guarantee a profit. Nothing guarantees a profit. But I did tests this way. A 4-year training and then a test of 4 months after the training period. I had 25-40% of profit with a dd 5-6%. I shall now test this kind of training in May-June.

Oh dear, why should I not try a 6-year or even an 8-year training anyway?!

The good news is that you can now get your real drawdown when you do a visual test with my advisors. Like the following picture for the training period of January 2019 - January 2020. Check it in the history log of the tester subterminal for a visual test of the advisor with defaults.

The advisor NewsCatcher Free opens trades when the price makes a reversal move from support and resistance levels. Market entries should be confirmed by the Relative Strength Index (RSI). The RSI is implemented as a tachometer. It is recommended to use this advisor in a highly volatile market after a political event or a release of major economic data. You can use this advisor in the semi-automated mode (the RSI performs an information role) or in the fully automated mode (the RSI decides when

The advisor NewsCatcher Free opens trades when the price makes a reversal move from support and resistance levels. Market entries should be confirmed by the Relative Strength Index (RSI). The RSI is implemented as a tachometer. It is recommended to use this advisor in a highly volatile market after a political event or a release of major economic data. You can use this advisor in the semi-automated mode (the RSI performs an information role) or in the fully automated mode (the RSI decides when

The advisor NewsCatcher Visual automatically downloads actual data from the mql5.com calendar. The advisor can work in the "autoclick" mode, that is it can open trades automatically by comparing actual and forecast values. It also allows to manually open both instant and pending orders with a set volume. Recommendations By default the advisor NewsCatcher Visual applies the "autoclick" strategy to all events of high volatility. This allows the advisor to work in the fully automatic mode. However

The advisor NewsCatcher Visual automatically downloads actual data from 2 economic calendars: investing.com or mql5.com . The advisor can work in the "autoclick" mode, that is it can open trades automatically by comparing actual and forecast values. It also allows to manually open both instant and pending orders with a set volume. Recommendations By default the advisor NewsCatcher Visual applies the "autoclick" strategy to all events of high volatility. This allows the advisor to work in the

NewsCatcher Pro opens both pending and market orders based on data from the mql5.com calendar. In live mode, NewsCatcher Pro automatically downloads the calendar, opens orders, trails and closes orders. NewsCatcher Pro can trade any event from the calendar with any symbol available in MetaTrader, including Gold, Oil and cross-rates. To change the default symbol, go to the event view you want to change it for. NewsCatcher Pro uses two strategies: Strategy 1 (pending orders): the advisor opens two

High Trend Pro - https://www.mql5.com/en/market/product/34485

(MT5 https://www.mql5.com/en/market/product/34460)

and TradeKeeper Pro - https://www.mql5.com/en/market/product/34434

(MT5 https://www.mql5.com/en/market/product/34433)