All Blogs

Estimated pivot point is at the level of 1.7191. Our opinion: Sell the pair from correction below the level of 1.7191 with the target of 1.6830 – 1.6720. Alternative scenario: Breakout and consolidation above the level of 1.7191 will enable the price to continue the rise up to 1.73...

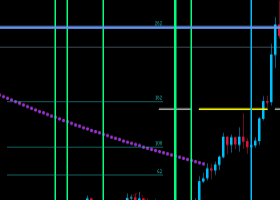

Estimated pivot point is at the level of 1.3572. Our opinion: Sell the pair from correction below the level of 1.3572 with the target of 1.3350 – 1.33. Alternative scenario: Breakout of the level of 1.3572 will allow the price to continue the growth up to the levels of 1.3750 – 1.38...

The most recent short interest data has just been released by the NASDAQ for the 07/15/2014 settlement date, and we here at Dividend Channel have sifted through this fresh data and screened out these five S&P 500 stocks...

• Billion-Dollar Billy Beane (FiveThirtyEight) • Don’t tell anybody this story on HFT power jump trading (Bloomberg) • Soaring student debt sparks response from Catholic colleges (Catholic News Agency) • If you can’t choose wisely, pick at random (Aeon) • We Work: A Secret History of the Workplac...

Fundamental Forecast for Gold: Neutral Gold, Crude Oil Vulnerable As Traders Look Past Ukrainian Tensions Gold Sets Monthly Low as US Dollar Moves to a Five-Week High Gold prices are softer on the week with the precious metal off by 0.51% to trade at $1298 ahead of the New York close on Friday...

Wall Street plunged, after the Standard $ Poor’s 500 Index expanded a record, as Amazon.com Inc. and Visa Inc. reported earnings that missed projections and durable goods data propelled fears that corporate investment still is volatile. Amazon declined 9...

Identifying Your Own Personal Preferences for Trading In order to be a successful trader - either discretionally or algorithmically - it is necessary to ask yourself some honest questions...

US Housing data, ADP Non-Farm Employment Change, GDP figures in the US and Canada, US rate decision and Non-Farm Payrolls are the main market movers this week. Here is an outlook on the major events coming our way. US Pending Home Sales: Monday, 14:00...

With the growing popularity and easy access to the foreign exchange (ForEx) market, more and more people are drawn to it as their financial vehicle of choice. Along with this popularity come all the extras...

Playing palladium’s uptrend remains preferred with the prospect of a run on the psychologically-significant 900 handle over the near-term still looking likely. A retest of 861 or push back above former support-turned-resistance at 875 would offer a fresh buying opportunity...

Natural gas futures headed for a sixth consecutive weekly decline in New York on forecasts for mild weather that would curtail demand for the power-plant fuel. Gas prices last fell for six straight weeks in 2010...

Crude’s bounce back to noteworthy resistance at 103.76 offered a fresh opportunity to look at shorts. The failure to breach the 23.6% Fib Level alongside an intact downtrend suggests further weakness ahead. However, given the close proximity to nearby support at 101...

An ideal neural network expert advisor must trade by itself, without human intervention at all. Regular advisor sooner or later has to be optimized, and you have to find parameters at which it begins to trade profitably...

An increase in volatility can cause price to breakout Camarilla Pivots can be designated for planning order entries Traders can use 1x extension of the trading range for profit targets While price may spend the majority of its time reversing between lines of support and resistance, there will als...

If examine closely, it turns out that there is much in common between those who earn money in the Forex market and those who spend their working days at poker tables online...

AUDUSD Moves to Support at .9431 R3 Range Resistance Sits at .9476 Price Under S4 Signals a Breakout to New Lows The AUDUSD spent most of the overnight trading session reversing between key points of support and resistance...

The US stock market eked out a record high yesterday, as investors weighed positive earnings from the technology industry against disappointing news from Boeing and other companies. Among big tech names, Apple’s earnings topped Wall Street expectations, helped by rising shipments of iPhones...

Fundamentals Forex Review The pound retreated again in yesterday’s forex trading sessions, as the UK retail sales fell short of expectations. The report showed a mere 0.1% uptick instead of the projected 0.2% gain, barely enough to rebound from the previous 0.5% decline...

Prices resumed their move upward to set a new record high. Near-term resistance is at 1995.80, the 38.2% Fibonacci expansion, with a break above that on a daily closing basis exposing the 50% level at 2010.40. Alternatively, a reversal below the 23.6% Fib at 1977...