GOLD (XAUUSD) Fundamentals Weekly Outlook: 2014, July 27 - August 03

Fundamental Forecast for Gold: Neutral

- Gold, Crude Oil Vulnerable As Traders Look Past Ukrainian Tensions

- Gold Sets Monthly Low as US Dollar Moves to a Five-Week High

Gold prices are softer on the week with the precious metal off by 0.51% to trade at $1298 ahead of the New York close on Friday. The losses come amid continued strength in the greenback with the Dow Jones FXCM Dollar Index breaking into fresh monthly highs as equities struggled. However with the month close at hand, escalating geopolitical tensions abroad and a jam packed economic docket, our bearish bias is curbed as we close the week just above key support.

Looking ahead to next week, US economic data comes back into focus with

2Q GDP, the FOMC rate decision and non-farm payrolls on tap. Inflation

data early this week was broadly in line with expectations with core

CPI even missing expectations by 0.1% to print at 1.9% y/y. In light of

last week’s Humphrey Hawkins testimony, where Fed Chair Yellen

continued to cite a more cautious outlook on the economy, traders will

be closely eying the advanced second quarter growth figures on

Wednesday with consensus estimates calling for an annualized read of

3.0% q/q- a sharp rebound from the 2.9% q/q contraction seen in the

first quarter. The FOMC policy decision is released later in the day

with the central bank expected to stay on course with another

$10billion taper in the pace of asset purchases. Look for the policy

statement to drive price action should the Fed cite an improved labor

market outlook on the back of last month’s blowout 288K print.

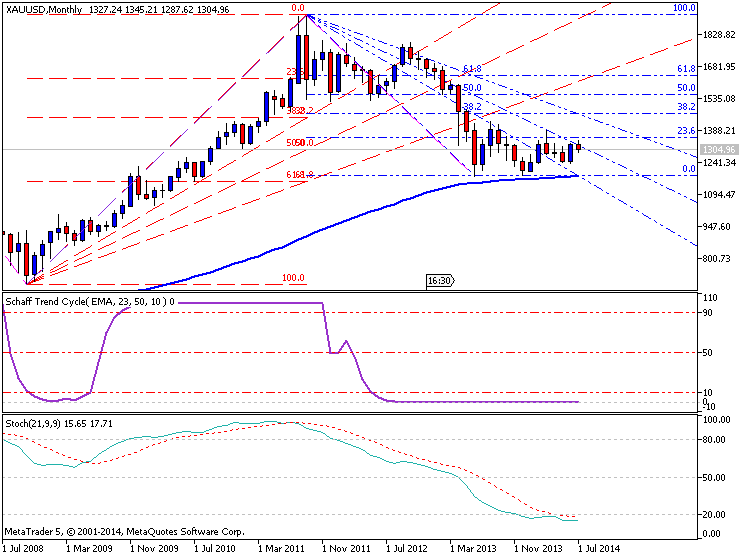

From a technical standpoint, gold remains vulnerable below key

resistance at $1321/24 with more definitive support at $1292/93. We

will continue to eye this level as a key inflection point heading into

the close of July trade with a break below targeting support objectives

at the 61.8% retracement of the June rally at $1280 and a multi-year

pivot zone around $1270. A topside breach/close above $1324 invalidates

our near-term approach with subsequent resistance levels seen higher

at $1335 the monthly high at $1345 and the 78.6% retracement of the

decline off the March highs around $$1360.” We’ll maintain a more

neutral stance as prices hold just above support into the close of the

month with next week’s event risk and the August opening range likely

to offer further clarity on our medium-term directional bias.